Buy Ajanta Pharma Ltd for the Target Rs.3,200 by Motilal Oswal Financial Services Ltd

Consistent growth ahead of industry in DF/Asia

US generics shows revival in growth for two quarters

* Ajanta Pharma (AJP) delivered better-than-expected financial performance for the quarter. It recorded a 5%/8%/9% beat on revenue/EBITDA/PAT for 1QFY26 vs our estimates.

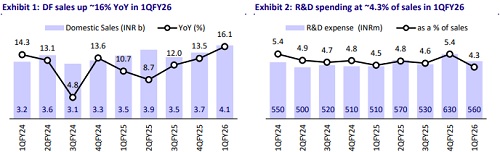

* AJP has consistently outperformed the domestic formulation (DF) market, led by the robust pace of new launches, including first-to-market, scaling up newer therapies, and increasing reach through additional MRs.

* After a moderate YoY growth in FY25, AJP has shown healthy improvement in the US generics segment for the second consecutive quarter.

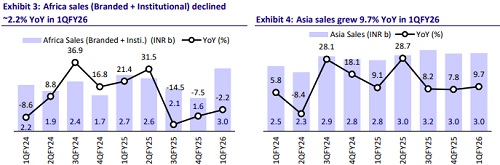

* AJP is strengthening its presence in Asia by adding products in chronic therapies as well as enhancing its MR resources.

* We largely maintain our estimates for FY26/FY27. We value AJP at 34x 12M forward earnings to arrive at a TP of INR3,260. AJP is a differentiated play, with ~76% of its business in the branded generics segment. It follows a geographic-specific strategy to outpace industry growth in DF/Asia/Africa. It maintains a healthy pace of launches and offers better growth prospects in the US generics segment. Overall, we expect a 15% earnings CAGR over FY25-27. Reiterate BUY.

Product mix benefit offset by higher opex YoY

* AJP’s 1QFY26 revenue grew 14% to INR13b (our est: INR12.5b), led by growth across all key businesses.

* DF sales rose 16% YoY to INR4.1b (31% of sales). US generic sales rose 36% YoY to INR3.1b (24% of sales). Branded generics Asia sales rose 10% YoY to INR3b (23% of sales).

* Africa branded generic sales declined 1% YoY to INR2.3b (18% of sales). Africa Institutional sales declined 10% to INR380m (3% of sales).

* Gross margin expanded 220bp YoY to 78.8% due to a better product mix.

* However, EBITDA margin contracted ~260bp YoY to 29% (our est. 28%) as higher gross margins were offset by an increase in employee costs/other costs (up 110bp/390bp YoY as a % of sales).

* Operational costs (employee expense/other expense) have increased at a significantly higher rate than revenue over the past four quarters, driven by MR addition as well as increased marketing/promotional activities for newer therapies.

* Consequently, EBITDA grew 4.5% YoY to INR3.8b (our est. INR3.5b).

* Adjusting for the net forex loss impact of INR158m, Adj. PAT grew 2% YoY to INR2.7b (our est. INR2.5b).

Highlights from the management commentary

* While no ANDA was filed in 1QFY26, AJP has maintained its guidance of 10- 12 ANDA filings for the US market in FY26.

* The company aims to sustain a gross margin of 78% (+-1%) for FY26. It indicated maintaining FY26 EBITDA margin at similar levels to those in FY25.

* AJP guided for mid-to-high single-digit YoY growth in the domestic formulation segment in FY26.

* It aims to sustain the US sales run rate on the back of new launches, market share gains, and upcoming launches

* AJP has taken steps to revive YoY growth in cardiology therapy within the domestic formulation segment, with the impact expected to become visible in the coming quarters.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412