Buy ABB India Ltd for the Target Rs. 5,800 by Motilal Oswal Financial Services Ltd

In-line performance; recovery still some time away

ABB’s 3QCY25 performance was in line with our estimates. The company remains affected by lower ordering as well as margin pressure due to Quality Control Order (QCO) implementation, higher RM costs, and increased competition. Overall order inflows were down 3% YoY, while base ordering has remained strong. ABB continues to benefit from a growing addressable market from data centers, electronics, and renewables, while government and private sector ordering is yet to pick up. Due to lower-than-expected capex from the government and private sectors, we project the current trend of weakness in order inflows will continue for a few more quarters. This can hurt execution growth too for a few more quarters. Along with this, higher costs related to QCO implementation can affect margins too for a few more quarters. However, we expect these adversities to bottom out in 2-3 quarters. We project ABB to benefit from demand improvement across key capex areas. To bake in the 9MCY25 performance, we cut our CY26/27 estimates for ABB by 6%/7% and revise our TP to INR5,800, based on Dec’27 estimates. We reiterate our BUY rating, as we expect the company to benefit in the long run from improved ordering and higher margins.

Results broadly in line

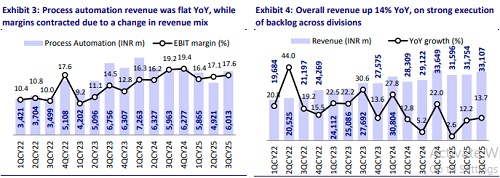

ABB’s results came in line across all metrics. Revenue grew 14% YoY to INR33.1b. EBITDA margin came in ahead of our estimates. However, the margin contracted 350bp YoY to 15.1% due to higher material costs and reliance on imports to support delivery commitments in the wake of QCO compliance. Overall, PAT came slightly ahead of our estimates. However, PAT declined 7% YoY to INR4.1b due to margin contraction over the past year. Order inflows dipped 3% YoY to INR32.3b, primarily due to the timing of large orders. Base orders remained strong, rising 13% YoY, which lifted the overall order book to INR99b. For 9MCY25, revenue increased 9% YoY. EBITDA/PAT declined 9%/8% YoY, while EBITDA margin in 9MCY25 contracted 320bp YoY to 15.5%. ABB’s cash position continues to remain strong at INR50b at the end of 3QCY25.

Overall ordering momentum remains weak

Base orders grew 13% YoY, reflecting broad-based demand across business divisions, while overall orders declined 3% YoY due to the timing of large orders. The order backlog stood at INR99b, providing healthy revenue visibility, with about 30% of the order book comprising large, long-cycle system orders and the balance being shorter-cycle product and service orders. Growth in base orders was supported by strong activity in Motion and Robotics and Discrete Automation, driven by demand from renewables, buildings and infrastructure, data centers, and process industries. Ordering was impacted by the deferment of large project decisions, and private capex activity remained selective.

Margin performance can remain weak in the near term vs. last year

EBITDA margin stood at 15.1% for the quarter, improving from 13.0% in 2QCY25 but lower than 18.6% in 3QCY24. The sequential improvement was driven by stronger execution, higher service contribution, and operating leverage, while the YoY moderation reflected an unfavorable product mix, pricing pressure, and cost impact from QCO-related imports and forex fluctuations. ABB quantified these headwinds as roughly 1% from mix, 1.0–1.5% from pricing, 0.75–0.8% from QCO, and 0.6% from forex, together resulting in about a 3% YoY impact. We expect near-term margin performance to remain affected by these negatives, as QCO implementation timelines are still not over yet, especially for the motion and electrification segments. We thus expect an EBITDA margin of 15.5%/15.7%/16.2% for CY25/CY26/CY27.

Electrification segment: QCO and forex weigh on profitability

The electrification segment witnessed 19% YoY revenue growth in 3QCY25, while PBIT margin contracted 120bp YoY to 19.6% due to higher reliance on imports to comply with QCO guidelines, material cost impact, and forex volatility during the quarter. Order inflow for the segment declined 2% YoY owing to a high base of large orders last year. Demand remains strong across key industries such as renewables, data centers, smart buildings, and infrastructure. Weakness in inflows can weigh on execution growth, and QCO compliance continues to weigh on margins for this segment. We thus expect the segment’s revenue/orders to clock a CAGR of 17%/ 18% over CY25-27, with PBIT margin to be in the range of 19-20%.

Motion & Robotics: Performance led by an uptick in demand for drives and automation

Motion and Robotics segments grew 14% YoY, supported by healthy execution in motors, drives, and automation systems. PBIT margin declined 780bp YoY to 14.5% due to an unfavorable product mix, pricing pressure, and higher import and forex costs arising from QCO-related sourcing. Order inflows increased across Motion and Robotics, aided by a large Motion order of about INR1.5b and total Robotics orders of INR2b, primarily from automotive and electronics customers. Demand remained strong in select segments such as cement, steel, and oil & gas in Motion and automotive and electronics in Robotics, with growing participation in EV-related and process automation applications. We expect both these segments together to clock a revenue and order inflows CAGR of 13% each over CY25-27 on stronger execution, with PBIT margin ranging around 16-18%.

Process Automation: Sequential recovery amid delayed project decisions

Process automation segment revenue stood at INR6b, flat YoY but improving QoQ (up 22%), supported by execution of existing orders and stronger service contributions. PBIT margins improved 50bp QoQ, mainly due to a higher share of service and retrofit execution. Order inflows declined 4% YoY but increased 2% QoQ, as large project decisions were delayed, while service and base orders provided stability. Demand was led by metals, energy, and marine industries, while customers in process sectors deferred major greenfield expansions amid macro uncertainty. We expect the segment’s revenue/orders to clock a CAGR of 6%/15% over CY25-27, with PBIT margins to be in the range of 17.0-18.5%.

Financial outlook

We broadly maintain our estimates for CY25 and cut our estimates by 6%/7% for CY26/27 to bake in lower margins for the Electrification and Motion segments, which are currently affected by QCO implementation as well as competitive pricing. We thus expect revenue/EBITDA/PAT CAGR of 13%/16%/15% over CY25-27.

Valuation and recommendation

We believe that in the near term, ABB can underperform due to pressure on margins as well as sluggish ordering activity across the private and government sectors. However, in the long run, we expect ABB to improve upon margins once QCO implementation is over in the next few quarters and revenues once ordering activity starts ramping up. We thus reiterate our BUY rating with a revised DCFbased TP of INR5,800, implying a target multiple of 55x Dec’27 earnings. Scope of rerating back to higher multiples, as seen earlier for ABB, will emerge once inflows and margins start showing an improving trend.

Key risks and concerns

Slowdown in order inflows, pricing pressure across segments, increased competition, supply chain issues, and geopolitical risks could affect our estimates and valuations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412