Neutral Voltas Ltd for the Target Rs. 1,350 by Motilal Oswal Financial Services Ltd

Weather headwinds hurt demand; recovery defers

RAC volume declines ~20-25%, VOLT follows similar trend

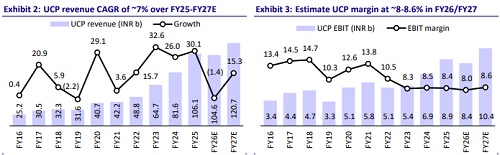

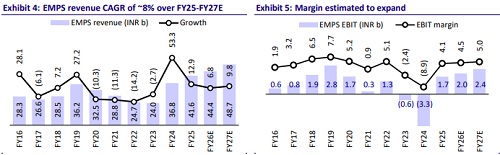

We interacted with the management of Voltas (VOLT) to gain insights into the current demand trends, the company’s strategy amid challenging conditions, and segmental performance. The management believes that unfavorable weather conditions led to ~20-25% YoY decline in industry RAC demand during Apr-May’25, with VOLT reflecting a similar trend. While North India saw some recovery in Jun’25 due to rising heatwaves, it remains watchful on the outlook given the evolving weather conditions. In view of this, we have reduced our FY26/FY27 UCP revenue by ~14% each and trimmed the UCP segment margin by ~80bp/40bp. As a result, our FY26/FY27 EPS estimates have been reduced by ~17%/14%. We downgrade our rating to Neutral from BUY with a revised TP of INR1,350 (earlier INR1,600) based on 45x FY27E EPS for the UCP segment, 20x FY27E EPS for the PES and EMPS segments, and INR22/share for Voltbek.

UCP segment: Delayed summer and early rains disrupt demand

* In FY25, VOLT outperformed expectations with ~36% volume growth in the UCP segment, exceeding industry growth of ~29% and selling over 2.5m AC units. Anticipating a strong summer, the company had built up inventory, but erratic weather conditions led to a weaker-than-expected season. Industry demand saw ~20-25% decline in Apr-May’25, with VOLT reflecting a similar trend.

* North India witnessed some recovery in RAC demand during Jun’25 (so far) due to rising heatwaves. If sustained, this could help recover some lost volumes and partially mitigate the estimated YoY revenue decline in 1QFY26, given the high base of last year. Despite the weak demand, no material price correction has been observed in the market. However, the company remains cautious on pricing, preferring a wait-and-watch approach depending on demand-supply dynamics. Further, liquidation of inventory remains a priority amid weak secondary demand. The company received a PLI incentive of INR180m in FY25. EBIT margin for the segment is expected to remain in high single digits.

* Industry’s channel inventory stands at around 7-8 weeks, in line with the company’s inventory levels. Further, North contributes ~35-40% of the company’s overall UCP sales. Chennai plant’s utilization remained low due to weak demand but is expected to improve to ~75-80% by end-FY26, contingent on a revival in demand. The company has limited backward integration at the Pantnagar plant (15-20%) while higher at the Chennai plant (40-45%). It does not foresee any significant price hikes following the implementation of new BEE rating norms from Jan’26, as the cost increase is expected to be at ~INR800-1,000/unit.

* In the Commercial AC business, performance was better than other businesses but below internal expectations. The Commercial Refrigeration segment also saw a slower-than-expected demand recovery.

EMPS segment: Domestic growth ahead; selective in international order

* In the projects segment, VOLT remains cautious on the international front, where order inflows have been limited to a few small bookings. Management indicated that a meaningful pickup in international orders will take time as it continues to adopt a selective approach in global markets.

* On the domestic side, the company expects order booking momentum to strengthen meaningfully in FY26, which is likely to drive overall growth for the projects business in the near term. Management reiterated that domestic projects will be the key growth driver for the segment, while international operations will take longer to scale up.

* The company remains prudent in provisioning, with regular assessments of cost and recoverability. No significant incremental provisions are expected. As of 31st Mar’25, the segment’s total carried forward order book stood at over INR65.0b.

Voltbek’s growth continues to outpace industry growth

* Voltbek recorded significant market share gains in Refrigerators and Washing Machines, achieving ~57% YoY volume growth and surpassing 1.0m unit volume in each category. This robust growth in FY25 was driven by the introduction of a wide range of smart and sustainable offerings, along with expansion into additional retail outlets. Voltbek’s product offering includes Refrigerators, Washing Machines, Microwave Ovens, Dishwashers, Dry Iron, and Mixer Grinders.

* In Semi-Automatic Washing Machines, Voltbek has risen to become the secondlargest player, with a YTD market share of 15.3%. Additionally, it has emerged as the market leader in the Dishwasher category across e-commerce platforms. As of YTD Mar’25, Voltbek’s market share improved to 8.7% for Washing Machines and 5.3% for Refrigerators.

* The company plans to fully localize the manufacturing of Washing Machines and Refrigerators over time, which is expected to support margin expansion and strengthen its competitive positioning. It continues to target EBITDA break-even for Voltbek by FY26, depending on seasonal support.

Valuation and view

* VOLT reported a robust performance in FY25, with strong growth in the UCP segment and healthy margins. The company maintains a leadership position in RAC with ~19% market share and benefits from the ramp-up of its Chennai facility. However, a delayed summer and unfavorable weather conditions have adversely impacted growth for the UCP segment. Considering demand moderation, we estimate VOLT’s revenue/EBITDA/PAT CAGR at ~7%/12%/15% over FY25-27. We estimate the UCP segment’s margin to stand at 8.0% in FY26 (vs. 8.4% in FY25), though demand recovery will be crucial in 2HFY26, led by the festive season and change in energy rating norms.

* We downgrade our rating to Neutral from BUY due to a decline in demand, near-term headwinds, and challenges in the project business. We revise our TP to INR1,350 (earlier INR1,600) based on 45x FY27E EPS for the UCP segment, 20x FY27E EPS for the PES and EMPS segments, and INR22/share for Voltbek.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412