Neutral Torrent Pharma Ltd for the Target Rs. 3,430 by Motilal Oswal Financial Services Ltd

DF, lower interest/tax drive earnings

MR addition/increasing reach to improve outlook of India business

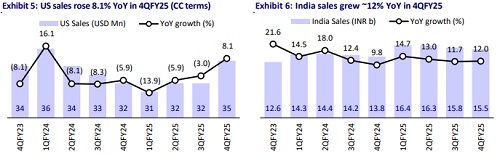

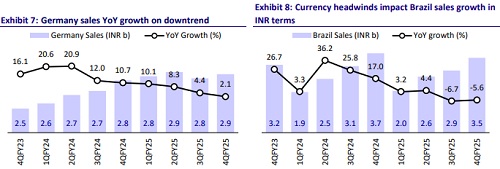

* Torrent Pharma’s (TRP) 4QFY25 performance was largely in line with our expectations. Healthy mid-teen YoY growth in US and domestic formulation (DF) was offset to some extent by currency headwinds in Brazil and modest YoY growth in Germany.

* TRP continues to focus on strengthening its branded business (73% of 4QFY25 sales) in India/Brazil and ROW markets.

* Specifically, in India, it has a multi-prong strategy – product launches in prescription and OTC segment, widening its reach, and adding MRs to support growth.

* Brazil remains a focus branded market for TRP with established presence through its own MR force and enhanced offerings.

* We reduce our FY26/FY27 earnings estimates by 5%/4%, factoring in a) gradual pick-up in US sales, b) moderation in outlook for Germany business and c) reduction in CDMO business. We value TRP at 38x 12M forward earnings to arrive at a price target of INR3,430.

* While revenue growth has moderated over FY23-25, TRP has delivered 25% earnings CAGR, aided by improved profitability and reduced finance cost/tax rate. ROCE reached 20% in FY25. We estimate 25% earnings CAGR over FY25-27, supported by 10% sales CAGR and consistent margin expansion. However, the current valuation (45x FY26 earnings/36x FY27 earnings) largely factors in the earnings upside. Maintain Neutral.

Improved margins, lower finance cost drive earnings growth YoY

* Sales grew 7.8% YoY to INR29.6b.

* India formulations revenue grew 12% YoY to INR15.5b (52% of sales).

* US generics grew 15.3% YoY to INR3b (10% of sales).

* Germany sales grew by 2.1% YoY to INR2.9b (10% of sales).

* LATAM business declined by 5.6% YoY to INR3.5b (12% of sales).

* ROW+CDMO sales grew 5.3% YoY at INR4.7b (16% of sales).

* There is one-time impact of INR170m on account of inventory revaluation of in-licensed products, which went off-patent. Adjusting for the same, gross margin expanded 60bp YoY to ~76% due to a better product mix.

* EBITDA margin expanded by 100bp to 33.2% YoY due to better GM and lower other expenses (down 160bp as % of sales), offset by an increase in employee expenses (up 130bp as a % of sales).

* Accordingly, EBITDA grew 11% YoY to INR9.8b (vs our Est: INR9.7b).

* Adj. PAT grew 18% YoY to INR5.2b.

* In FY25, revenue/EBITDA/PAT grew 7.3%/11.6%/22.7% YoY to INR115b/ INR37.4b/INR19.4b.

Highlights from the management commentary

* TRP is readying itself to be in the first wave of launch of Semaglutide in India market.

* Its Curatio portfolio grew 18-19% YoY in FY25 and aspires to grow this business at higher rate in coming year.

* TRP’s chronic portfolio in DF market grew 14% vs. industry growth of 9% for the quarter.

* The company posted volume/price YoY growth of 4%/7% during the quarter.

* TRP added 200 MRs QoQ and intends to take the total MR strength to 6,800- 6,900 by the end of FY26.

* The company expects high-single-digit YoY growth in Germany revenue in FY25, led by incremental tender wins.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412