Buy Federal Bank Ltd for the Target Rs. 250 by Motilal Oswal Financial Services Ltd

Strong earnings beat led by surprise NIM performance

Reiterates 55bp credit cost guidance for FY26

* Federal Bank (FB) reported 2QFY26 PAT of INR9.6b (down 10% YoY, up 11% QoQ, 13% beat), led by healthy NIMs (up 12bp QoQ, vs our estimate of 8bp decline).

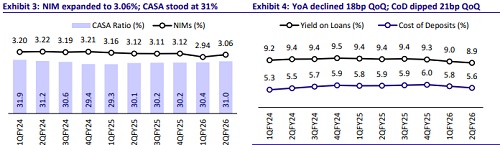

* NII stood healthy (8% beat to MOFSLe), as NIMs expanded 12bp QoQ to 3.06% amid a faster reduction in CoF. FB remains focused on reorienting its asset mix to improve yields and the CASA mix.

* Advances grew 6% YoY/1% QoQ, led by faster growth in SME (CoB + BuB), CV, and Gold. Deposits grew 7.4% YoY/ 0.5% QoQ, while CASA deposits grew 10.7% YoY/2.7% QoQ. CASA ratio improved to 31.01% (30.35% in 1Q).

* Slippages declined to INR6.8b (down 11.6% YoY), driven by a decline in retail and agri slippage. GNPA/NNPA ratios declined 8bp/ flat QoQ to 1.83%/0.48%.

* We raise our PAT estimate by ~5% for FY26/27E, factoring in NIM expansion as well as slightly lower provisions. We estimate FB to deliver FY27E RoA/RoE of 1.19%/12.8%. Reiterate BUY with a TP of INR250 (1.5x FY27E ABV).

Business momentum modest; CASA mix improves to 31%

* FB reported 2QFY26 earnings of INR9.5b (down 10% YoY, up 11% QoQ, 13% beat) amid a healthy uptick in NIMs as well as controlled opex and provisions.

* NII reported a sharp 8% beat as NIMs expanded 12bp QoQ to 3.06%, driven by a reduction in CoF and improving CASA mix.

* Other income declined 2.8% QoQ to INR10.8b (3% lower than MOFSLe) amid lower treasury income, while fee and distribution income continues to report healthy growth.

* Opex grew 9.5% YoY/ 2% QoQ, in line with MOFSLe), while C/I ratio declined 85bp QoQ to 54%. FB expects the C/I ratio to remain in the mid-50s range in the near term. PPoP increased 5% YoY/ 5.6% QoQ to INR16.4b (10% beat).

* On the business front, advances grew 6.2% YoY/1.4% QoQ to INR2.47t, with retail growth being largely flat QoQ. Meanwhile, SME (up 4.9% QoQ), Gold (3.4% QoQ), and CV (3.9% QoQ) continued to grow at a healthy pace. Within retail, credit cards grew faster at 4.5% QoQ (up 18.5% YoY), while housing stood flat and LAP grew 1% QoQ.

* Deposits grew 7.4% YoY/ flat QoQ, driven by SA deposits (up 3.5% QoQ), while the CA book stood flat QoQ. As a result, the CASA mix improved to 31% (vs 30.35% in 1Q), while the LCR ratio declined to 129% (down 3.5% QoQ).

* Slippages declined to INR6.8b (down 11.6% YoY) amid a decline in retail and agri slippages. GNPA/NNPA ratios declined 8bp/remained flat QoQ to 1.83%/0.48%. The bank’s credit costs declined 15bp QoQ to 0.5%. Restructured book declined to 0.49% (down 6bp QoQ).

Highlights from the management commentary

* NIM expanded 12bp QoQ to 3.06%, driven by an 18bp decline in the cost of deposits and moderation in the cost of borrowings. Yield on advances declined 14bp, while a 2bp impact came from optimization of other assets and liabilities, along with a 1bp boost from CRR.

* 50% of the asset book was earlier concentrated in low-yielding segments such as corporate and home loans. A year ago, 53% of the book was repo-linked assets. The bank is undertaking a structural shift in its portfolio mix, which is expected to take time.

* Improvement in RoA will be driven by higher CASA, a better fee mix, and a change in the mix of assets.

* Slippages in the MFI segment have been declining each month, supported by improved collections. Some accounts are also showing reversals, moving from higher to lower buckets.

Valuation and view: Reiterate BUY with a TP of INR250

FB reported a healthy quarter due to better-than-expected NIMs, which were led by a sharper reduction in CoF, an improving CASA mix, and a product mix shift towards mid-yielding assets. Loan growth was modest, driven by traction in the SME segment (CoB + BuB), along with growth in the Gold and CV portfolios, while the MFI book also witnessed some improvement. Deposit growth remained modest; however, faster SA growth led to an improvement in the CASA mix to 31%. NIM witnessed expansion as the bank worked on T+1 loan repricing, and CoF reduction contributed to the 12bp QoQ improvement in NIMs in 2QFY26. The bank expects this momentum to continue, assuming no rate cuts. Asset quality ratios improved, driven by a decline in slippages in agri and retail, leading to a QoQ decline in credit costs. We increase our earnings estimate by 5-5.5% for FY26/27E, factoring in margin expansion as well as slightly lower provisions. We estimate FB to deliver an FY27 RoA/RoE of 1.19%/12.8%. Reiterate BUY with a TP of INR250 (based on 1.5x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)