Buy Coal India Ltd For Target Rs. 480 by Motilal Oswal Financial Services Ltd

Robust growth outlook and recent price hike to support earnings; valuation attractive

Robust domestic demand outlook

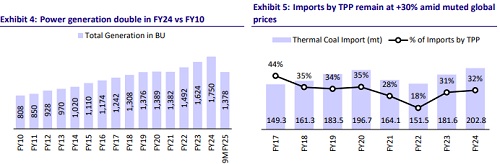

* Coal India’s (COAL) production/dispatches for 11MFY25 stood at 695mt/ 686mt, flat YoY. Despite near-term weakness, the energy demand outlook remains robust for the medium-to-long term as the Central Electricity Authority (CEA) projects peak power demand in summer to hit 270GW over Mar-Jun’25 (~363GW by FY30). The upcoming a +40GW coal-based plant by FY30 will support coal demand. We expect COAL to clock a 6% CAGR in production over FY24-27E.

Dominant position in India's energy sector

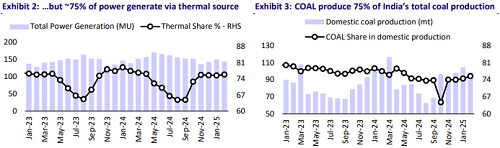

* COAL produces over 75% of India’s coal, with 80% supplied to the power sector. This positions COAL as a dominant player in the coal mining space. Thermal power accounts for ~75% of electricity generation (45% installed capacity), while other sources make up 53%. As India is marching toward becoming an USD5t economy, coal demand is expected to reach 1.3-1.5bt by 2030. COAL is well-positioned to benefit from this stable demand.

Higher e-auction volumes to improve margins; recent price hike at NCL subsidiary to further add to earnings

* In FY24, COAL sold ~70mt (~9% of dispatches) via e-auctions at a 99% premium over FSA prices, which softened to 67% with ~58mt (~10% of dispatches) in 9MFY25. COAL targets 15% of volumes via e-auctions, which will improve NSR and boost margins. We believe the e-auction premiums will remain at ~60%, in line with the historical average of 55-70%. COAL undertook a price hike of INR300/t in its Northern Coalfield subsidiary, which would translate into INR39b in incremental revenue from FY26 onward.

Capex to drive product diversification and portfolio mix

* COAL has ramped up capex for evacuation infrastructure, from INR65-85b before FY20 to INR167b in FY24. Management targets INR200b capex annually for FY25 and FY26 to develop railway corridors, land acquisitions, HEMM procurement, and CHPs. Mine expansions will be funded via internal accruals, with partial borrowing for diversification into RE and coal gasification. COAL operates 12 washeries (29.35mtpa), including 10 for coking coal. A 5mtpa coking coal washery was commissioned in BCCL, with five more (14.5mtpa) set for CCL.

Valuation and view

* The prospects for COAL remain strong. We estimate COAL's production to clock a 6% CAGR over FY24-27, with 15% dispatches via e-auction to result in higher NSR and better margins.

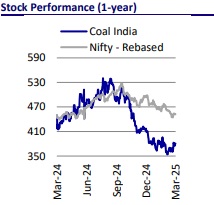

* The recent stock correction offers an attractive valuation, with the stock trading at 3.3x on FY27E EV/EBITDA, below its 10-year historical average. We reiterate our BUY rating with a TP of INR480/share, valuing the stock at 4.5x FY27E EV/EBITDA. COAL remains our top pick in the sector.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412