Buy Larsen & Toubro Ltd for the Target Rs. 3,950 by Motilal Oswal Financial Services Ltd

Healthy future outlook

Larsen & Toubro (LT) ended FY25 on a strong note, with its 4QFY25 and full-year performance exceeding our estimates. The company reported strong 20%/19% YoY growth in inflows/revenue in the core E&C segment, largely driven by a strong uptick in inflows and execution from international geographies. Despite strong inflows during FY25, LT has guided for 10% YoY inflow growth as its prospect pipeline jumped 57% YoY to INR19t. This was driven by international prospect pipeline improvement despite domestic prospect pipeline being flat YoY. LT is optimistic about spending in the GCC region for renewable, clean energy and transmission projects and has strong funding lines for existing projects, despite oil prices hovering around USD60 per barrel. We expect LT’s execution to remain strong with a strong order book. We remain positive on LT considering its ability to benefit from a large prospect pipeline and maintain healthy NWC and RoE. We thus raise our inflow and execution estimates for core E&C. However, with a reduction in estimates and valuation for IT subsidiaries, our TP is revised to INR3,950 (from INR4,100) based on 28x Mar’27E earnings for core business and a 25% holding company discount to subsidiaries. Maintain BUY

Results ahead of our estimates

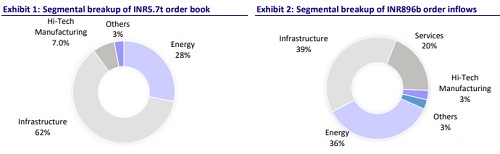

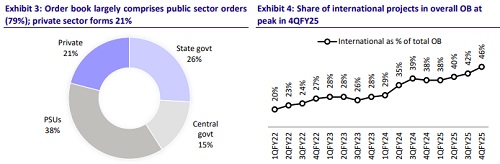

For 4Q, consolidated revenue/EBITDA/PAT stood at INR744b/INR82b/INR51b, which grew 11%/13%/19%. Consolidated revenue was 7% below our estimate, while consolidated PAT was 6% above our estimate, mainly led by higher-thanexpected margins. FY25 consolidated PAT was also ahead of our estimate. For the core E&C business, FY25 order inflows came in much above our estimate at INR2.89t, up 20% YoY. Domestic order inflow was down by 14% YoY in FY25, while international order inflow was up by 54% YoY. This resulted in a core order book of INR5.8t, up 21% YoY. Core E&C revenue came in at INR1.9t, up 19% YoY and slightly below our estimate, as domestic execution was flat YoY. International execution surged by 54% YoY. For FY25, core business EBITDA margin stood largely flat YoY at 8.3%, ahead of our est. of 8.1%, led by betterthan-expected margin in the infra segment.

Margin performance driven by Infrastructure and Others segments

During FY25, infrastructure segment margin stood at 6.4%, up 20bp YoY, driven by execution cost savings. Energy segment margin stood at 8.4% in FY25 vs. 10% in FY24, as some projects are yet to reach margin recognition threshold. Hi-tech manufacturing margin stood at 17.3% vs. 16.3% in FY24, driven by improved job mix. ‘Others’ segment EBITDA margin was at 29.2% vs. 21.3% in FY24, mainly driven by a favorable revenue mix in realty business.

Prospect pipeline surges 57% YoY

LT’s prospect pipeline for FY26 stands at INR19t, up 57% YoY, due to a significant increase in infrastructure and energy segment prospects. The domestic prospect pipeline is flat YoY at INR7t, while international stands at INR12t. The strong growth in international prospect pipeline is coming from GCC region, which is transitioning from oil to gas and renewable projects, and expected spending across power transmission, renewables, and green infrastructure. The company historically had a win rate of 20-25% in the prospect pipeline and expects this to improve in the future given its track record now in international geographies.

Outlook on domestic order inflows

Domestic prospect pipeline is largely flat YoY and the company’s inflows from the domestic segment were down 15% YoY. LT is selectively bidding for domestic projects and is eyeing projects across infrastructure, heavy civil, B&F, metals and mining, and thermal power. It is going slow on water-related projects, which have seen delayed payments and stretched working capital.

Outlook on GCC region order inflows

International orders form 46% of LT’s total order book, and GCC region accounts for 81% of its international order book. With oil prices hovering around USD60 per barrel, LT is not concerned about a reduction in capex spending as funding lines for these projects are strong and LT is working with best-in-class clients across GCC region. Spending across gas and renewable projects remains strong. We expect LT’s execution to remain strong across international projects.

Comfortable NWC and RoE; healthy guidance

LT achieved a comfortable NWC of 11% of sales for core E&C division. Core E&C RoE also improved by 140bp to 16.3% in FY25, aided by improved execution of international projects, where NWC is much lower than domestic projects. For FY26, management provided guidance of 10% growth in order inflows, factoring in a conservative outlook due to global uncertainties and potential softness in domestic activity in the first half. Revenue growth is expected to grow by 15% YoY, while core E&C margin is targeted to be at 8.5%. The company expects to maintain a net working capital-to-revenue ratio of 12%.

Valuations and view

We increase our estimates for the core E&C segment to factor in improved inflows and execution. However, with a reduction in estimates and valuation for IT subsidiaries, our TP is revised to INR3,950 (from INR4,100) based on 28x Mar’27E earnings for core business and a 25% holding company discount to subsidiaries. We remain positive on the company considering its ability to benefit from a large prospect pipeline and maintain healthy NWC and RoE. Maintain BUY

Key risks and concerns

A slowdown in order inflows, delays in the completion of mega and ultra-mega projects, a sharp rise in commodity prices, an increase in working capital, and increased competition are a few downside risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412