Buy UltraTech Cement Ltd for the Target Rs. 15,200 by Motilal Oswal Financial Services Ltd

Industry leader poised for robust growth

South India emerges as growth engine

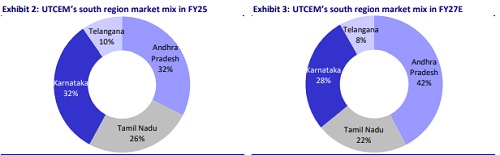

* UltraTech Cement (UTCEM) has in the recent past strengthened its market presence in the southern region through organic and inorganic expansions. The company’s grey cement capacity mix in the south region has increased to ~27% of total capacity currently from ~16% in FY23. Further, its capacity share in the south region (in the industry) has increased to ~25% currently from ~12% in FY23.

* UTCEM management, in its 1QFY26 earnings concall, sounded optimistic about pricing and profitability in the south region. Despite significant capacity additions in the past two years, we believe the company will continue to expand its presence in the south.

* The company is on track to achieve its 200mtpa domestic grey cement capacity target well ahead of schedule and is anticipated to announce the next phase of expansion in the coming quarters. We believe UTCEM will announce ~12mtpa clinker/~18-20mtpa grinding capacity expansions across South, North and Central regions.

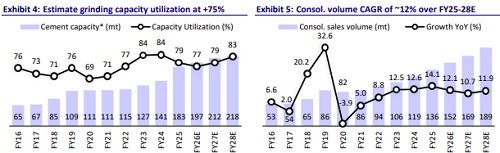

* Its capacity CAGR of ~12% over FY16-25 outpaced peers and the industry. Over the same period, the company’s market share surged 12pp to ~28%, the highest in the industry. We estimate the company’s capacity CAGR at ~6% over FY25-28 and volume CAGR at ~12%, as we believe the company will focus on ramping up its utilization. We estimate the company’s market share to rise to ~32% by FY28. Reiterate our BUY rating.

UTCEM to achieve capacity target ahead of schedule; next phase likely

* UTCEM has remained prudent in terms of capacity expansions, ensuring a balance between growth and capital discipline. It has strategically scaled up its operations through organic and inorganic expansions. Based on the ongoing capacity expansions, the company’s domestic grey cement capacity is estimated to rise to 212.2mtpa by FY27 from 183.4mtpa in FY25.

* Looking ahead, the company is well positioned to announce the next leg of expansions, which will further consolidate its leadership in the industry and strengthen its ability to capture incremental demand from infrastructure development, real estate, and urbanization trends.

* We believe it will add aggregate ~12mtpa clinker capacity and ~18-20mtpa grinding capacity under its next phase of expansions. Based on the environmental clearance data, we anticipate the next phase of expansion will include clinker capacities at Kalaburagi, Karnataka (South), Chittorgarh, Rajasthan (North), Neemuch/Sidhi, Madhya Pradesh (central), and associated grinding units across regions.

* UTCEM, with ICEM’s acquisition and ongoing expansions, established a welldiversified presence across Andhra Pradesh and Tamil Nadu (Exhibit 1). We believe the upcoming expansion at Kalaburagi is aimed at balancing its regional presence. Moreover, the Karnataka facilities, including the acquired Kesoram plant, are estimated to reach optimal utilization in the near term, warranting additional capacity expansion.

Sustainable efficiency gains support profitability; further upside ahead

* Over the past few years, the company has seen sustainable efficiency gains, backed by - 1) a reduction in energy consumption (both thermal and electrical energy), clinker factor, and lead distance, and 2) an increase in green power and alternative fuel share.

* In FY24, the company had set a cost-saving target of INR300/t for the next three years (FY27E) through various initiatives. As of FY25, it has achieved cost savings of INR86/t, led by higher usage of green power (INR31/t), reduction in lead distance (INR44/t), and higher clinker conversion/usage of alternate fuel (INR13/t).

* Going forward, it is aiming for further cost savings through an increase in green power share to ~60% by FY27E vs. ~28% in FY25, a reduction in lead distance to ~343km vs. 384km in FY25, an increase in the clinker conversion ratio to 1.54x vs. 1.47x in FY25 and an increase in AFR share to ~15% vs. ~6% in FY25. We believe these sustainable cost-saving measures will support the company’s profitability and competitiveness.

Higher cash flow generation and deleveraging led by robust earnings

* We estimate a CAGR of ~14%/25%/30% in consol. revenue/EBITDA/PAT over FY25-28. We estimate a consolidated volume CAGR of ~12%. We estimate its EBITDA/t at INR1,157/INR1,252/INR1,286 in FY26/FY27/FY28 vs. INR924 in FY25 (average of INR1,116 over FY21-25).

* We estimate the company’s cumulative OCF of INR521b over FY26-28 vs. INR306b over FY23-25. We estimate cumulative FCF of INR266b over FY26-28, aided by inorganic growth, vs. FCF of INR67b over FY23-25.

* We estimate the company’s net debt to peak out at INR177b (net debt-toEBITDA ratio at 1.4x) in FY25 and thereafter start falling to INR155b/INR100b (net debt-to-EBITDA ratio at 1.2x/0.6x) in FY26/FY27. We believe the company’s comfortable leverage—a net debt-to-EBITDA ratio of <1.0x—will support its expansion journey funded through internal accruals.

View and valuation

* UTCEM (+10% YTD) has outperformed the broader indices (Nifty Index +5% YTD) on account of profitability improvement, resilient pricing despite monsoon season, and positive sentiment in the sector owing to GST rate cuts and increased government spending.

* Our current earnings estimates factor in the resilient pricing trend as indicated by management in the 1QFY26 earnings call. We estimate the industry to pass on GST rate cut benefits to end-consumers in the near term and hence, no material changes in our revenue estimates. However, the pricing trend needs to be monitored, followed by a pick-up in demand and fuel cost trends.

* The stock is currently trading at 18.0x/15.0x FY27E/FY28E EV/EBITDA (vs. its 10- year average EV/EBITDA of 17x). UTCEM’s improved earnings, return ratios, and low-cost expansions warrant a higher valuation multiple. We value the stock at 20x Sep’27E EV/EBITDA to arrive at our TP of INR15,200. Reiterate our BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412