Buy Escorts Ltd For Target Rs. 3,500 By Emkay Global Financial Services Ltd

Healthy Q4; long-term drivers intact, ramp-up to be gradual

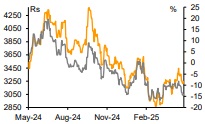

Escorts logged a healthy operational performance in Q4, with revenue up 6% YoY, EBITDA margin up by 63bps QoQ to 12.1% (a ~7% beat). The mgmt guided to a mid-to-high single-digit domestic tractor industry growth in FY26, with Escorts performance to be in-line/marginally better; it also expects 20-25% growth in tractor exports this year, with long-term triggers around US export (#2 market for Kubota) and component exports to stay intact. While we still like long-term exports catalysts (products and components), we moderate the FY26E/27E EPS by ~2.5%/6%, building in the slower than expected exports rampup; product/distribution actions and captive finance could act as domestic share-gain drivers. We retain BUY and revise down our TP by ~8% to Rs3,500 at unchanged 30x PER; at CMP, Escorts trades at LTA on 1YF PER basis.

Healthy operational performance in Q4

Standalone revenues of continuing operations (ex-Railways) were up ~6% YoY at Rs24.3bn (in-line) amid 8% YoY growth in tractor volumes to 26.6k units and flattish ASPs QoQ. EBITDA was flattish YoY at Rs2.9bn (~7% beat on estimates), with EBITDA margin higher by 63bps QoQ at 12.1% driven by 370bps gross margin expansion. Agri revenues rose 11% YoY, with margins up by 90bps QoQ at 11.4%. Construction equipment (CE) revenue declined 10% YoY (volumes down 12% YoY), with EBIT margins down by 180ps QoQ to 9.1%. Adjusted PAT rose 12% YoY to Rs2.8bn.

KTAs from earnings call

1) Expects mid-to-high single-digit growth for domestic tractor industry in FY26, driven by favorable agri macros, expectation of above-normal monsoon, and good water reservoir levels. It targets performing in line with or marginally better than the industry. 2) While the geographic spread could be adverse (South seen growing much faster, with core North and Central markets possibly growing at a low single-digit), performance would be driven by actions on products (recently introduced Promaxx series in Farmtrac, with Phase 2 launch at start-Q4, launch of new series focused on paddy/South in Powertrac in Q3, and mid-segment launch in Kubota, in Q2) and filling of distribution white spaces across the 3 brands. 3) Exports volumes have started improving, with 20- 25% growth seen in FY26 driven by markets like Africa, Asia, and Mexico; US remains a large opportunity over the long term, amid strong focus of Kubota, with associated specific product development going ahead. 4) Land acquisition for a greenfield plant in UP likely to completed by end-Q2/early-Q3. 5) Targets Rs2bn from component exports in FY26, with potential intact for much stronger ramp-up ahead, depending on pace of localization by Kubota. 6) Expects stable margin at FY25 levels in FY26, with 11.5-13% range seen in the mid-term; major benefits to flow once Kubota’s localization levels rise. 7) CE demand to see revival in H2 with stable margin in the near-to-mid term; recent emission changes lead to 7-10% cost increase for customers, with full recovery seen by festive. 8) FY26 capex guidance: ~Rs8bn, including ~Rs4-5bn on land for greenfield. 9) Ramp-up on the captive finance front to be gradual, with eventual penetration levels at 30-35%. 10) Does not expect TREM emission norms implementation in Apr-26.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354