Buy Power Grid Corporation of India Ltd for the Target Rs. 386 by Motilal Oswal Financial Services Ltd

Strong capex outlook and expanding pipeline, but dividend pressure likely

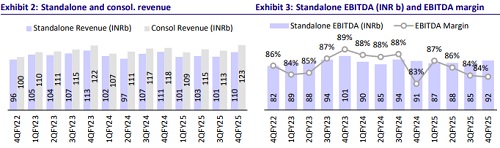

* Power Grid (PWGR)’s 4QFY25 reported standalone (SA) EBITDA and Adj. PAT were in line with our estimates at INR92.2b/42.9b (flat YoY). On a consolidated basis, the reported PAT was flat YoY at INR41.4b.

* In the earnings call, management highlighted a strong capex trajectory, rising capitalization, and an impressive HVDC/TBCB pipeline. As per PWGR, the capitalization trajectory remains aggressive despite the company missing FY25 guidance by ~50%. It also plans to capitalize INR230-250b in FY26. Its capex targets were maintained at INR280b/INR350b for FY26-27, and an FY28 capex target was introduced, with capex rising to INR450b by FY28 from INR262b in FY25. The right-of-way/land acquisition issues have been the key obstacles to completing projects, and it believes some of these challenges should recede as states adopt revised right-of-way compensation guidelines issued by the Center.

* The medium-to-long-term HVDC pipeline remains impressive with at least five domestic HVDC projects (Khavda-Nagpur, Fatehpur-Badla, Leh-Pang, Khavda-South Olpad, Rajasthan to Maharashtra, Kurnool to Vizag, et al.) and several international ones (India to SG via Andaman, India-Sri Lanka, IndiaMyanmar, India-Oman, etc.). Further, the inter- and intra-state TBCB pipelines should see additional bids worth INR6t and INR3t, respectively, by 2032. Of the current order book of INR1.54t, 30% is attributable to RTM projects, where the company earns a healthy 15% RoE.

* However, given the rising capex needs, management highlighted that there could be a further downside to DPS; the company paid INR9/share as dividend in FY25 (FY25: 54% payout, FY24: 67%).

* We reiterate our BUY rating on the stock with a TP of INR386 based on 3.4x FY27E BVPS.

In-line 4QFY25

* Standalone (SA) performance:

* In 4QFY25, PWGR reported SA revenue of INR110b (-1% YoY) and EBITDA of INR92.2b (+1% YoY), in line with our estimates.

* Adj. SA PAT was in line with our est. at INR42.9b. Higher-than-expected interest expenses were offset by lower depreciation and tax expenses and higher-than-expected other income (including a profit of INR2.4b from the 26% stake sale in SPVs transferred to PGInvIT, which was classified as ‘assets held for sale’ as of end-3QFY25).

* The net movement in regulatory deferral account balances was positive at INR0.5b during the quarter.

* SA revenue/EBITDA/APAT stood flat YoY at INR414b/INR352b/INR151b in FY25.

* Consolidated performance:

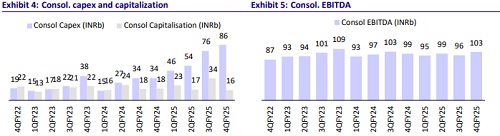

* Reported PAT came in at INR41.4b (flat YoY), while EBITDA rose ~4% YoY to INR102.7b.

* The transmission segment remained the primary revenue driver, contributing 96.95% of consolidated EBIT (INR70.2b). The telecom segment contributed 1.96%, with EBIT of INR1.4b. ? In 4QFY25, its JVs reported a loss of INR0.29b, taking the total loss to INR1.1b for FY25 (vs. a loss of INR0.19b in FY24).

* Key Announcements:

* The Board recommended a final dividend of INR1.25/share.

Highlights of the 4QFY25 performance:

* Operational performance and financials

* The company added 645ckm of transmission lines and 12,000MVA of transformation capacity in 4QFY25.

* The transmission system had an availability rate of 99.8% in FY25, reflecting high operational efficiency.

* For FY25, the reliability rate was 0.27 trippings per line.

* On a standalone basis, the average borrowing cost was 7.41% in 4QFY25.

* The telecom division successfully added 75 new customers during the year and reported an income of ~INR11b for the year.

* Project wins and capex outlook

* PWGR secured a record 24 TBCB projects in FY25 with a total cost of projects won amounting to ~INR920b.

* In 4QFY25, on a consol. basis, capex was INR86b and capitalization was INR16b.

* In FY25, a capex of INR263b was incurred; its capitalization stood at INR90b in FY25 (vs. a guidance of INR180b).

* Capex targets for FY26/FY27/FY28: INR280b/INR350b/INR450b, and work in hand is INR1.55t.

* Future growth and dividend

* The dividend for FY25 was INR9/share (dividend payout: ~54%), and management highlighted that there could be further downside going forward, given its aggressive capex plans

Valuation and view

We derive our TP of INR386 for PWGR based on FY27E BVPS and a P/B multiple of 3.4x, which we believe is reasonable given that capex and capitalization are on a multi-year uptrend with the order book at an elevated level.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412