Buy Tata Power Company Ltd for the Target Rs. 500 by Motilal Oswal Financial Services Ltd

Mundra shutdown weighs on earnings

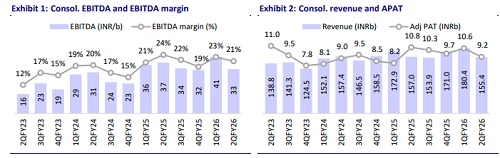

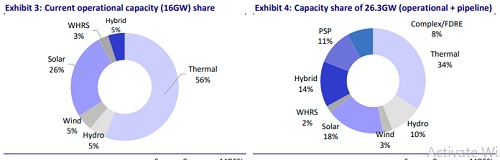

* TPWR’s consolidated EBITDA/adj. PAT came in at INR33b/INR9.2b, below our estimates by 12%/13%. The weakness in results was largely attributable to Mundra plant shutdown in 2Q, which offset the stronger performance at Odisha distribution and the solid ramp-up at TP Solar on a YoY basis. TPWR is targeting 1.3 GW of RE capacity commissioning in 2HFY26, with the annual target for FY27 maintained at 2-2.5GW. New distribution opportunities (e.g., UP discom privatization) and the potential tie-up of supplementary PPA for Mundra remain key catalysts for the stock. TPWR announced its intent to further strengthen backward integration at TP Solar via 10 GW ingot/wafer capacity and the company remains in discussion with states for subsidies related to the same.

* We maintain our BUY rating with a revised TP of INR500/share

Result misses estimates; Mundra shutdown affects performance

Results overview:

* Cons. EBITDA stood at INR33.0b and was 12% below our est. of INR37.3b (- 12% YoY, -20% QoQ).

* Revenue stood at INR155.4b (-1% YoY, -14% QoQ), missing our estimate by 15%. Reported PAT came in at INR9.2b (flat YoY), missing our estimate by 13%.

* Adj. PAT of INR9.2b also missed our est. of INR10.5b by 13%, impacted by a 57% YoY drop in standalone PAT due to Mundra plant shutdown and lower PLF.

Operational highlights:

* Solar rooftop EPC and utility-scale EPC (third-party) order book stood at INR11.2b and INR18.8b, respectively, as of 2Q end.

*TPWR installed a record 370MWp of rooftop solar.

* TPWR commissioned 293MW of utility scale renewable capacity during the quarter.

* 970MW of modules and 928MW of cells were produced. The plant was included in the ALMM-II list.

*As of 2Q, TPWR had a clean and green operational capacity of ~7GW (44% of total installed capacity), with an additional 10.4GW under construction.

* Mundra delivered an operating income of INR1.8b in 2QFY26 vs. INR21.1b in 1QFY25.

Highlights of 2QFY26 performance

* ~700 MW RE capacity addition targeted in 3Q and ~600 MW in 4Q, mainly solar; RE capacity to exceed 7 GW by FY26-end.

*Planning a 10 GW ingot and wafer facility under backward integration; discussions underway with states for subsidies and PLI support.

* Advanced discussions with Gujarat Govt. for a long-term Mundra UMPP resolution to replace annual Section 11 extensions; expected to conclude within a month.

* Construction started on 600 MW Kholongchhu Hydro Project (Bhutan); plans to invest in 1,125 MW Dorjilung Hydro Project.

* 1HFY26 capex at INR73.5b; on track for INR250b FY26 target (60% renewables, 40% transmission, pumped storage & thermal).

* Net debt rose by INR64b to INR540b; ND/EBITDA at 3.3x and ND/Equity at 1.2x.

* RE pipeline at 5.8 GW with nearly full PPA tie-ups.

* Produced 928 MW of cells and 970 MW of modules in 2Q.

*Rooftop solar achieved record 370 MWp installations in 2Q.

*Optimistic on upcoming UP DISCOM privatization; awaiting bid announcement.

Valuation and view

* The valuation of TPWR is segmented across various business units, leading to a TP of INR500/share.

* Regulated business is valued using a 2x multiple on regulated equity.

* Coal segment is valued at 1x book value.

*Renewables segment is valued at 14x FY28E EBITDA.

* Pumped storage segment and other segments are valued at 1x PB. Cash and investments add INR49/share.

*The sum of these contributions results in a TP of INR500/share, reflecting the comprehensive valuation of TPWR’s diverse business segments.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412