Buy AU Small Finance Bank Ltd For Target Rs. 775 by Motilal Oswal Financial Services Ltd

Swiftly navigating through challenges; RoA expansion on track

PCR spikes to 68.1%

* AU Small Finance Bank (AUBANK) posted a 4QFY25 PAT of INR5.04b (7% beat; -5% QoQ), amid better other income partly offset by higher provisions.

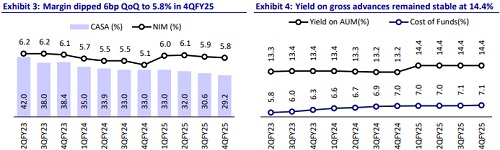

* NII grew 3.5% QoQ to INR20.9b (in line), while NIM contracted 6bp QoQ to 5.8%, primarily on account of a change in asset mix.

* PPoP grew 7.2% QoQ to INR12.9b (7% beat) as other income was 12%higher than our estimate (with treasury gains of INR1b). Opex was broadly in line. The C/I ratio thus stood largely flat at 54.7% (vs. 54.4% during 3QFY25).

* Provisions came in higher at INR6.4b (11% higher than MOFSLe, 27% QoQ increase). The bank made an accelerated provision of INR1.5b to strengthen its PCR, which improved to 68% from 61.2% in 3QFY25.

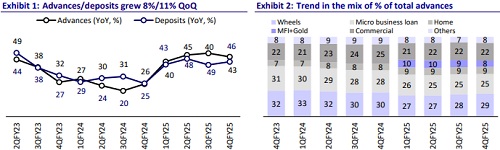

* Business growth was healthy with strong advances growth of 8% QoQ to INR1.07t; deposits too came in very strong at 11% QoQ to INR1.24t. CD ratio thus moderated to 86.2% (88.7% in 3QFY25).

* Slippages stood at INR8.9b vs. INR9.6b in 3QFY25. GNPA/NNPA ratios improved 3bp/17bp QoQ to 2.28%/0.74%. PCR improved 683bp QoQ to 68.1%. Credit costs as % of total average assets stood at 1.3% for FY25.

* We raise our earnings estimates by 4%/6% for FY26/27 and expect the bank to deliver an RoA/RoE of 1.71%/17.7% by FY27. Reiterate BUY with a TP of INR775 (based on 2.5x FY27E BV).

Growth outlook robust; credit costs to dip sharply during FY26

* AUBANK reported 4QFY25 PAT of INR5.04b (7% beat to MOSLe, down 5% QoQ), amid better other income partially offset by higher provisions. In FY25, earnings grew 37% YoY to INR21b.

* NII grew 3.5% QoQ to INR20.9b (in line), while NIM contracted 6bp QoQ to 5.8%. Management expects margins to remain under pressure while it remains optimistic on the decline in credit costs as stress in the unsecured segment ebbs. Provisions were high at INR6.4b (11% higher; +27% QoQ) as the bank made an accelerated provision of INR1.5b to strengthen its PCR.

* Other income grew 23% YoY to INR7.61b (a strong beat of 12%) due to an increase in fee income and treasury gains. Opex stood broadly in line, up 9% QoQ to INR15.6b. The C/I ratio thus stood largely flat at 54.7%.

* Advances grew 8% QoQ, with commercial assets up 8.3% QoQ and retail up 7.5% QoQ. Deposits grew by 11% QoQ to INR1.24t. The CD ratio thus declined to 86.2%. However, the CASA mix moderated to 29.2%. Cost of funds increased slightly to 7.14% vs 7.06% in 3QFY25.

* Slippages stood at INR8.9b vs. INR9.6b in 3QFY25. GNPA/NNPA ratios dipped 3bp/17bp QoQ to 2.28%/0.74%. PCR improved 680bp QoQ to 68.1%. Credit costs as % of total average assets stood at 1.3% for FY25 (1.7% on loans).

Highlights from the management commentary

* AUBANK has cut term deposit rates by 25bp; the SA rate was rationalized, but it is difficult to cut the rate further due to competitive pressures.

* Of the incremental book, 70-80% of the book of MFI would be covered by the CGFMU scheme. Credit costs on credit cards should be in the range of 6-7% by 2HFY26, while 1H credit costs will remain elevated.

* Credit costs on total assets are expected to decline from 1.3% in FY25 to 85bp in FY26 and 75bp in FY27.

Valuation and view

AUBANK reported a healthy quarter with a beat in earnings fueled by healthy other income, which was partially offset by provisions that increased sharply as the bank strengthened its PCR. Margins contracted 6bp QoQ, and management remains watchful on NIM due to the pressure on yields amid the ongoing rate cuts by the RBI. On the business front, both advances and deposits grew at a healthy rate. As a result, the C/D ratio declined to 86.2%. Asset quality improved with slippages declining sequentially (though they stood elevated). Management expects credit costs to remain elevated in the near term, but they are likely to improve to 85bp (as % of avg. assets) in FY26. The conversion to a universal bank is expected in the current year, which will further enable healthy growth and strengthen the bank’s market positioning. We raise our earnings estimates by 4%/6% for FY26/27 and expect the bank to deliver an RoA/RoE of 1.71%/17.7% by FY27. Reiterate BUY with a revised TP of INR775 (based on 2.5x FY27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412