Buy Larsen & Toubro Ltd for the Target Rs. 4,100 by Motilal Oswal Financial Services Ltd

Focus on growth and better return profile

* LT’s annual report of 2025 highlighted its consistent focus on diversifying revenue streams, exploring new opportunities and enhancing return profile. We expect LT to benefit from the strong international prospect pipeline, a low base of domestic ordering last year, an improved RoE profile, and better capital allocation over the past few years.

* The company’s near-term ordering may be affected by the Israel-Iran conflict in the Middle East and fluctuating oil prices, but the long-term support comes from 1) a strong order book sustaining healthy revenue growth, 2) fairly stable working capital driving improvement in return ratios, and 3) margin improvement.

* We incorporate details of the annual report and roll forward our valuations to Jun’27 to arrive at a revised TP of INR4,100, based on 28x Jun’27E earnings for core business and a 25% holding company discount to subsidiaries. Maintain BUY.

Changing business mix led to improved return profile

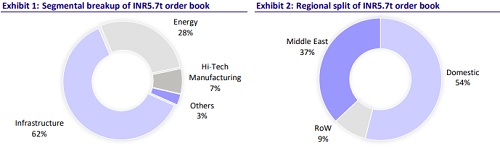

LT’s business mix across domestic and international businesses has shifted over last few years. Driven by a robust ramp-up in international ordering, particularly in the last three years, LT’s order inflows have grown 2x in FY25 to INR2.8t and core EPC revenue has surged 1.7x vs. FY22. Strong inflows and a healthy prospect pipeline should result in higher mid-teens growth in core EPC revenue over the next five years vs. 11% revenue CAGR in the past five years. Despite changing business mix of L&T in terms of higher share of international projects in overall order inflows (57% share in FY25) as well as revenues (44% share in FY25) and a 90bp margin contraction over FY22-25, LT has managed to improve its return profile with efficient working capital. RoE has improved from 11% in FY22 to 16.3% in FY25. We expect LT to remain focused on improving the overall return profile.

International prospect pipeline is strong

LT’s prospect pipeline for FY26 is up 57% YoY at INR19t, mainly driven by a surge in its international prospect pipeline. This is spread across infrastructure, renewable and energy projects. Within the region, apart from Saudi Arabia, LT remains positive on Qatar, Kuwait, UAE and other CIS countries. Spending was strong in CY24 in the GCC region, but GCC contract awarding came down in 5MCY25 due to slower project awards from Saudi giga projects. This slowdown was also attributed to a fall in oil prices and uncertainty caused by the US’s imposition of global tariffs. Despite the fall, LT is confident of getting strong inflows from the Middle East, as LT is focusing on other areas like Kuwait, Qatar, and the UAE, apart from Saudi Arabia. The recent escalation in the Israel-Iran conflict has raised concerns about the geopolitical situation in the Middle East, leading to a spike in oil prices to USD70 per barrel. LT noted that if oil prices fall below USD55 per barrel, the region could witness growth headwinds.

We expect domestic market inflows to grow selectively

In domestic markets, LT is optimistic about ordering from segments like transmission and distribution, nuclear, thermal power projects, defense, buildings and factories. Within the infrastructure segment, we expect stable traction in B&F from both government and private projects, power T&D, renewables, minerals and metals. Within the energy segment, the company had a high base in FY25 due to an ultra-mega project received in hydrocarbon from Qatar and a thermal BTG contract received from NTPC in the carbon lite segment. We, thus, expect growth to moderate in FY26 for this segment, though the outlook remains strong in this segment for hydrocarbon and thermal power. In hi-tech manufacturing, we expect the defense addressable market to remain strong for LT, especially in artillery programs, air defense programs, armored platforms, weapon delivery platforms, combat engineering systems, naval shipyards and space segment. The heavy engineering segment’s outlook remains promising in nuclear projects. In the ‘others’ segment, L&T Realty revenue is witnessing an uptrend. L&T Realty has a development potential of 70m sq.ft. across residential, commercial and retail segments in Mumbai, Navi Mumbai, Bengaluru, Delhi-NCR and Chennai.

Subsidiaries and JVs

For Hyderabad metro, the concession agreement includes real estate development rights of 18.5m sq.ft. in the form of TOD, of which 4.74m sq.ft. has been monetized as of Mar’25. Further, L&TMRHL has developed and operationalized four retail malls aggregating to 1.20m sq.ft. of leasable area. The company continues to pursue opportunities to monetize TOD rights from third-party investors.

Focus remains on capital allocation

Capital allocation has been prudent for LT for the last 10 years, when the company has selectively infused equity in subsidiaries and majorly distributed cash flows as a payout to shareholders. In FY25 too, the overall investment increase was nearly INR100b primarily toward current investments (INR80b), investment in L&T Semiconductor Technologies (INR3b), L&T Green Energy Tech (INR2b), E2E Networks (INR10b), business park and corporate park another nearly INR4b, and L&T Finance (INR2.2b).

Financial outlook

We expect a CAGR of 11% in core EPC order inflows over FY25-28. With a strong track record of execution, we expect a 15% CAGR in core EPC revenue over the same period, with core EPC margin assumption of 8.5-8.8% for FY26-FY28. We thus expect a CAGR of 18%/21% in core EBITDA/PAT over FY25-28.

Valuation and view

At the current price, LT is trading at 30x/25x P/E for FY26/27E for core EPC business. We incorporate annual report details and roll forward our valuations to Jun’27 to arrive at a revised TP of INR4,100, based on 28x Jun’27E earnings for core business and a 25% holding company discount to subsidiaries. We remain positive on the company considering its ability to benefit from a large prospect pipeline and maintain healthy NWC and RoE. Maintain BUY.

Key risks and concerns

A slowdown in order inflows, geopolitical issues, delays in the completion of mega and ultra-mega projects, a sharp rise in commodity prices, an increase in working capital, and increased competition are a few downside risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412