Neutral Aditya Birla Fashion and Retail Ltd For Target Rs.285 by Motilal Oswal Financial Services Ltd

GM expansion drives beat; near-term focus on demerger

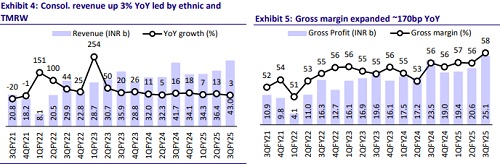

* Aditya Birla Fashion and Retail (ABFRL)’s revenue growth remained muted at ~3% YoY (in line) in 3QFY25. The growth was driven mainly by Ethnic and TMRW (to be part of demerged ABFRL), whereas growth remained muted in Lifestyle Brands (robust LTL offset by weak wholesale) and Pantaloons (shift in Pujo dates).

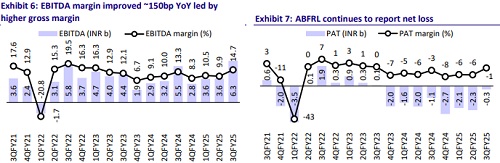

* EBITDA was up 15% YoY (11% beat), driven by broad-based improvement in profitability, with ~150bp YoY expansion in consolidated EBITDA margin.

* Recently, ABFRL successfully raised USD490m (INR42.4b) through QIP and preferential issuance to the promoter and Fidelity group, resulting in the complete deleveraging of the company.

* Management expects to complete the demerger in the next 2-3 months. After the demerger, ABLBL will start with a net debt of INR7b, while demerged ABFRL will have a net cash of INR13b.

* We raise our FY25-26E EBITDA by 6-7%, primarily led by better profitability in demerged ABFRL, while Earnings improve sharply on account of lower interest costs after the recent fundraise.

* We build in a CAGR of 7%/16% in revenue/EBITDA over FY24-27E for ABFRL, with demerged ABFRL to record better ~11%/26% revenue/EBITDA CAGRs.

* We value ABFRL on the SOTP basis. We assign EV/EBITDA multiple of 14x to both ABLBL and Pantaloons business and EV/sales of 1x to other businesses of ABFRL (demerged) on FY27E. We reiterate our Neutral rating with a TP of INR285.

Muted revenue growth; GM expansion drives beat

* Consol. revenue grew 3% YoY (in line) to INR43.1b, driven by growth in the ethnic and TMRW portfolios.

* Lifestyle revenue remained flat YoY (2% miss) as 12% LTL growth in the retail channel was offset by weaker primary sales in wholesale and other channels.

* Pantaloons revenue declined ~2% YoY due to the shift in festive dates (Pujo in 2Q) and continued store closures.

* Ethnic revenue grew 7% YoY, driven by robust growth in designer-led brands amid strong festive and wedding seasons.

* TMRW revenue surged 26% YoY.

* Gross profit grew 6% YoY to INR25.1b (2% beat) as margins expanded ~170bp YoY to 58.2% (120bp beat).

* EBITDA rose 15% YoY (11% beat) to INR6.3b, led by higher gross margin.

* EBITDA margin expanded ~150bp YoY to 14.8% (~150bp beat).

* Margin expansion was broad-based across Lifestyle, Pantaloons, and Ethnic segments.

* However, ABFRL continued to report a net loss, with a loss of INR0.4b (though better than INR1.1b loss YoY and our estimate of ~INR1b loss).

Key highlights from the management interaction

* Demand: The overall consumption environment remained subdued in 3Q with inconsistent footfalls. Demand was robust in the festive and wedding season, though it tapered through rest of the period.

* Debt: The overall net debt at the end of Jan’25 (post QIP) stood at INR18b, which should come down further after the INR23.8b preferential issuances. Management indicated that ABLBL (Lifestyle Brands) is likely to start FY26 with a net debt of INR7b, while the demerged entity (ABFRL) will likely start with a cash balance of INR13b.

* Demerger: The demerger process is progressing well and is expected to be completed in the next 2-3 months. The final NCLT hearing is scheduled in the third week of Mar’25.

* Lifestyle Brands: Management indicated that lifestyle brands performed well during the festive and wedding period, which led to robust LTL retail growth. The growth was impacted by weaker primary sales in the wholesale channel (also impacted by a strategic shift by one of the top large-format retail partners for ABLBL). Its focus on reducing markdowns and consolidation of unprofitable stores led to margin improvements. The company plans to add 300 stores in the next 12 months, primarily in top cities, with a focus on opening larger stores.

* Priorities for demerged ABFRL: Management is likely to focus on scaling up value fashion (through Style Up) and Ethnics (through Tasva). It believes that INR13b is enough cash cover to support the growth plans for demerged ABFRL as the Pantaloons and ethnic segments (excl. Tasva) can self-fund the growth and there will be a separate fundraise for the digital segment (TMRW). Management expects demerged ABFRL to be a cash-generating company in the next three years.

Valuation and view

* The company is currently undergoing a demerger process, with the scaled-up cash-generating businesses (Lifestyle brands) to be transferred to a new entity, ABLBL. The demerged ABFRL will house the Pantaloons, value fashion (Style Up), Ethnic, digital-first brands (TMRW) and Luxury Retail.

* In the last few years, ABFRL has invested in multiple new businesses, with a long tail of businesses that are presently loss-making or yet to stabilize. While the debt concerns have been addressed with the recent fundraise. We believe that profitably scaling up the value fashion and ethnic wear and turning around the newly set up digital-first brands could be a bumpy ride. The inclusion of TCNS in the Ethnic portfolio may further accentuate near-term profitability risks.

* We raise our FY25-26E EBITDA by 6-7%, primarily led by better profitability in demerged ABFRL, while earnings improve sharply on account of lower interest costs after the recent fundraise.

* We build in a CAGR of 7%/16% in revenue/EBITDA over FY24-27E for ABFRL, with demerged ABFRL to record better ~11%/26% revenue/EBITDA CAGRs.

* We value ABFRL on the SOTP basis. We assign EV/EBITDA multiple of 14x to both ABLBL and Pantaloons business and EV/sales of 1x to other businesses of ABFRL (demerged) on FY27E. We reiterate our Neutral rating with a TP of INR285.

* Our SoTP implies an enterprise value of INR203b (or ~INR166/share) for ABLBL and INR165b (or ~INR135/share) for the demerged ABFRL business.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412