Buy Bharat Electronics Ltd for the Target Rs. 500 by Motilal Oswal Financial Services Ltd

Strong beat versus estimates

Bharat Electronics’ (BHE) 2QFY26 revenue/EBITDA/PAT exceeded our estimates, driven by strong execution and better-than-expected margins. Concerns over BHE’s plateauing order book seem unwarranted as despite order book growing at a CAGR of 9% during FY23-1HFY26, the company has consistently grown its revenue by 14-17% over the same period, supported by strong inflows, except in FY25. The future order pipeline also remains strong, driven by orders from the AoNs approved across Army, Navy and Air Force over the last two years. This will be further supported by largesized order prospects from QRSAM, project Kusha and next-generation corvettes and export opportunities in future. We also expect margin performance to remain strong, led by project mix and indigenization. We, thus, maintain our positive stance on BHE and retain BUY with a marginally revised TP of INR500, based on 45x Dec’27E EPS (Rs490 earlier).

Beat across all parameters

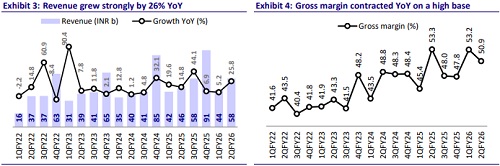

BHE reported a strong set of results with a beat across revenue, EBITDA and PAT. Revenue grew 26% YoY to INR57.6b, beating our estimate of INR52.6b by 10%. Order book stood strong at INR746b, with an inflow of ~INR54b (+116% YoY) during the quarter. Gross margin was slightly below our estimate at 50.9% in 2QFY26. Margin performance is dependent on the project mix during the quarter. However, lower-than-expected operating expenses led to 18% beat in absolute EBITDA at INR17b (+22% YoY), while margins stood at 29.4% vs. our estimate of 27.4%. Strong topline and margin performance resulted in 16%/15% beat to our PBT/PAT estimates. PAT stood at INR12.9b, up 18% YoY vs. our estimate of INR11.2b. For 1HFY26, revenue/EBITDA/PAT grew 16%/26%/21%, while margins expanded 230bp YoY to 28.8%. Operating cash outflow stood at INR8.9b in 1HFY26 vs. an outflow of INR22.9b in 1HFY25. FCF outflow stood at INR13.4b as of 1HFY26.

Near- to long-term prospect pipeline remains strong

BHE’s long-term order pipeline remains strong and well diversified across major defense platforms, ensuring growth visibility beyond FY26. Over the medium term, it sees opportunities exceeding INR500b from recent AoN approvals totaling INR1.7t, including about INR100b from the latest tranche of AoN approvals. The company has already received 11 emergency procurement orders worth around INR13-15b, with another INR20b in advanced approval stages. It also expects next-generation corvette subsystems (INR45b this year and INR80-100b next year) and INR25b avionics orders for the LCA Mk1A. Other programs such as GBMES, mountain radars, Shatrughat, Samaghat, AMCA, and Archer UAV further strengthen BHE’s long-cycle growth outlook. BHE also expects QRSAM worth INR300b to be awarded by Mar’26, with prototype to take another 12-18 months and revenue recognition from FY28 onward with a five-to-six year execution timeline, and later Project Kusha, with production orders by Dec’29.

Transitioning from being an electronics supplier to a full system-level integrator

BHE has entered a strategic consortium with L&T to participate in the AMCA stealth fighter program led by ADA/DRDO. Unlike previous aircraft programs where BHE’s role was limited to supplying avionics and electronic modules, the company aims to move up the value chain into system integration, aircraft integration, and testing roles. The scope includes development of prototypes, validation, and higher-level integration, reflecting a deliberate shift toward end-to-end platform capability. The initial phase involves realization of five prototypes over the next six to eight years, with limited capex requirements of INR1-2b for module testing and jigs. AMCA is a long-cycle program that strengthens BHE’s positioning in high-value aircraft platforms while deepening its collaboration with ADA and DRDO.

Targeted investment for long-term capability expansion

BHE plans to invest about INR14b over the next three to four years in a new defence system integration complex (DSIC) in Andhra Pradesh, covering 920 acres. This facility will primarily support QRSAM system integration, testing, and validation while housing production for unmanned, missile, and radar systems. The investment has been endorsed by both state and central authorities, and BHE has retained flexibility to expand capacity further if programs like Kusha or AMCA advance to production. The company’s steady capex discipline supports its long-term goal of maintaining advanced integration capabilities and readiness for next-generation defense projects.

Guidance maintained

The company continues to target over 15% revenue growth, driven by timely deliveries and new project inflows. EBITDA margins are expected to remain above 27%, aided by favorable product mix, cost optimization, and ongoing indigenization efforts. Order inflows are guided at around INR270b and nearly INR570b including QRSAM, while R&D investment is expected to exceed INR16b and capex over INR10b. Management also reaffirmed its long-term export strategy, aiming to increase exports from the current 3-4% of turnover to about 5% over the next two to three years, and eventually to 10% of total revenues. The company’s healthy USD326m export order book and strong leads across friendly nations provide visibility toward achieving this target.

Fourth Pay Revision Committee (PRC)

BHE mentioned that the Eighth Pay Commission is not applicable to PSUs. Instead, BHE will come under the Fourth PRC, which will determine wage revisions for PSU employees, effective from 1st Jan’27. The committee has not yet been constituted, but management expects the framework to offer flexibility for each PSU to adapt based on its financial performance and profitability, with salaries expected to rise ~10-15% from current levels once the new structure is implemented. This financial impact is expected to begin in 4QFY27, though BHE believes strong revenue growth and operational efficiency will comfortably absorb the cost increase. We have already factored in this increase in employee cost in our estimates.

Valuation and view

BHE is currently trading at 51.2x/43.2x/37.2x on FY26E/FY27E/FY28E EPS. We marginally tweak our estimates to bake in slight margin improvement and lower other income. We marginally revise our TP to INR500, based on 45x Dec’27E EPS, and maintain BUY rating on BHE.

Key risks and concerns

A slowdown in order inflows from the defense and non-defense segments, intensified competition, further delays in the finalization of large tenders, a sharp rise in commodity prices, and delays in payments from the MoD can adversely impact our estimates on revenue, margins, and cash flows.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412