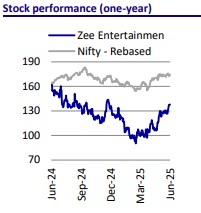

Neutral Zee Entertainment Ltd for the Target Rs. 150 by Motilal Oswal Financial Services Ltd

Promoters to infuse INR22.4b to increase stake to ~18.4%

Zee’s Board of Directors has approved the issuance of up to 169.5m fully convertible warrants to promoter group entities on a preferential basis at INR132 per warrant (~2.6% premium to the SEBI floor price). The issuance of warrants is subject to shareholders’ approval and will result in a capital infusion of ~INR22.4b, increasing the promoter shareholding to 18.39% (from ~4% currently), upon full conversion of the warrants. While the intended use of funds has not been disclosed yet, capital allocation will remain a key monitorable. At the outset, we view the promoters’ move to raise their stake in the company as a positive development. Our earnings remain unchanged as we await further clarity on usage of funds. We remain Neutral on Zee with revised TP to INR150 (earlier INR125), premised on 14x FY27E PE (vs. 12x earlier) as we await sustained revival in ad revenue and favorable outcome in ICC rights arbitration with Star.

Promoter infusion to improve Zee’s financial strength and cap table

* Following a strategic review of Zee’s growth plans and market perception conducted by a banker, the Board has approved an increase in promoter shareholding in the company by way of issuance of fully convertible warrants.

* Zee’s promoters will infuse ~INR22.4b over a period of 18 months through the issuance of 169.5m fully convertible warrants at a price of INR132/warrant. As a result, promoters’ shareholding in Zee will increase to ~18.4% (vs. ~4% currently).

* We believe the promoters’ funding for warrants is driven by the recovery of certain dues of Essel Group (~INR6b recovered recently, with potential recovery of up to INR18b over the next 12-18 months as per media reports).

* Zee emphasized that this fund infusion is intended to strengthen its financial base by providing access to significant growth capital and supporting the execution of its strategic growth plan, with a focus on becoming a leading content and technology powerhouse.

* Additionally, this move will enable the company to further fortify its core business and strengthen its financial foundation to explore value-accretive growth opportunities in the Media & Entertainment space.

* We note Zee had raised FCCBs (~INR20b) for funding future growth initiatives last year and management has not laid out any concrete M&A targets yet.

* The additional fund raise from promoters is also said to be for funding the next phase of growth, without any specific mention of the use of fund raise.

* While the use of fund raise is not clear and share purchase from the market could have been considered, we believe promoter infusion through warrants could still be considered sentimentally positive at the outset.

Promoter confidence in business transformation sentimentally positive

* According to the company’s press release, the proposal to increase promoters’ shareholding in Zee was first submitted in early May’25 (when the stock was at ~INR106.4/share).

* Despite the recent run-up, promoters have shown their commitment to the business by subscribing to warrants at a higher price.

* We believe the promoters’ infusion to raise shareholding should be viewed as sentimentally positive for the stock price and could prompt renewed interest from other financial investors.

* However, the use of the fund raise will remain key monitorable, along with a sustained recovery in ad revenue.

Valuation and view

* Zee aims to deliver a revenue CAGR of 8-10% with its current portfolio and improve EBITDA margins to an industry-leading range of 18-20% by FY26.

* We believe that a sustainable recovery in ad revenue remains key to achieving these aspirations and driving a potential re-rating of multiples.

* Our earnings estimates are unchanged as we await more clarity on the use of promoter fund infusion (~INR22b) and FCCBs (~INR20b). However, the fund infusion will provide Zee with enough firepower to improve its competitive position in the industry.

* We build in a CAGR of 4%/7%/8% in revenue/EBITDA/PAT over FY25-27E.

* As noted earlier, Zee’s valuations have turned attractive. However, a sustained recovery in domestic advertisement revenue and a favorable outcome in ongoing litigation for ICC rights with Star remain key for rerating.

* We reiterate our Neutral rating on Zee with a revised TP of INR150, premised on 14x FY27E PE (vs. 12x earlier).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412