Neutral Siemens Ltd For Target Rs.5,750 by Motilal Oswal Financial Services Ltd

Demerger on track

Siemens has reported demerged financials for 1QFY25. For the combined entity, revenue was 9% below estimates and PAT was 3% above estimates. Revenue/PAT grew 4%/22% YoY, largely driven by the energy segment. The non-energy segments were impacted by a slowdown in the short-cycle private sector capex spending and the normalization of demand in digital industries business. The energy segment’s demerger is on track. We lower our EPS estimates by 7%/8%/10% for FY25/FY26/FY27 to factor in a slower-than-expected pickup in the smart infrastructure, digital industries and mobility segments and slightly better growth in the energy segment. We will revisit our numbers once we have full-year details of the demerged business; hence, our current estimates are consolidated estimates for Siemens as a combined entity. We maintain Neutral rating on the stock with a revised TP of INR5,750, based on 55x Mar’27 estimates for the combined entity.

Revenue/PAT (combined entity) 9% below/3% ahead of our estimates

Siemens reported financials separately for non-energy business in the quarter. Performance of the company for this quarter was impacted by a slowdown in the short-cycle private sector capex spending and the normalization of demand in Digital Industries business. Revenue for non-energy business was down 3% YoY/20% QoQ, while revenue for the energy business was up 26% YoY. Combined revenues for Siemens were up by 4% YoY at INR50b vs. our estimate of INR55b. Gross margin for the non-energy segment grew by 330bp YoY to 32.5% in the quarter. EBITDA margin for non-energy business stood at 11.2%, down 100bp YoY and QoQ, and net profit was down by 10% YoY/29% QoQ. This was due to weaker-than-expected growth in the smart infrastructure, mobility segment and digital industries segments. All three segments’ revenues were lower than our estimates. Digital industries segment continued to face pressure on both revenues and margins, which impacted overall margins for the nonenergy business. For energy business, the implied EBITDA margin stood at 21.5% for 1QFY25. Combined entity PAT was 3% ahead of our estimates, mainly driven by energy segment. The company declared a dividend of INR12 for FY24.

Segmental performance

Energy segment financials were reported separately by the company, with revenue growing 26% YoY and implied PBIT margin expanding YoY to 21.5%. The outlook remains strong for India and overseas, emanating from the global shift toward renewables. The demerger is on track to be completed in CY25. Digital Industries continued to face challenges in the form of customer destocking and supply chain issues. Revenue decreased 24% YoY, while margins halved YoY to 6.1% in 1QFY25 vs. 12.7% in 1QFY24. Order inflows will start picking up once private capex sees a broad-based revival, which is currently tepid. Mobility revenue was down 4% YoY, while margins expanded ~60bp YoY to 8.1%, in line with estimates. Smart Infra revenue grew 6% YoY, while margins jumped ~140bp YoY to 12.0%.

Outlook across segments

We expect the energy segment of Siemens to benefit from continued focus on renewable capacity addition and T&D network. The company is selective across HVDC projects in terms of technology used, and hence, it will limit the large HVDC order inflow for Siemens. However, management remains optimistic on prospects for this segment, with a robust domestic and export opportunity pipeline converging with SIEM’s wide range of offerings. Smart infra segment is expected to benefit from continued investments seen across data centers, EV charging infra, commercial real estate, and industrial investments. Siemens continues to face challenges in growing digital industries at a fast pace due to demand normalization of industrial automation products as supply chain snags eased; hence, growth in near to medium term may remain impacted. For mobility segment, as highlighted by the company earlier, the order pipeline is currently weak, as there are no imminent big-ticket railways orders. During the quarter, excl. energy business, order inflows grew by 20% YoY. However, revenue declined due to weak order inflows during FY24.

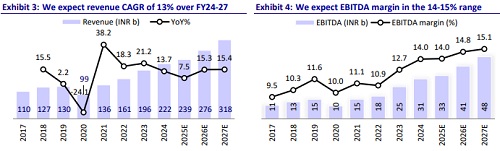

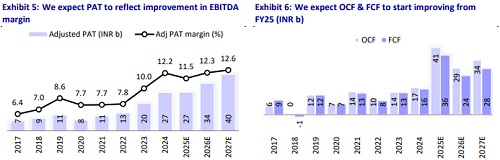

Financial outlook

We lower our estimates for the combined entity on account of lower growth in all segments, except Energy. We expect the company to clock a revenue/EBITDA/PAT CAGR of 13%/16%/14% over FY24-27E. We will revisit our numbers once we have full-year details of the demerged business; hence, our current estimates are consolidated estimates for Siemens as a combined entity

Valuation and view

The stock is currently trading at a P/E of 68x/55x/46x on FY25E/FY26E/FY27E EPS. We value the stock at 55x on Mar’27E EPS and maintain our Neutral rating with a revised TP of INR5,750 (INR6,300 earlier).

Key risks and concerns

1) Slowdown in order inflows from key government-focused segments such as transmission and railways, 2) aggression in bids to procure large-sized projects would adversely impact margins, 3) related-party transactions with parent group entities at lower-than-market valuations to weigh on the stock performance.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412