Buy LT Foods Ltd for the Target Rs. 550 by Motilal Oswal Financial Services Ltd

Volume growth continues to drive revenue

Earnings in line

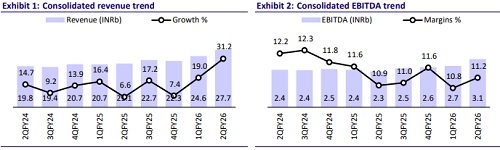

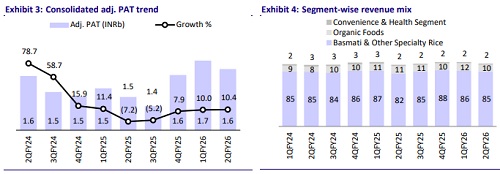

* LT Foods (LTFOODS) reported a strong quarter with revenue growth of 31% in 2QFY26, led by 36% YoY growth in Basmati and Other Specialty Rice (branded business volume up 26% YoY). Normalized growth is ~15%, excluding Golden Star integration and the US tariff-related price hikes. Organic and RTC segments grew 21% and 9% in 2QFY26, respectively.

* Demand remained strong across regions, with volume likely to grow in the double digits for FY26. The US market is expected to see some uncertainty due to tariffs, while other regions are expected to see good growth in 2HFY26. Margin is expected to be under pressure due to the tariff impact, integration of Golden Star, and plant ramp-up in the EU.

* Factoring in this, we cut our FY26 earnings by 6% while broadly retaining our FY27E/FY28E earnings. We reiterate our BUY rating on the stock with a TP of INR550 (premised on 20x FY27E EPS).

Margins under pressure due to higher ad spending and strategic investments

* In 2QFY26, LTFOODS‘s consolidated revenue stood at INR27.7b (+31% YoY, +12% QoQ) (est. INR26b). EBITDA grew 35%/17% YoY/QoQ to INR3.1b (est. of INR2.9b). EBITDA margin expanded 30bp/40bp YoY/QoQ to 11.2% (est. 11%), led by a gross margin expansion of 80bp YoY, offset by a 60bp YoY increase in other expenses. Adj. PAT grew 10% YoY, while declining 3% QoQ to INR1.6b (in line) for the quarter.

* The Basmati & Other Specialty Rice segment’s revenue grew 36% YoY (including the Golden Star acquisition), led by strong demand across geographies. Gross margin expanded 300bp YoY to 34%, and EBITDA margin expanded 100bp YoY to 13%, while volumes grew 26%. India business grew 13% YoY, while the International business grew 47% YoY, led by the integration of Golden Star and tariff-related price increases.

* Organic Foods' revenue grew 21% YoY. Gross/EBITDA margins contracted 1100bp/800bp YoY to 33%/3.9% due to the higher initial cost of commissioning a new plant in Europe. The RTC segment revenue grew 9% YoY, mainly due to the strong performance of the Dawat Biryani Kit and the introduction of the Thai Green Curry kit. Gross margin dipped 1,100bp to 31%, and operating loss stood at INR72m, led by a rise in brand investments.

* In 1HFY26, its revenue/EBITDA/Adj. PAT grew 25%/22%/10% YoY to INR52.3b/INR5.7b/INR3.3b. Region-wise, India/North America/EU grew 13%/47%/31%, while the Middle East declined 18% for 1HFY26. For 2HFY26, our implied revenue/EBITDA/Adj. PAT growth is ~27%/29%/25%

Highlights from the management commentary

* Acquisition in Hungary: LTFoods entered into the EUR15b European processed canned food market via the acquisition of Global Green. The acquisition is at an EV of ~EUR25m, financed largely by debt on an all-cash basis. This acquisition strengthens the company’s footprint across Central & Southern Europe.

* Organic business: LTFoods entered the B2C segment in Europe with the inauguration of a new facility in Rotterdam. With an initial investment of INR200m, a further INR150m over the next three years. LTFoods is expecting incremental revenue of INR4b over the next five years, with expected revenue acceleration from FY26-27.

* Working capital days improved by 21 days vs. Sep’24, led by higher payable days by 15. An increase in payables days was on account of better negotiation with vendors.

Valuation and view

* LTFOODS reported a strong performance in 1HFY26, fueled by growth in both India and international markets. We expect this momentum to continue, led by 1) strong demand in the Indian market, led by a continued shift from the unorganized to organized players and increased consumption of basmati rice, 2) increasing demand in global markets, 3) new plants and partnerships with the top four retail chains in the EU, and 4) the rising global adoption of basmati rice.

* We estimate a revenue/EBITDA/adj. PAT CAGR of 16%/19%/22% over FY25-28. We reiterate our BUY rating with a TP of INR550 (based on 20x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)