Rupee gains alongside Asian peers as US policy worries trouble dollar

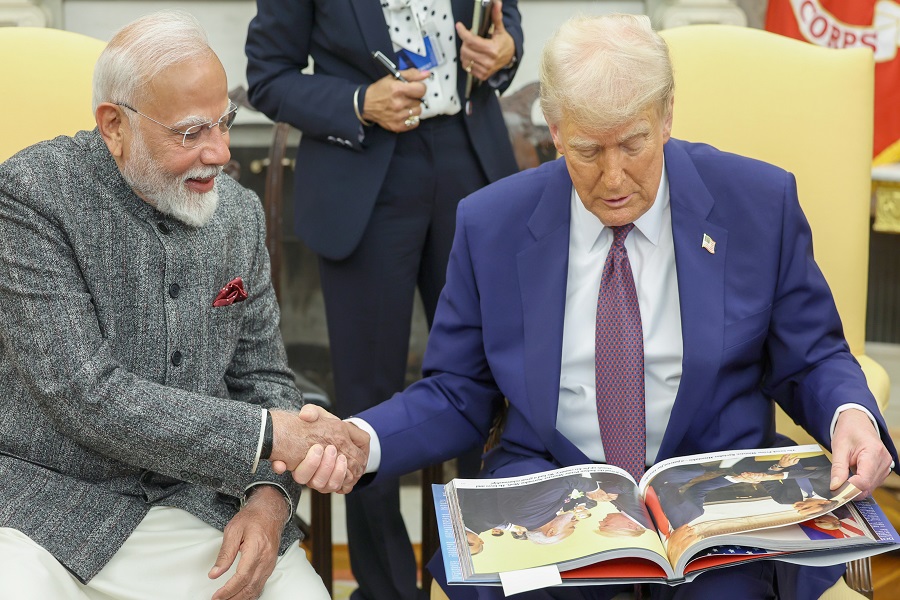

The Indian rupee strengthened on Tuesday, alongside most Asian peers, as worries over U.S. President Donald Trump's fiscal policies and uncertainty around trade deals kept the dollar pinned at a more than three-year low against major peers.

The rupee closed at 85.52 per U.S. dollar, up about 0.3% on the day.

While the rupee strengthened on the day, it was unable to hold onto gains above the 85.50 mark, with traders pointing to bids from a large state-run bank and a few local private banks.

The currency is likely to stay rangebound in the near term unless it convincingly breaches either 85.45-85.50 on the upside or 86 on the downside, a trader at a private bank said.

Asian currencies were mostly up between 0.1% and 0.4%, while the dollar index declined 0.3% to 96.37, its lowest level since February 2022.

Worries about U.S. fiscal policies, uncertainty over trade deals ahead of a looming deadline and concerns over the future independence of the Federal Reserve have all hurt the dollar this year.

The dollar index is nursing losses of 11% on the year so far.

"The dented safe-haven status of the U.S. amid demanding asset price valuations portends a redistribution of global portfolio flows across various regions. Asia can both drive and benefit from this redistribution," ANZ said in a Tuesday note.

While countries with sizeable external investment surpluses, such as Taiwan and South Korea, will lead the diversification from U.S. assets, potential inflows will also extend more broadly to economies like India and Indonesia, the note added.

With investors also ramping up wagers on faster rate cuts by the Fed this year, the focus will turn to U.S. economic data due later in the day.

Remarks from Fed Chair Jerome Powell will also be in the spotlight for cues on the future path of policy rates.