Neutral SAIL Ltd for the Target Rs. 145 by Motilal Oswal Financial Services Ltd

In-line revenue; muted costs drive earnings beat

* SAIL reported in-line revenue of INR293b (+12% YoY and +20% QoQ) in 4QFY25, primarily driven by strong volume growth.

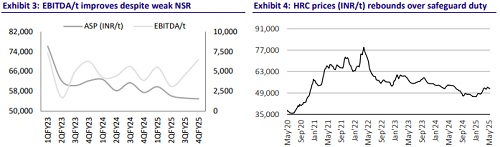

* EBITDA stood at INR34.8b (+97% YoY and +72% QoQ) against our estimate of INR28.8b, led by lower costs. EBITDA/t came in at INR6,536 (vs. our est. of INR5,423), up 69% YoY and 43% QoQ in 4QFY25.

* Adj. PAT came in at INR12.8b (vs. our est. INR7.9b) as compared to INR1.1b in 3QFY25 and INR1.8b in 4QFY24.

* Crude steel production stood at 5.1mt (+1% YoY and +10% QoQ), while sales volume stood at 5.3mt (+17% YoY and 20% QoQ), including semis volume of 0.48mt and 0.36mt from NMDC steel (NSL). ASP for the quarter remained flat QoQ at INR55,000/t, but was lower by 4% YoY.

* For FY25, revenue stood at INR1008b (-1% YoY), EBITDA came in at INR90b (+17% YoY) and APAT was INR13.4b (+24% YoY).

* Production volume stood at 18.2mt (flat YoY), while sales volume grew 5% YoY to 17.9mt in FY25. ASP during FY25 moderated by 6% YoY to INR56,435/t; however, EBITDA/t grew 12% YoY to INR5,042/t, driven by muted costs.

Highlights from the management commentary

* For 1QFY26, management expects coking coal costs to largely remain stable QoQ. Currently, the coking coal price is hovering at INR17,500/t.

* In Apr-May’25, the avg NSR for long steel was INR55,000/t (vs. INR53,500/t in 4QFY25), and for flat, it was INR50,500/t (vs. INR47,300/t in 4QFY25).

* SAIL expects employee costs to decline further in FY26 by ~INR4-5b through normal separation. SAIL expects to achieve 20mt of crude steel volume and 19.2mt of saleable volume (sales volume to remain higher).

* Management targets to spend INR75b in FY26E and guided for peak capex of ~INR100b during FY28/29E.

Valuation and view

* SAIL’s 4QFY25 performance was strong, driven by healthy volume growth, stable prices and muted costs. We slightly raise our FY26 estimates to incorporate the volume and cost guidance; however, we maintain our FY27 estimates.

* SAIL plans to undertake 15mtpa expansions to reach 35mtpa capacity. The plan is currently in the initial tendering phase and any notable development is expected after FY27. Considering the limited room for production, we believe SAIL will see a modest volume CAGR of 6% over FY25-27, and any incremental earnings will be driven by healthy pricing and lower costs.

* At CMP, SAIL trades at 6x EV/EBITDA on FY27E, which is fully priced in. We reiterate our Neutral rating on the stock with a revised TP of INR145 (premised on 6.5x EV/EBITDA on FY27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412