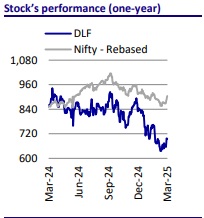

Buy DLF Ltd For Target Rs. 954 by Motilal Oswal Financial Services Ltd

Focusing on sustainable and profitable growth ahead

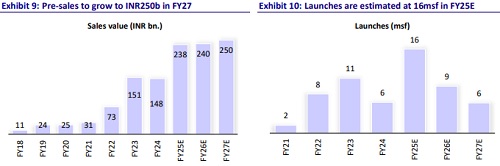

We attended DLF’s Analyst Day, which included visits to several projects followed by a meeting with management. The company laid out its detailed future roadmap for both business segments—development and annuity—highlighting an incremental potential of 27msf due to its revised TOD/TDR potential. Management is focused on sustainable and profitable growth, guided by a strong launch pipeline and underdevelopment annuity assets, along with a strategically located land bank. However, we have not considered the incremental potential for our calculations due to the revised TOD/TDR potential. DLF has a strong portfolio of luxury residential projects that have received an extraordinary response at launches. Gurugram is emerging as a destination for uber-luxury residences, where DLF has an absolute monopoly. With pre-sales expected to clock a 20% CAGR over FY24-27, coupled with healthy collections visibility, a large land bank to support long-term growth, a cashpositive balance sheet, steadily growing rental income, and reducing debt, our confidence in DLF remains strong. Reiterate BUY with a TP of INR954.

Analyst meet highlights

* Strong financial growth and shareholder commitment: DLF reported over INR130b in revenue and more than INR70b in EBITDA in FY24, marking steady and rapid growth over the past five years. The company has consistently maintained dividend payments for 17 years, with a notable increase in recent years, reflecting its commitment to shareholder value.

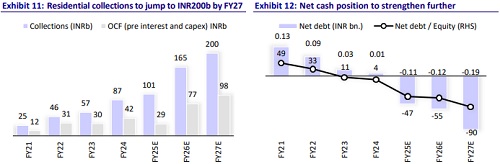

* Focused debt reduction and financial discipline: Reducing net debt has remained a central focus. Over the past five years, DLF has brought down its net debt from INR240b to INR147b, a reduction of ~INR95b. This progress was accompanied by a decline in net debt/EBITDA ratio to ~2.5x as of December-end, driven by strong operational performance.

* Core business structure and strategy: DLF's operations center around two core businesses: development and annuity. Both business verticals are analyzed separately, with insights into their performance and strategic direction.

* Land bank strength and business philosophy: The company holds a highquality land bank acquired at opportune times. This land bank is primed for high-value monetization in the coming years. DLF's customer-centric philosophy remains paramount and is continually emphasized across the organization. In addition, the company prioritizes margins and cash flow, considering them as two critical pillars of business development and performance tracking.

* Conservative accounting approach: DLF follows a conservative accounting policy, which means its financial statements may not immediately reflect current activities. Revenue is recognized only after project completion, typically with a lag of 3-5 years. As such, recent strong sales and operational performance will be reflected in future financials.

* Exceptional sales performance in FY24: For the current fiscal year, DLF achieved approximately INR192b in new sales bookings. Project launches such as Privana South, Privana West, and Dhalias, particularly in the super-luxury segment, received exceptional market response, exceeding expectations. The company had to prioritize allocations due to oversubscription, highlighting the high demand for its offerings.

* Margins and revenue recognition outlook: Strong sales have been complemented by superior margins. As of Apr’20, DLF had INR94b of unrecognized margins. Since then, an additional INR257b in margins has been booked, with INR138b already realized in financial statements. As of Dec’24, over INR201b in residual margin is yet to be recognized and will be progressively reflected in P&L as projects are completed.

* Operating cash flow and strategic investments: Despite significant investment in land acquisition and approvals, DLF continues to generate robust operating cash flows. For instance, the acquisition of strategic parcels like Sector 61, located across from Golf Course Road, is expected to be highly value-accretive.

* Strong liquidity position: The company has achieved a net cash position of INR45b as of December-end, with INR71b held in RERA-regulated accounts. This liquidity serves as a foundation for growth and debt management.

* Customer returns and investment performance: Over a 10- to 15-year period, DLF projects have delivered strong long-term returns to customers across all categories: Super-Luxury at ~17-18% CAGR, Luxury at ~11-12% CAGR, Premium at ~9-10% CAGR. These returns are competitive with traditional asset classes like equities, debt, and gold.

* Medium-term launch pipeline and execution: DLF’s medium-term launch pipeline consists of 37msf, with a GDV of INR1.15t. As of 9MFY25, ~35% of this pipeline (INR406b) has been launched and another ~15% (INR172b) is expected to be launched in FY26. This reflects that 50% of the defined launch pipeline is already underway.

