Neutral UPL Ltd For Target Rs.610 by Motilal Oswal Financial Services Ltd

Demand outlook turns positive, driving margin improvement

Operating performance above expectations

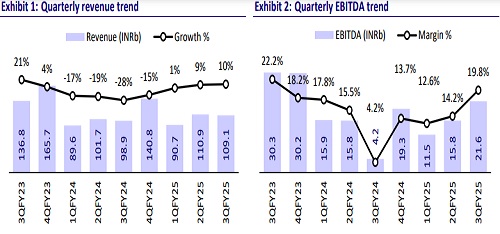

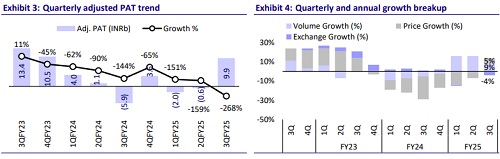

* UPL Ltd (UPLL) reported a strong quarter as EBITDA surged 5.2x YoY on a low base to INR21.6b (est. INR19.9b), due to pricing improvement (up 5% YoY), better product mix, rebate normalization, improved operating efficiency, and lower input costs. The business has normalized, which resulted in healthy volume growth of 9% YoY.

* Overall improvement has been observed in UPLL’s global business, with inventory destocking being largely completed in key markets. Further, margins are expected to continue improving, led by an increase in highmargin product sales, favorable regional mix, better operational efficiency, and margin expansion in the Indian business.

* Factoring in the strong performance in 3Q and improved outlook for 4QFY25, we raise our EPS Estimate for FY25 by 10% while largely maintaining our FY26E/FY27E EPS. Reiterate Neutral with a TP of INR610

Robust growth across platforms fueled by higher volume and pricing

* UPLL reported revenue of INR109.1b (in-line) in 3QFY25, up 10% YoY (volume growth: 9%, price surged: 5%, forex down: 4%). EBITDA stood at INR21.6b (est. INR19.9b), 5.2x YoY. EBITDA margin was 19.8% vs. 4.2% in 3QFY24, due to a 150pp expansion in gross margin. The contribution margin was improved due to improved product mix and stabilization in prices.

* Adj. PAT came at INR9.9b (est. Adj. PAT INR8.1b) vs. a net loss of INR5.9b in 3QFY24. The company witnessed a higher profit on account of the impact of the income tax provision’s reversal (INR5.9b), previously made due to uncertainty over the allowability of eligible expenditure.

* The India revenue rose 28% YoY to INR11.5b, led by higher volumes because of volume growth in natural plant protection (NPP) and steady Rabi placement. North America revenue grew 59% YoY to INR15.7b on account of the continued strong in-season demand. LATAM revenue grew 12% to INR48.1b, as the strong volume growth (of Mancozeb and differentiated products) in Brazil was offset by price softening and forex. Europe revenue rose 28% YoY to INR12.9b, aided by strong volume growth in Fungicides and NPP, while RoW revenue declined 22% YoY to INR21.3b, owing to price challenges in Africa, Australia, and China.

* Advanta’s revenue increased 11% YoY to INR10b, driven by grain sorghum in Argentina, Sunflower (Argentina, Europe), and Corn in India, while UPLL Specialty Chemical’s revenue grew 54% YoY to INR28.5b due to growth in both the non-captive business as well as in the captive business.

* Gross debt (excluding perpetual bonds) declined to INR302.4b in Dec’24 vs. INR361.7b as of Dec’23, Net debt declined to INR258.7b in Dec’24 vs INR313.4b in Dec’23. The decline was due to improved working capital days which declined to 107 in Dec’24 from 155 in Dec’23.

* In 9MFY25, revenue increased 7% to INR310.6b. EBITDA also grew 36% YoY to INR48.8b. Adj. PAT stood at INR7.3b vs Net loss of INR848m in 9MFY24. For 4QFY25, implied revenue/EBITDA growth is 10%/60%, led by margin expansion YoY.

Highlights from the management commentary

* Guidance & outlook: UPLL expects strong volume growth as the crop protection market recovers, supported by stable Active Ingredient (AI) prices, normalized farmer buying, and pricing stability for post-patent products. The company is confident in maintaining FY25 EBITDA guidance, projecting 50% YoY EBITDA growth driven by volume recovery, pricing normalization, and cost efficiencies.

* Debt repayment: UPLL is focused on debt reduction, utilizing proceeds from the rights issue (USD400m) and Advanta’s stake sale of 12.44% (USD350m), with a structured debt repayment plan of USD750m/USD900m in FY26/FY27. Management is aiming for a net debt-to-equity ratio of ~2x by FY27.

* Capex plans: UPLL has revised its FY25 CAPEX guidance downward to INR15-16b (from INR18b) and for going ahead it indicated capex to be ~USD250-300m split between product registrations and manufacturing expansion. Further clarity on FY26 CAPEX will be provided post-4QFY25.

Valuation and view

* With the overall macro scenario improving, we expect 4Q to witness robust growth (on a low base) and a margin trajectory, aided by price improvement, better product mix, improved operational efficiency, and a favorable regional mix. Demand is expected to improve with a major part of global inventory destocking being completed.

* We reiterate Neutral with a TP of INR610 (based on 9x FY27 EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412