Buy Go Fashion (India) Ltd for the Target Rs. 750 by Motilal Oswal Financial Services Ltd

Weak SSSG dents 2Q performance, valuations attractive

* Go Fashion reported yet another muted quarter with revenue growth of 7%. A strong pickup in LFS (up 18% YoY) was offset by persistent weakness in same-store sales (-4%).

* Margin pressure persisted as pre-Ind AS EBITDA margin fell ~130bp YoY to 14.3%. EBITDA declined 1% YoY to INR320m due to negative operating leverage.

* Overall, FY26 had a weak start, with 1H revenue/EBITDA/PAT performance standing at +4%/flat/-10%. We bake in 6%/4%/4% growth in 2H.

* We cut our FY25-28 revenue/EBITDA estimates by ~4% to reflect weakness in SSSG and calibrated store expansion. We expect 11%/10%/14% CAGR in revenue/EBITDA/PAT over FY25-28E.

* Valuations remain reasonable at ~32x 1-year forward earnings, though a sustainable turnaround in SSSG is key to re-rating. We maintain our BUY rating with a TP of INR750, based on 30x Dec’27E EPS..

Weak SSSG leads to negative operating leverage; In line with estimates

* Revenue was up 7% YoY at INR2.2b (in line with estimate) as strong growth in LFS was offset by the underperformance in EBO stores (-3.6% SSSG).

* EBO revenue grew by a modest 4% YoY to INR1.b, impacted by a 3.6% decline in SSSG.

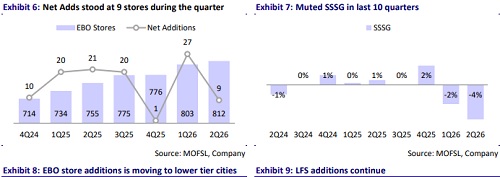

*Go Colors added 9 net new stores in 2Q (14 additions and 5 closures), and 36 net new stores in 1HFY26.

* Management has trimmed the net store addition outlook to 80-90 (from 120-130 gross with limited closures earlier).

* Growth was impacted by SSSG decline of 3.6% in 2Q (down 2.4% in 1HFY26).

* LFS revenue recovered strongly with 18% YoY growth, led by ~80 new store additions during the quarter (~300 in 1HFY26). Ecommerce channel declined 4% YoY.

* Gross profit at INR1.4b was up 7% YoY and margins contracted ~45bp to 62.6%.

* Due to negative operating leverage, pre-IND AS EBITDA declined by 1% YoY, with margins at 14.3% (down 125bp YoY).

* Reported EBITDA at INR0.7b was up 5% YoY, with margins at 29.7% (down 70bp).

* Higher other income drove PAT growth of 6% YoY to INR218m.

* Core working capital increased to 135 days, led by a jump in receivables (up by 12 days to 52 days), while inventory largely remained stable at 97 days.

* Cash flow from operations (adj. for leases) declined to INR272m (vs. INR551m in 1HFY25), impacted by muted profitability and higher working capital requirements. After incurring a capex of INR196m, FCFF stood at INR76m (vs. INR318m YoY).

Highlights from the management commentary

* Demand trends: Demand is recovering, driven by strong festive sales in markets like Tamil Nadu and Maharashtra, though post-Diwali softness persists. West and North are improving and South is still lagging. Management is betting on refreshed designs and new launches to revive growth.

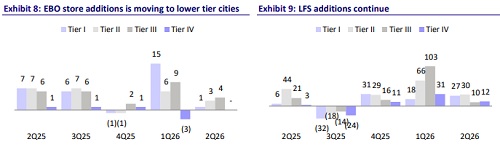

*Expansion strategy: FY26 store guidance is trimmed to 80-90 net store additions (vs. 120 gross) to safeguard margins during weak SSSG, with expansion to pick up only after demand stabilizes.

*Essential-wear pilot in two Chennai stores is getting good response with INR1,000 SPSF/month from the added space, exceeding internal benchmarks. These are extensions of existing stores, and the company plans to scale up the pilot to 18-20 locations to assess long-term potential.

* Promoter pledges rose due to the stock price correction but are set to reduce by more than 50% soon, with around 2.5m to 3.0m shares likely to be depledged in the next few months.

Valuation and view

* Go Fashion is poised to scale up its leadership in women’s bottom wear through a strong D2C model and continued expansion into new cities, with ~14 stores added in 1HFY26 and a focus on Tier 2 and Tier 3 markets via additional EBOs.

* Management is tackling muted SSSG through fresh product launches in 2H. Strong festive-led volume recovery drives confidence in a sustainable rebound ahead.

* While pilot initiatives like essential wear and international expansion are gaining traction, management remains firmly focused on reviving core bottom-wear growth.

* We cut our FY25-28 revenue/EBITDA estimates by ~4% to reflect weakness in SSSG and calibrated store expansion. We expect a CAGR of 11%/10%/14% in revenue/EBITDA/PAT over FY25-28E.

* Valuations remain reasonable at ~32x 1-year forward earnings, though a sustainable turnaround in SSSG is key to re-rating. We maintain our BUY rating with a TP of INR750, based on 30x Dec’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412