Neutral Vedanta Ltd For Target Rs.3,410 by Motilal Oswal Financial Services Ltd

Operational performance in-line; lower tax outgo drives APAT beat

* VEDL reported consolidated net sales of INR391b (+10% YoY and +4% QoQ), in-line with our estimates. The QoQ growth was majorly driven by favorable market prices and higher premiums.

* VEDL’s consolidated EBITDA stood at INR111b (+30% YoY and +13% QoQ), in-line with our estimate of INR107b. The EBITDA growth was driven by structural cost-saving initiatives across businesses and favorable output commodity prices, partially offset by input commodity inflation. EBITDA margin for 3QFY25 stood at 28.4%, compared to 26.1% in 2QFY25 and 24.0% in 3QFY24.

* APAT for the quarter stood at INR36b (+76% YoY and +20% QoQ) against our estimate of INR31b.

* Net debt stood at INR574b and net debt/EBITDA improved to 1.4x as of 3QFY25 vs 1.49x in 2QFY25.

Segment highlights

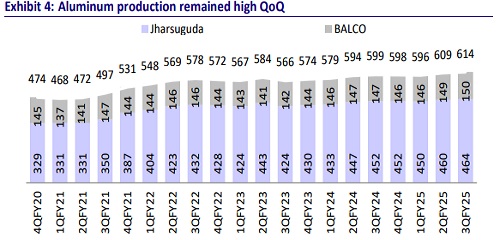

* Aluminum: VEDL produced 613kt of aluminum, growing 2% YoY and 1% QoQ. Alumina production from Lanjigarh refinery grew 7% YoY and 1% QoQ to 505kt. Net sales stood at INR153b (YoY/QoQ: +26% / +11%), which was largely in line with our est. of INR156b. Reported EBITDA stood at INR45b (YoY/QoQ: +58% / +9%) against our est. of INR50b. The aluminum Cost of Production (CoP) increased 8% for both YoY and QoQ in 3QFY25.

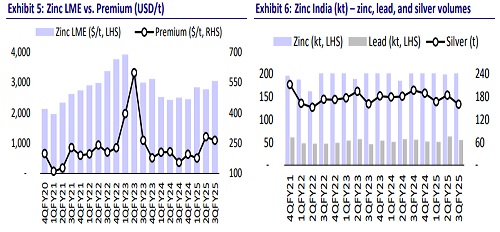

* Zinc India (HZL): Revenue stood at INR86b (YoY/QoQ: +18%/+4%) against our estimate of INR82b. The growth was largely driven by higher zinc and silver prices, along with a strong dollar, which was marginally offset by lower metal volumes. EBITDA stood at INR45b (YoY/QoQ: +28%/+9%) against our estimate of INR41b, led by higher revenues and lower-than-expected CoP. Zinc CoP for 3QFY25 stood at USD1,041/t (INR87,960/t), which declined 5% YoY and 3% QoQ. APAT stood at INR27b (YoY/QoQ: +32%/ +15%) against our estimate of INR23b. Total refined metal production stood at 259kt, flat YoY and marginally down QoQ, led by a planned maintenance shutdown. Silver volume stood at 160t (YoY/QoQ: -19%/ -13%) on account of lower silver output from SK Mine.

* Zinc International: Zinc production was up 12% YoY and 5% QoQ, supported by a 21% increase at Gamsberg. Revenue stood at INR10b, up 42% YoY and 3% QoQ. EBITDA came in at INR3.5b (YoY/QoQ: +470% / -6%), led by the lowest CoP at USD1,182/t.

* Copper: Copper Cathodes production stood at 45kt, up 3% YoY and 9% QoQ. Revenue came in at INR58b (YoY/QoQ: +8% / -9%); the QoQ decline was due to a decline in prices. EBITDA came in at INR40m (-43% YoY) against an operating loss of INR100m in 2QFY25.

* Iron Ore: Saleable ore production stood at ~1.5mt, down 17% YoY (+7% QoQ). Revenue stood at INR18.6b (YoY/QoQ: -25%/ +36%) while EBITDA stood at INR3.8b (YoY/QoQ: -41% / +174%).

Highlights from the management commentary

* The increase in alumina production costs was due to the higher consumption of imported bauxite. Going forward, 60% will be sourced domestically and 25-30% from other sources, while only 10-15% will be imported. Management expects alumina costs to be close to USD320-325/t for the coming year.

* At the Bicholim mine, the company has achieved a production run-rate of 2.4mtpa of sellable ore.

* The pig iron business received ECs for a 1.2mtpa capacity. The company is now focused on improving realization and profitability from the iron ore business.

* Earlier, the Gamsberg mine faced production constraints due to geotechnical issues and under-stripping, which have now been largely resolved. The per month production run rate improved to 18kt in Jan’25, indicating a steady rampup.

* Post-expansion, production is expected to increase 20-25% YoY, reaching 240- 250kt from Gamsberg & Black Mountain combined.

Valuation and view

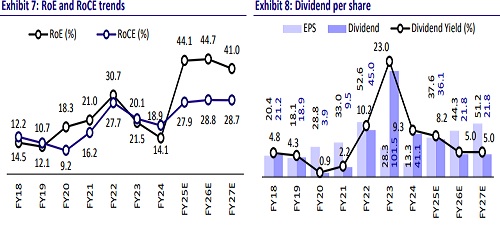

* VEDL’s 3QFY25 performance came largely in line across segments. Capex plans are progressing well and will likely lead to further cost savings.

* Management targets to maintain strong growth in earnings, led by the upcoming capacity, which will produce higher VAP products. VEDL remains firm on its deleveraging plans, and going forward, higher cash flows will support both its expansion plan and deleveraging efforts.

* The stock currently trades at 4.9x FY27E EV/EBITDA. We largely maintain our estimates and reiterate our Neutral rating on the stock with a SoTP-based TP of INR500.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412