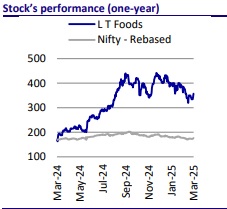

Buy LT Foods Ltd For Target Rs. 460 by Motilal Oswal Financial Services Ltd

Basmati beyond borders!

Export growth picks up

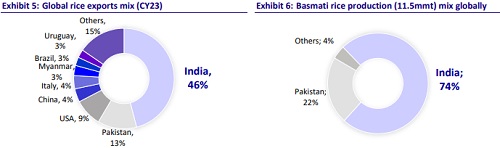

The global rice trade has experienced a sharp uptick, driven by rising consumption, policy shifts, and record production. With global rice consumption projected to reach 530mMT in FY25, up from 522mMT in FY24, demand remains robust across key markets. India, the world’s largest rice exporter, has capitalized on this trend, with rice exports surging 21% YoY in 9MFY25. This was fueled by the removal of export restrictions and a strong global appetite for Indian basmati and non-basmati rice:

* India’s rice reserves soared to 44.1mMT in Dec’24, far exceeding the government’s target of 7.6mMT. Record production has led to a 20% drop in basmati paddy prices this season, easing inflationary concerns but pressuring margins as inventory costs remained elevated.

* The lifting of the non-basmati rice export ban and the removal of minimum export price (MEP) on basmati rice exports in Sep’24 led to a spike in export volumes, particularly in Jan’25, when rice exports surged 50% YoY. However, higher supply has exerted pressure on realizations.

* Despite a 20% YoY increase in 9MFY25 basmati export volumes, realization declined by 7% YoY due to softer global prices. Expanding basmati production, improving yields, and new seed varieties have driven output to record levels, ensuring steady availability.

* As domestic consumption rises gradually and India holds substantial rice reserves, the government’s decision to lift the MEP and export ban on non-basmati rice is set to drive higher exports. Moreover, with better margins and realizations in exports vs. the domestic market, LTFOODS is well-positioned for strong growth.

* We expect LTFOODS to report a revenue/EBITDA/PAT CAGR of 14%/19%/25% over FY25E-27E. We value the stock at 17x FY27E EPS to arrive at our TP of INR460; reiterate BUY.

India’s rice reserves soar propelled by strong production

* India’s rice inventory, including unmilled paddy, has surged to a record 44.1mMT in early Dec’24. This significantly exceeded the government's reserve target of 7.6mMT, primarily due to robust domestic production and previous export restrictions that increased local supplies.

* For FY25, rice output is likely to reach a record 145mMT, up from 138mMT in FY24, with basmati rice production also hitting an all-time high of over 16mMT of paddy harvested across the GI region and all basmati varieties. This 10% YoY increase is driven by expanded cultivation and improved yields. The introduction of pest- and disease-resistant seed varieties has enhanced productivity while reducing dependence on chemical pesticides.

* Due to higher production, basmati paddy prices have declined by 20% this season compared to the previous year, largely driven by strong supply levels and a balanced supply-demand equation.

* Global rice consumption is estimated to reach 530mMT in FY25, while its estimated production stands at 534m, indicating that production will once again exceed consumption. This shift marks a reversal of the deficits observed in FY22 and FY23.

* Further, India remains one of the largest consumers of rice, with total consumption inching up to ~110mMT in FY24, from 108mMT in FY23.

Global rice trade on the rise

* As India holds a massive stockpile of rice, and domestic consumption is expected to remain stable, the Indian government lifted the export ban on non-basmati rice. It also removed the MEP of USD950/MT on Basmati rice in Sep’24.

* This policy shift led to higher trade volumes as there is a proven global appetite for consuming Indian basmati rice. This resulted in India's total rice exports surging 21% YoY in 9MFY25, with an impressive 50% spike in Jan’25. Indian basmati rice exports increased 10% YoY in 9MFY25, while volume surged 20% YoY. However, basmati realization dropped 8% YoY to INR85.5/Kg due to record production of basmati rice in India as well as Pakistan.

