Neutral Bandhan Bank Ltd for the Target Rs. 175 by Motilal Oswal Financial Services Ltd

Weak performance; margins contract by sharp 55bp QoQ

MFI slippages remain elevated

* Bandhan Bank (BANDHAN) reported 2QFY26 PAT at INR1.12b (down 70% QoQ, 64% miss), dragged by a sharp contraction in NIMs, lower other income, and elevated provisions.

* NII declined 12% YoY/6% QoQ to INR25.9b (in line). Margins contracted 55bp QoQ to 5.8% (vs MOFSLe of 5.98%) as the bank has cut 200bp of MCLR and passed on the full 75bp of repo rate.

* Other income declined 8% YoY/25% QoQ to INR5.5b (26% miss), Opex grew 8% YoY/1% QoQ to INR18.2b (broadly in line). C/I ratio, thus, increased 610bp QoQ to 58.2%.

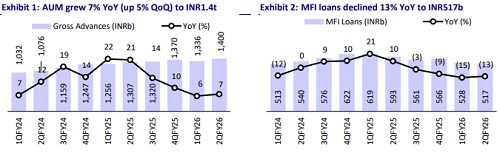

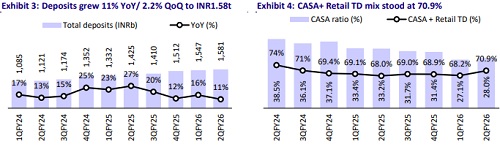

* Net advances grew 6.8% YoY (up 4.7% QoQ), while deposits grew 10.9% YoY (up 2.2% QoQ). The CASA mix, thus, improved slightly sequentially to 28%. The CD ratio stood at 85% vs 83% in 1QFY26.

* The GNPA/NNPA ratio increased 6bp/1bp QoQ to 5.02%/1.37%. Fresh slippages stood elevated at INR15.9b (vs INR15.5b in 1QFY26). PCR stood flat at 73.7%.

* We cut our earnings estimates by 34%/17% for FY26/FY27 and expect FY27E RoA/RoE of 1.28%/11.3%. Reiterate Neutral with a TP of INR175 (1.1x FY27E ABV).

MFI declines to 37%; credit cost guided at ~1.5% for FY28

* BANDHAN reported 2QFY26 PAT at INR1.12b (down 88% YoY, down 70% QoQ, 64% miss), due to a sharp contraction in NIMs, lower other income, and elevated provisions.

* NII declined 12% YoY/ 6% QoQ to INR25.9b (in line). Margins contracted 55bp QoQ to 5.8%.

* Other income declined 8% YoY/25% QoQ to INR5.5b (26% miss). As a result, total revenue declined 12% YoY/10% QoQ to INR31.4b (5% miss).

* Opex grew 8% YoY/1% QoQ to INR18.2b (in line). PPoP, thus, declined 29% YoY (down 21% QoQ) to INR13.1b (7% miss). Provisions came in 15% higher than our estimates at INR11.5b (up 90% YoY, flat QoQ).

* Gross advances grew 7% YoY/5% QoQ. EEB book declined 13% YoY (down 2% QoQ), whereas the non-micro credit book rose 24% YoY (9% QoQ). Mix of EEB moderated to 37%.

* Deposit grew 10.9% YoY (up 2.2% QoQ). The CASA mix improved sequentially to 28%.

* GNPA/NNPA ratio increased 6bp/1bp QoQ to 5.02%/1.37%. Fresh slippages stood elevated at INR15.9b (up 43% YoY, 2.6% QoQ). PCR stood flat at 73.7%. SMA book increased 100bp QoQ to 4.8%. EEB (MFI) slippages are likely to continue for the next 2-3 months, and the full guardrail is taking longer than expected.

Highlights from the management commentary

* As the bank is moving toward a secured book, NIM is expected to reach 6% in two years.

* With the upcoming Bihar elections, collections remain normal and in line with expectations; proactive measures are in place, customer concerns are minimal, and no major disruptions have been observed, with ongoing regular customer meetings.

* The bank expects credit costs for EEB to remain at around 2.5-3% by the end of FY27, and expects bank-level credit costs to remain at 1.5% for FY28.

* Secured mix is expected to improve 3-4% over the next 3 to 4 years. The bank is expecting growth to rebound in EEB.

Valuation and view

BANDHAN reported a weak quarter with an all-around miss, driven by higher-thanexpected provisions, lower other income, and a sharp 55bp QoQ moderation in margins due to a 200bp MCLR cut and the full pass-through of the 75bp repo rate cut. Loan growth was 7% YoY as the MFI book continues to decline, with the segment mix also reducing to 37%. Asset quality continues to deteriorate, and slippages remain elevated. With reduced SA funding costs and moderation in TD rates upon renewal, NIMs are expected to expand, especially from 4Q onwards, aided by the bank’s shift toward a secured book. However, MFI slippages are expected to continue for the next 2-3 months, and the full guardrail is taking longer than expected. We cut our earnings estimates by 34%/17% for FY26/FY27 and expect FY27E RoA/RoE of 1.28%/11.3%. Reiterate Neutral with a TP of INR175 (1.1x FY27E ABV)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412