Buy IndiaMART Ltd for the Target Rs. 2,650 by Motilal Oswal Financial Services Ltd

ARPU anchors growth amid subdued collections

Churn in silver accounts continues to haunt; reiterate BUY

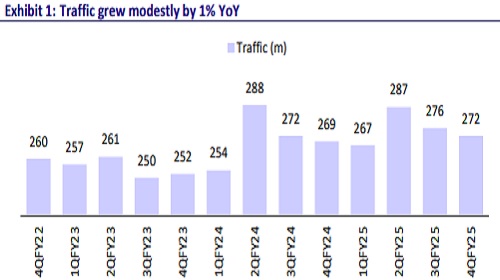

* IndiaMART (INMART) reported 4QFY25 revenue growth of 13% YoY, vs our estimate of 15.8% YoY growth. Deferred revenue rose 17% YoY to INR16.7b. EBITDA margin was down ~240bp QoQ to 36.7%, below our estimates of 38.5%, due to increased manpower expense and outsourced sales cost. PAT stood at INR1,802m, up 49% QoQ/81% YoY, beating our estimate of INR1,056m due to higher other income. For FY25, revenue/EBITDA/PAT grew 16%/57%/64% YoY. We expect revenue/EBITDA/PAT to grow 6.4%/6.9%/2.5% YoY in 1QFY26. We reiterate our BUY rating on the stock, citing undemanding valuations, with a TP of INR2,650.

Our view: Gold and platinum accounts remain sticky

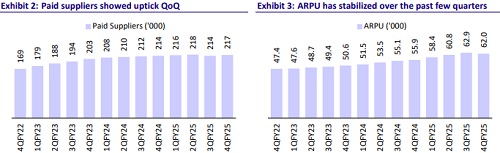

* Monitoring collections closely as ARPU holds steady: INMART’s growth continues to be driven by a resilient premium customer base and steady ARPU gains. However, gross customer additions remained muted, and churn in the silver segment continues to be a sticking point—particularly among first-year users, where retention challenges persist. Collections growth was also muted at 9% in the quarter. We anticipate that this trend could persist a little longer before stabilizing.

* ARPU rose 11% YoY, driven largely by the top 10% of customers (ARPU up 17%). However, growth remains heavily reliant on existing users, with limited contribution from new customer cohorts.

* Gold and platinum segments doing the heavy lifting: Premium segments— now contributing ~75% of revenue—continue to anchor growth with ~1% churn and steady ARPU expansion. These customers offer predictability and pricing power, helping offset volatility elsewhere.

* Supplier base rationalized; quality-first strategy in play: INMART continued its strategic pivot toward high-quality supplier onboarding, even if it meant a slowdown in gross additions. Platform enhancements—like reducing buyer introductions per supplier and aligning inquiries with geography—are aimed at boosting conversion and retention, particularly in the silver segment.

* Improvements in RFP quality and matchmaking are yielding anecdotal gains in engagement. While supplier consolidation may weigh on headline metrics in the near term, it should support longer-term retention. That said, execution will be key, and we remain in the wait-and-watch mode over the next couple of quarters to see whether churn metrics—especially in the silver bucket—show sustained improvement.

* Margins: With low customer acquisition spending, margins remained high at 38-40%. However, as INMART gears up to accelerate supplier additions and advertising pilots, we expect these margins to step down toward a more sustainable 33-34% over time.

Valuation and changes in estimates

* We continue to view INMART as a key beneficiary of the growing technology adoption by India’s MSME universe and the ongoing shift toward a formalized ecosystem. We keep our estimates largely unchanged. We expect INMART to deliver a 12% revenue CAGR over FY25-27. We estimate EBITDA margin of 35.3%/34.4% for FY26/FY27.

* Currently, INMART is trading at an undemanding valuation, in our view, as the valuations reflect uncertainties surrounding the churn rate, product-market fit, and subscriber growth. We value INMART on a DCF basis to arrive at our TP of INR2,650, assuming 11.5% WACC and 6% terminal growth. Reiterate BUY.

Revenue in line and margins miss; paying subscribers up 1.4% QoQ

* INMART reported 4QFY25 revenue of INR3.5b, growing 13% YoY vs. our estimate of 15.8%. For FY25, revenues grew 16% to INR 13.8b.

* Consolidated collections stood at INR5.4b (+12% YoY). Deferred revenue rose 17% YoY to INR16.7b.

* The company added 2.1k paying subscribers QoQ. ARPU grew 11% YoY to INR62k.

* EBITDA margin was 37%, down 240bp QoQ and below our estimate of 38.5%, due to increased manpower expense and outsourced sales cost. For FY25, EBITDA margins stood at 38%.

* PAT was INR1,802m, up 49% QoQ/81% YoY, beating our estimate of INR1,056m due to higher other income.

* Traffic was flat YoY at 272m. Total suppliers on the platform stood at 8.4m, up 6% YoY.

* Total cash and investments stood at INR28.9b.

Highlights from the management commentary

* Collections grew to INR5.41b for the quarter, up 12% YoY. For FY25, collections reached INR16.2b, reflecting 10% YoY growth on a consolidated basis.

* Unique business inquiries grew 10% QoQ. The company continues to address churn within the silver bucket and focuses on acquiring higher-quality customers.

* Pilot projects on advertising are underway to increase traffic and engagement. These experiments will continue over the next two quarters. If scaled, they could have a significant impact on margins.

* The company estimates that 66% of churn-related issues have been identified and aims to shift to an 80:20 ratio over the next 3-4 quarters.

* 50% of the customer base and 75% of revenue come from the gold and platinum segments, which exhibit low churn and strong ARPU growth.

* Gold and platinum revenue contribution is steadily increasing QoQ as the customer base grows.

* 20% of deferred revenue is expected to be recognized within the next year.

* Margins remain elevated in the 38-40% range due to low customer acquisition costs. As acquisition investments normalize, margins are expected to settle at around 33-34%. A strategic pause in gross additions supports sustainable margin performance.

Valuation and view

* We are confident of strong fundamental growth in operations, propelled by: 1) higher growth in digitization among SMEs, 2) the need for out-of-the-circle buyers, 3) a strong network effect, 4) over 70% market share in the underlying industry, 5) the ability to improve ARPU on low price sensitivity, and 6) higher operating leverage.

* We value INMART on a DCF basis to arrive at our TP of INR2,650, assuming 11.5% WACC and 6% terminal growth. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd ( 1 ).jpg)