* Inventory and gross margin potential: From the launched projects worth INR406b, INR174b has already been sold. The remaining INR232b in inventory will contribute significantly to future cash flows. The combined gross margin potential from sold and unsold launched projects is estimated at INR371b.

* Future margin contributions: Additionally, future pipeline projects are expected to contribute another INR300b in margin, bringing the total medium-term gross margin potential to ~INR670b.

* Projected cash realization: If these margins are converted into cash, DLF has INR90b of cash as of Dec’24, while receivables from sold inventory total INR300b. Project execution costs are estimated at INR200b, resulting in potential cash realization of INR190b from launched projects. Further, by adding another INR240b from unsold inventory (net of expenses), DLF projects generating INR430b in cash from launched projects alone.

* Net cash surplus forecast: After deducting operating expenses, taxes, and interest (estimated at INR170-190b), DLF expects a net medium-term cash surplus of approximately INR250b. New pipeline launches are anticipated to generate another INR240-260b, potentially bringing the total cash surplus to INR500b.

* Land bank reassessment and long-term potential: DLF reassessed its land development potential, revising it from 169msf to 196msf based on updated zoning and TOD/TDR regulations. Of this, 23msf is under development, 29msf is in the pipeline, and 144msf remains as residual developable land bank. This inventory is expected to sustain development operations for the next 20 years. Segment-wise, super-luxury, luxury, and premium/commercial land bank assets carry margin expectations of 65%+, 40%+, and 30%+ respectively. Overall, the group targets a long-term gross margin of 45%+ from its development business.

* Commitment to responsible growth: DLF emphasized the importance of not chasing speculative growth or sales bookings. The focus remains on building communities, maintaining quality, and carefully managing the buyer mix— prioritizing end-users and long-term investors while avoiding speculative buyers. The company is committed to fostering customer loyalty, supporting distressed customers, and proactively managing receivables. Typically, as many as 25% of buyers exit early, and DLF facilitates these exits by prioritizing resale inventory before selling new units.

* Land monetization strategy and upgrade potential: With ~85msf of premiumsegment land available, the company is confident that portions of this will upgrade to luxury or super-luxury status as market dynamics evolve. Not all land parcels will be monetized; 5-10% may be sold outright if they do not meet strategic criteria.

* Geographic and segment focus: DLF’s geographic focus will remain on NCR (including Gurugram, Delhi, Noida), North India (e.g. Chandigarh), and Mumbai. The company is not inclined to expand into new regions unless the opportunity is both compelling and scalable.

* Approach to affordability and mid-income segment: While committed to affordability in concept, the company will continue to focus on premium offerings due to land cost and execution constraints. However, successful lowrise premium housing experiments like Garden City Enclave demonstrate DLF’s openness to serving the middle-income segment where viable.

* Launch capacity and execution planning: The company is cautious in managing its launch bandwidth. While 2-3 launches per year have been typical, DLF is wellequipped to handle 4-5 residential and 2-3 rental/commercial project launches annually starting from FY26.

* Annuity business portfolio: In the annuity business, DLF currently has 44msf of operational portfolio, including 39msf of office space and 4.3msf of retail space, with the hospitality and services verticals further complementing rentals. In 9MFY25, the annuity business generated INR57b in total revenue, including INR38b in rentals. It delivered over 36% PAT and maintained a net debt/EBITDA ratio of 3.6x. DLF plans to expand the annuity portfolio to 73 msf (60 msf office + 13 msf retail) in five years. Estimated capex is INR200b (INR120b for DCCDL and INR80b for DLF rentals/hospitality). Rental income is expected to reach INR100b by FY30. Current occupancy rates are – Office at ~93% (97% excluding SEZ), Retail at 98%, and New Projects at 95% pre-leased.

* Synergy between development and annuity businesses: DLF’s rental business maintains high efficiency and significant embedded growth potential. In most cases, the land for future expansion is already paid for, improving return on capital. Both development and annuity businesses complement each other: development generates cash for annuity growth; annuity returns provide capital for future development. Together, they enable integrated community creation and sustain financial performance. DLF remains confident in its ability to deliver long-term value while maintaining focus, discipline, and capital prudence.

Valuation and view

We value DLF using an SoTP-based approach:

* The values of completed, ongoing, and upcoming projects and the landbank are derived through the NAV-based approach discounted at a WACC of 11.6%.

* The value of the operational portfolio is derived by applying an 8% cap rate on Mar’26E EBITDA for office and a 6.5% cap rate for retail on Mar’26E EBITDA.

* Our GAV stands at INR2,439b, and after netting off FY25E debt of INR78b (DLF’s share), we arrive at an NAV of INR2,361b or INR954/share, indicating a fair valuation. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412