Buy ABB India Ltd for the Target Rs. 6,400 by Motilal Oswal Financial Services Ltd

Revenue growth weak; good start for inflows

ABB India’s 1QCY25 results were lower than our estimates. Revenue/EBITDA/PAT growth of 3% each YoY for the quarter was impacted by softer execution, particularly in the process automation segment. Order inflows were strong and were up by 4% YoY and 39% QoQ on healthy base orders from railways, data centers, electronics, energy, tyres and water treatment, as well as large orders. With improvement seen in inflows, we expect revenue growth to scale up in the coming quarters. We trim our estimates by 3%/5%/5% for CY25/26/27 to bake in continued weakness in process automation segment. ABB is currently trading at 59.0x/53.8x on CY25E/CY26E earnings. We believe that beyond the transient weakness in execution as a result of weak inflows during last year, ABB has the right levers to benefit from improvement in government and private capex. We maintain BUY with a revised TP of INR6,400, which implies 60x Mar’27E earnings.

Results were weaker than our estimates

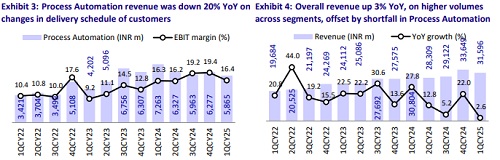

For 1QCY25, revenue/EBITDA/PAT grew by 3%/3%/3% YoY. Revenue and PAT both came in 7% below our estimates. EBITDA margin stood at 18.4% vs. our estimate of 18.6%. Gross margin during the quarter declined 200bp QoQ and 170bp YoY. The revenue miss was primarily led by a 19% YoY decline in revenue from the process automation segment. Order inflows were strong during the quarter at INR37.5b, up 4% YoY and 39% QoQ, driven by orders from railways, data centers, electronics, energy, tyres and water treatment. Base orders formed INR35.5b and large orders contributed INR2b to total order inflows. This resulted in the order book moving up to INR99.5b. ABB has mentioned that the long-term levers and outlook remain more positive. The government’s focus on emerging segments of renewable energy, green hydrogen, electronics, nuclear energy, battery storage and AI infrastructure augurs well for ABB India’s multisegment portfolio. The company’s cash position remains robust at INR57.5b as of 1QCY25 end.

Order inflow momentum remained strong during the quarter

Order inflows at INR37.5b were healthy despite a high base of last year. Going ahead, high-growth areas like data centers, electronics, smart buildings, traction/railways, and green cement are all benefiting from technological advancements and rapid execution cycles. Moderate-growth segments include core infrastructure and industrial markets with steady 8-12% growth. Lowgrowth but high-volume segments still contribute about 45% of ABB’s portfolio. These segments are seen as future opportunities as capex cycles revive. We expect electrification and motion to benefit from high and moderate growth segments, while process automation will remain weak in the near term.

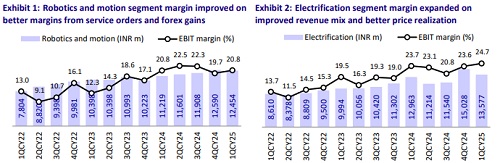

Sequential moderation in margin was driven by lower margin in process automation

EBITDA margin declined 90bp QoQ, mainly due to lower margin in process automation. PBIT margin remained strong in Electrification segment at 24.7% (vs. 23.7% in 1QCY24) and Motion segment at 21.9% (vs. 21.4% in 1QCY24). Process automation PBIT margin declined sequentially to 16.4% in 1QCY25 from 19.2% in 4QCY24 and remained flat YoY vs. 16.3% in 1QCY24. This decline was due to lower volumes in the segment and continued weakness in order inflows. PBIT margin also declined in robotics and discrete automation to 13.2% in 1QCY25 vs. 15.4% in 1QCY24. Motion and Robotics together had PBIT margin of 20.8% in 1QCY25. We revise our estimates to factor in slightly lower margin and expect EBITDA margin of 18.3%/17.6%/17.1% for CY25/26/27.

Electrification segment performance was strong on margins

Electrification segment witnessed 5% YoY revenue growth in 1QCY25 and PBIT margin also remained strong at 24.7%. However, order inflow for the segment declined by 2% YoY owing to a high base of large orders last year. Demand remains strong across key industries such as renewables, data centers, smart building, transportation, and food & beverage. We expect the segment’s revenue/orders to clock a CAGR of 20%/18% over CY24-27, with EBIT margins to be in the range of 20%-22%.

Motion and Robotics performance was led by uptick in demand for robotics and drives

Robotics segment benefited from strong inflows in electronics and witnessed 114% YoY growth in order inflows. Execution growth of 37% YoY for robotics too was driven by emerging segments. Motion segment revenue growth was driven by higher revenues from drives products and system drives as well as execution of high-value projects. Ordering in Motion segment was up 6% YoY due to a high-value order from railways and an uptick in demand for drives products and services. We expect both these segments together to clock a revenue CAGR of 12% over CY24-27 on stronger execution, with EBIT margin ranging around 19.5%-20.5%.

Process automation was impacted by demand slowdown

Process automation has continued to see a decline in inflows and revenues in nearly four out of five quarters and is impacted by delays in decision-making from clients. Process automation is largely the project-based business and projects form around 10% of the sales. It is dependent on customers and government projects such as oil and gas, power infra, etc. Many projects are in the pipeline, but the order finalization is taking time. We expect this segment’s growth to remain impacted by slower ordering; hence, we expect a negative revenue CAGR of 7% over CY24-27.

Valuation and recommendation

ABB India is currently trading at 59.0x/53.8x P/E on CY25/CY26 estimates. We trim our estimates by 3%/5%/5% for CY25/26/27 to factor in slightly lower ordering and margin assumptions across segments. We thus expect revenue growth of 10%/13%/14% in CY25/CY26/CY27 and margins of 18.3%/17.6%/17.1%, translating into PAT growth of 7%/10%/10% for CY25/CY26/CY27. We maintain our BUY rating with a revised DCF-based TP of INR6,400, implying a multiple of 60x P/E on Mar’27E EPS.

Key risks and concerns

Slowdown in order inflows, pricing pressure across segments, increased competition, supply chain issues, and geopolitical risks could affect our estimates and valuations

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412