Buy Niva Bupa Ltd for the Target Rs. 100 by Motilal Oswal Financial Services Ltd

Strong underwriting performance boosts PAT

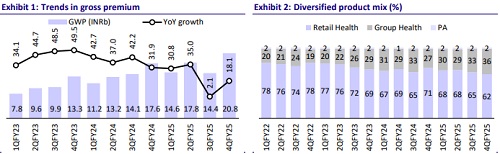

* Niva reported 25% YoY growth in NEP to INR14.4b (in-line) in 4QFY25. For FY25, it reported NEP growth of 27% YoY.

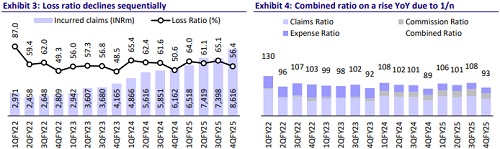

* Loss ratio at 56.4% (our est. of 59.1%) increased 580bp YoY. Expense ratio (incl. commission) was at 36.4% (our est. of 37%), with a YoY improvement of 50bp/190bp in commission ratio/expense ratio. This led to a better-thanexpected combined ratio of 92.8% (vs our est. of 96.1%), up 340bp YoY (86.1% without 1/n impact).

* PAT grew 31% YoY to INR2.1b (44% beat). For FY25, PAT was at INR2.1b, growing 161% YoY. FY25 IFRS PAT of INR2b was in line with our expectations.

* Niva saw its EOM on a gross basis improve by 190-200bp in both FY24 and FY25. With strong premium growth, the company is well-positioned to achieve a similar level of improvement going forward, which will help it comply with EOM regulations.

* Backed by a strong performance in 4QFY25, we have upgraded our estimates under IGAAP, mainly on expense ratio and slightly higher growth. However, our IFRS estimates have broadly remained unchanged, and we value the stock at 40x FY27E IFRS PAT to arrive at a fair value of INR100. We reiterate our BUY rating.

Robust operational performance

* GWP grew 18% YoY to INR20.8b, driven by 3%/59%/18% YoY growth in retail health/ group health/PA business. For FY25, GWP grew 21% YoY to INR67.6b. The company secured business from two large corporate accounts during the quarter, which significantly contributed to strong growth in group health.

* Without the impact of 1/n, GWP grew 36%/32% for 4QFY25/FY25.

* The underwriting profit for 4QFY25 came in at INR576 vs. INR661m in 4QFY24 (our est. of INR169m).

* The commission ratio at 17.7% (vs. our est. of 20.3%) declined 50bp YoY, while net commission grew 18% YoY to INR3b (5% below est).

* The expense ratio at 18.7% (vs. our est. of 16.7%) declined 190bp YoY on account of continued investments in digital capabilities.

* Elevated claims ratio and 1/n impact led to a combined ratio of 92.8% in 4QFY25. Without considering the impact of the 1/n framework, the combined ratio improved 330bp YoY to 86.1%.

* Investment assets stood at INR81.8b by the end of 4QFY25, with investment yield at 7.4%. The strong growth in AUM to INR81.8b from INR54.6b at the end of 4QFY24 was due to IPO proceeds.

* The company’s hospital network remained stable at the end of FY25 at 10,421 (10,460 in FY24), while the preferred partner network increased to 589 (326 in FY24).

* In FY25, agents/banks/ brokers contributed 29.7%/20.1%/30.6% to the business. The average ticket size per policy increased to INR30,252 (INR28,797 in FY24), while the GWP per policy sold by agents declined to INR23,233 (INR25,028 in FY24), reflecting non-metro penetration.

Key takeaways from the management commentary

* Niva launched a new product in 4QFY25 for the middle-class and lower-middleclass segment, which is one of the largest unserved populations.

* 80% of claims come from 100 PPNs. The company actively removes hospitals based on their cost practices, service, and quality.

* Claim inflation of 5% was in line with the 5-7% trend. This was supported by ongoing discussions with the provider network to ensure quality treatment and specific negotiation agreements based on data analytics. Billing review, case management, and other measures have also been deployed to ensure fair billing practices.

Valuation and view

* We believe Niva is well-positioned to harness growth opportunities with a strategic global partner, a growing customer base, and innovative product offerings. The diversified channel mix will ensure improved scalability as the company moves toward geographic expansion. Measures taken to mitigate claim inflation will continue to aid loss ratios, while operational efficiency will lead to an improved expense ratio going forward.

* Backed by a strong performance in 4QFY25, we have upgraded our estimates under IGAAP, mainly on expense ratio and slightly higher growth. However, our IFRS estimates have broadly remained unchanged and we value the stock at 40x FY27E IFRS PAT to arrive at a fair value of INR100. We reiterate our BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)