Neutral Pidilite Industries Ltd for the Target Rs. 1,500 by Motilal Oswal Financial Services Ltd

Growth trajectory sustains; rich valuations limit upside

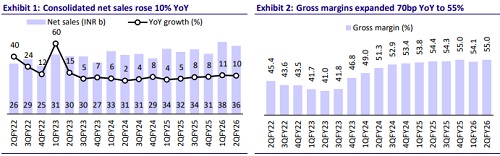

* Pidilite Industries (PIDI) reported consolidated revenue growth of 10% YoY (in line) in 2QFY26. Standalone revenue grew 10% YoY, with underlying volume growth (UVG) of 10% (est. 7%). Value/volume growth stood at 11%/10% YoY in the consumer business and 9%/10% in the B2B business. The company has not implemented any price hike during the quarter. The volume-value gap has now neutralized and is likely to remain stable through 2HFY26. Urban demand improved in 2Q; however, rural demand growth continued to outpace urban demand growth. In FY26E, we model 11% volume growth and 12% revenue growth.

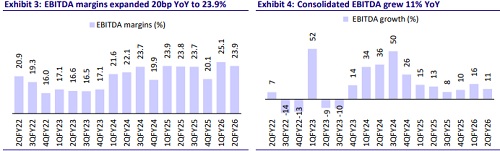

* Gross margin (GM) expanded 70bp YoY to 55% on benign RM prices. VAM dipped to ~USD883/t in 2QFY26 from USD980/t in 2QFY25. GM is expected to remain stable, with no major volatility in VAM prices. PIDI continues to prioritize reinvestment in brand building and customer acquisition. EBITDA margin expanded 20bp YoY to 23.9%. EBITDA grew 11% YoY.

* Consolidated EBIT growth for the consumer business was healthy at 11% YoY (10% in FY25). B2B business EBIT growth stood at 11% (53% in FY25).

* PIDI’s volume growth trajectory is inspiring, particularly in the current challenging environment. Operating margins remain elevated (>23% EBITDA margin), and it will be crucial to monitor whether the company can sustain these levels. Given the rich valuations, we reiterate our Neutral rating on the stock with a TP of INR1,500 (50x Sep’27E EPS).

Steady performance with consistent volume growth

* Double-digit volume growth sustains: Consolidated sales grew 10% YoY to INR35.5b (est. INR35.2b). Underlying volume growth (UVG) remained strong at 10.3% (est. 7%, 9.9% in 1QFY26). UVG was 10.4% for the Consumer & Bazaar (C&B) business and 9.9% for the B2B business.

* Healthy growth in C&B: The C&B segment’s revenue rose 10% YoY to INR28.4b (est. INR27.8b), EBIT grew 11% YoY to INR8.6b (est. INR8.5b), and EBIT margins expanded 40bp YoY to 30.2%.

* B2B outperformance continues: The B2B segment’s revenue rose 8% YoY to INR7.6b (est. INR7.7b), EBIT increased 11% to INR1.2b (est. INR1.3b), and EBIT margins expanded 40bp YoY to 15.2%.

* High single-digit growth in profitability: Gross margins expanded ~70bp YoY to 55% (est. 54.8%). Employee expenses rose 8% YoY, and other expenses rose 15% YoY. EBITDA margin expanded marginally 20bp YoY to 23.9% (est. 24.2%). EBITDA grew 11% YoY to INR8.5b (est. INR8.5b). PBT rose 8% YoY to INR7.9b (est. INR8.2b). Adj. PAT increased 9% YoY to INR5.8b (est. INR6.1b).

* In 1HFY26, net sales/EBITDA/APAT grew 10%/13%/14%.

* Subsidiary performance: Domestic subsidiaries’ C&B revenue grew 17% YoY and EBITDA grew 41%. Domestic B2B’s revenue grew 1% YoY, while EBITDA loss increased to 580m vs 210m in 2QFY25. The Middle East and Africa’srevenue grew 3% and EBITDA declined 3%. Asia’s revenue grew 6% and EBITDA grew 4%

Highlights from the management commentary

* The domestic operating environment is expected to improve, aided by a favorable monsoon, the indirect cascading impact of GST 2.0 on PIDI’s demand, and accelerated growth in the construction sector driven by benign interest rates and enhanced liquidity.

* The company’s Haisha Paints business continues to make steady progress. It had started with five southern states and is now present in several Eastern geographies. The focus remains on ‘Rurban’ (rural and smaller town) markets, with consistent QoQ growth.

* Capex is expected to be 3-5% of sales.

* The company has not implemented any pricing actions. With no significant commodity inflation seen currently, the company does not plan any major price hikes.

Valuations and view

* We maintain our EPS estimates for FY26, FY27, and FY28.

* PIDI’s core categories still enjoy a GDP multiplier. The advantage of penetration and distribution can help PIDI deliver healthy volume-led growth in the medium term. EBITDA margin is already high (23% in FY25). We do not estimate much expansion as growth drivers (consumer acquisition, distribution expansion, and brand investments) will require high opex. We build in a CAGR of 13%/14%/15% in revenue/EBITDA/PAT during FY25-28E.

* PIDI stands out for its market-leading position in the adhesives market, along with a strong brand and a solid balance sheet. However, we believe the current valuation limits the upside potential. As a result, we reiterate our Neutral rating on the stock with a TP of INR1,500 (premised on 50x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412