Electronic Manufacturing Services: EMS growth intact; margin pressure in CD by Prabhudas Lilladher Ltd

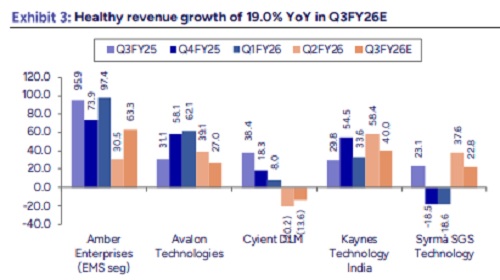

Electronics manufacturing services (EMS) companies under our coverage are expected to post moderate YoY revenue growth of 19.0% in Q3FY26, driven by single-digit growth in AMBER’s Consumer Durables (CD) segment, which contributes ~70% to its topline, while KAYNES, SYRMA, and AVAL are likely to maintain strong momentum, with YoY revenue growth of 40.0%, 22.8%, and 27.0%, respectively. We expect margins to remain largely YoY stable at 8.9% for the EMS universe, while AMBER is likely to witness a sharp correction due to higher input costs, adversely impacting profitability. Overall, EMS companies under our coverage are expected to deliver 12.7% YoY profit growth. Looking ahead, we expect pickup in order book across EMS companies, supported by their strategic focus on higher margin sectors and orders, which should further support margin expansion in the coming quarters, Additionally Changes in BEE norms in RAC led to price increases, while the GST cut provided a 1–2% benefit that partially cushioned the impact. RAC inventory is expected to normalize by Q4FY26.

We expect our EMS universe to register sales/EBITDA/PAT growth of 19.0%/17.8%/12.7% YoY in Q3FY26, on the back of robust order execution and margin improvement led by cost rationalization and increased contribution from high-margin segments. We continue our positive view on EMS companies that will see healthy growth and continuously expanding opportunity market.

EMS sector maintains healthy growth: EMS companies (incl. AMBER’s Electronics segment) under our coverage universe are expected to report healthy revenue growth of 28.5% YoY in Q3FY26. AMBER’s revenue is expected to grow ~17% YoY; however, its Consumer Durables segment is likely to report single-digit growth. This is primarily due to a ~5% YoY decline in the RAC segment, impacted by subdued demand and an extended monsoon. AVAL is expected to grow by 27.0% YoY, with Mobility/Industrial/Clean Energy segment to grow by 33%/25%/30% YoY. CYIENTDL revenue to decline by 13.6% YoY (Altek revenue to decline by 8.0%) in Q3FY26. KAYNES is expected to grow by 40.0% YoY, led by strong performance across segments — Automotive/Industrial/Medical is expected to grow by 37%/52%/50% YoY. SYRMA revenue is expected to grow by 23.0% YoY, with a margin expansion of ~50bps due to the shift to margin-accretive segments and reducing consumer segment contribution to revenue

In Q3FY26, margins of the coverage companies are expected to remain stable. CYIENTDL/KAYNES/SYRMA are expected to see margin improvements of ~320/120/50bps YoY. Whereas AMBER/AVAL is expecting margin contraction of ~160/180bps YoY.

AVAL/KAYNES /CYIENTDL/SYRMA are expected to see PAT growth of 1.3%/16.1%/37.8%/47.9% YoY due to expansions in the margin. However, in AMBER PAT is expected to decline by ~30% due to increase in input cost and slowdown in consumer durable business led to contraction in margins.

Key changes in ratings/TP: As we roll forward our TP to Mar’28E, we upward revise our TP for all the companies and upgrade our rating for AVALON to ‘BUY’ from ‘HOLD’ due to correction in the stock price, while maintaining for other companies.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271