* During India's export curbs, Pakistan gained market share, with its total rice exports surging 61.5% in volume and 83.5% in value for its fiscal year ending Jun’24. During Jun-Dec’24, Pakistan’s Basmati rice exports jumped 30% YoY, reflecting increasing global demand. Meanwhile, Vietnam also achieved a record-high 9mMT of rice exports in CY24, registering 11% YoY growth. This shift underscores strong global demand, with buyers increasingly willing to source rice from alternative markets.

* Some big buyers of Indian basmati, such as Iran, which were previously affected by geopolitical tensions, are recovering now, with Indian exporters securing 145k MT of orders. Saudi Arabia became the top buyer of basmati in FY24 (the second highest in FY23) and is likely to retain this position in FY25, driven by demand from the wholesale (55-60% of the market) and HORECA (20%) segments. To exploit this trend, LTFOODS plans to export 20K MT of basmati rice to Saudi Arabia in FY26.

* Oman also emerged as a high-growth market with a 46% basmati volume CAGR since FY22. The US market continues to report a 21% CAGR from FY22, with FY25 exports projected to grow 22% YoY. LTFOODS also registered a high growth of 37% and 17% in the Middle East and the US, respectively.

* With India's export restrictions lifted, higher global supplies in CY25 could intensify competition among other exporters, thus influencing price trends.

Basmati’s global sprint: demand hubs, industry trends, and supply woes

* India's basmati rice exports continue to witness strong demand, particularly from the Middle East, Europe, and the U.S. To capitalize on this, LTFOODS is investing SAR185m in Saudi Arabia over the next five years and is also expanding its UK production capacity to 60K MT. With this, the company expects to generate EUR145m in revenue from its UK and European operations by FY26, supported by a growing preference for packaged basmati rice.

* While basmati paddy prices have declined by 20% YoY, inventory costs remained elevated, temporarily impacting margins (inventory loss). The benefits of lower procurement costs are expected to be reflected in the financials from FY26 as inventory levels stabilize.

* Analyzing this trend, LTFOODS’ exports are likely to gain further momentum, leading to relatively higher revenue growth and margin expansion, as exports typically offer better realizations and higher margins than domestic trade.

* However, the industry is facing temporary challenges, with LTFOODS' logistics expenses mounting to 7.1% (up 2.3%/0.5% YoY/QoQ) of revenue in 3QFY25 due to the Red Sea rerouting, port congestion in the US and Europe, rising marine fuel costs, and higher insurance premiums. These factors have hit its EBITDA margin by ~200bp.

* While freight rates are projected to remain elevated in 4QFY25, industry experts anticipate cost stabilization from 1QFY26 as geopolitical tensions ease and alternative shipping routes become more efficient. Despite these short-term pressures, India’s Basmati rice exports continue on a strong growth trajectory, driven by rising global demand and expanding market reach.

LTFOODS fares well among peers

* LTFOODS reported a 14%/13% volume/revenue growth in 9MFY25, the best in the industry, backed by strong traction across key markets (refer to Exhibit 4).

* EBITDA margin for the industry contracted in 9MFY25 due to declining paddy prices and elevated freight costs as highlighted earlier. Among peers, LTFOODS witnessed the lowest contraction in margin (~100bp YoY), while other key players such as KRBL and Chamanlal saw a higher contraction of ~490bp/340bp (refer to Exhibit 9).

* LTFOODS has a well-diversified geographic presence that is insulated in multiple ways, such as well-distributed freight cost impact, diverse realization according to the industry, and strong growth across key markets. Further, the growing value-added segments, such as Organic and Convenience & Health, support the company’s margins.

Valuation and view

* With domestic consumption gradually rising and India holding substantial rice reserves, the government has decided to lift the MEP on basmati rice, which is anticipated to drive higher exports. Given the superior margins and realizations in exports compared to the domestic market, LTFOODS is well-positioned for strong growth as 66% of its revenue is derived from exports.

* LTFOODS is likely to witness margin improvements as we expect its export mix to strengthen, aided by the benefit of low-priced inventory from 2QFY26.

* We expect LTFOODS to report a revenue/EBITDA/PAT CAGR of 14%/19%/25% over FY25-27. We value the stock at 17x FY27E EPS to arrive at our TP of INR460; reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412