Neutral NALCO Ltd for the Target Rs. 250 by Motilal Oswal Financial Services Ltd

Strong alumina volumes with favorable aluminum prices drive earnings beat; estimates raised

* NALCO (NACL)’s revenue stood at INR42.9b (+7% YoY and +13% QoQ) vs. our est. of INR37.1b. The growth was driven by favorable aluminum prices.

* Consol. EBITDA stood at INR19.3b (+24% YoY and +29% QoQ) against our est. of INR11.5b during the quarter.

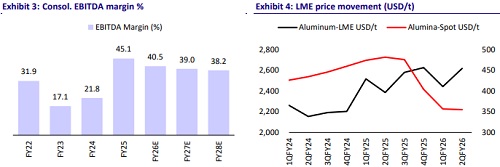

* EBITDA margin stood at 44.9% in 2QFY26 against 39.2% in 1QFY26 and 38.7% in 2QFY25.

* Adj. PAT for the quarter stood at INR14.3b (+37% YoY and +36% QoQ) against our est. of INR7.8b, supported by strong operating performance.

* In 1HFY26, NACL’s revenue stood at INR81b (+18% YoY), primarily led by a strong increase in aluminum prices and alumina volume, which largely offset the adverse impact of muted alumina prices.

* Alumina sales volume stood at 700kt, up +82% YoY, while aluminum sales volume saw a marginal contraction of 2% YoY to 226kt in 1HFY26.

* NACL’s EBITDA and adj. PAT stood at INR34.1b (+38% YoY) and INR24.8b (+52% YoY), respectively, for 1HFY26.

* The Board approved the first interim dividend of INR4 per share (~80% of FV) for FY26.

Aluminum business

* Revenue from the aluminum business stood at INR28.9b, up by 7% YoY and 6% QoQ during the quarter.

* Metal production stood at 119kt, up by +3% YoY and QoQ both, while sales volume was at 112kt (-7% YoY and -1% QoQ) during the quarter.

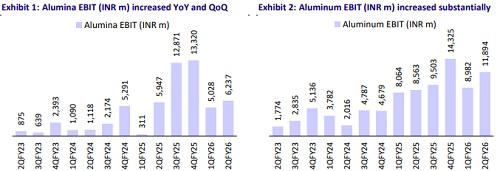

* NACL’s EBIT stood at INR11.9b, up by 39% YoY and 32% QoQ in 2QFY26.

Chemical (Alumina) business

* In 2QFY26, the revenue from the chemical business stood at INR18.3b, up +13% YoY and 8% QoQ, primarily driven by strong volume growth, which offset the impact of muted alumina prices.

* Alumina hydrate production stood at 576kt, increased by 13% YoY and flat QoQ, while sales volume grew by 33% YoY and 30% QoQ to 396kt.

* NACL’s EBIT came in at INR6.2b, up by 5% YoY and 24% QoQ in 2QFY26.

Key highlights from the management commentary

* Management guided alumina volume of ~1,200-1,280kt and aluminum sales of 470kt in FY26.

* ~50% of alumina production is used internally for aluminum smelting, and the balance is sold, mainly exported. NALCO has a limited storage capacity of ~75kt at Vizag silos and 36kt at Damanjodi; therefore, the alumina sales are closely aligned with production.

* The average alumina prices are ~USD320-340 currently. The aluminum prices stood at USD2,800-2,900.

* It has a 4mt coal production target for FY26. Out of the 7.2mt requirement, 3mt would be met from CIL (under FSA), not from the e-auction.

Valuation and view

* NACL posted a strong performance during 2Q, led by favorable aluminum prices and strong alumina volume, which helped to offset the muted alumina price impact during the quarter. With limited production room at the smelter, the LME prices become a vital factor for near-term operating performance.

* In the long run, NACL plans an expansion with a total capex of INR300b, which could significantly enhance production capacity. However, with the completion timeline of FY30, execution risks and cost escalations remain key concerns.

* Despite strong fundamentals, zero debt, and a robust demand outlook for aluminum in India, the near-term upside is capped by limited production headroom, US trade tension, on-time execution challenges, and regulatory risks. We raise our FY26 revenue/EBITDA/PAT estimates by 8/32/34%, while our FY27 estimates are flat/+21%/+25%, incorporating the strong alumina volume growth and favorable LME prices.

* At CMP, NACL trades at 4.7x on EV/EBITDA and 1.7x on P/B. We reiterate our Neutral rating on the stock with a revised TP of INR250, valuing the stock at 5x EV/EBITDA on Sep’27 estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412