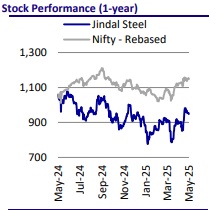

Buy Jindal Steel & Power Ltd for the Target Rs. 1,100 by Motilal Oswal Financial Services Ltd

Capex strategy to drive long-term competitiveness

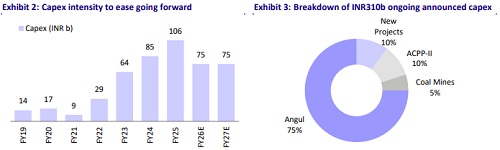

* Jindal Steel and Power (JSPL) has initiated a comprehensive capex plan for its Angul facility to expand its crude steel capacity by 65% to 15.9mtpa and finished steel capacity by 83% to 13.75mtpa. This expansion is expected to be complete by 1QFY27 and will position JSPL as the fourth-largest steel producer in India. Considering the capacity expansion, we estimate a ~17% CAGR in volume for JSPL over FY25-27E.

* JSPL is taking cost-effective measures to boost its operating margin, such as 1) strengthening raw material integration, 2) increasing its captive power plant share, 3) increasing the flat steel mix to ~70%, and 4) focusing on VAP (current share ~66%). Further, JSPL has started ramping up the Gare Palma IV/6 and Utkal block C, while Utkal C and B1 & B2 will be coming on stream soon, resulting in RM integration and cost effectiveness. Beyond the Angul expansion, JSPL plans an additional capex of INR160b over FY26-28 to enhance VAP (INR57b), strengthen logistics and supply chain (INR45b), and ensure operational sustainability (INR57b).

* The expansion will improve the realization for JSPL, particularly with an increased share of VAP and flat steel products. JSPL’s current VAP share is ~66%, which may moderate to ~50% in the near term with new capacity coming on stream. However, the commissioning of the CRM complex and VAP enhancement projects will improve the product mix and support the VAP share.

* JSPL has deleveraged its balance sheet significantly by reducing its net debt from INR464b in FY16 to INR114b in FY25 with a net debt-to-EBITDA ratio of 1.26x as of 4QFY25. Out of the ongoing capex of INR310b, +75% has already been spent by JSPL and the remaining is expected to be spent in FY26. It has also proposed an additional INR160b of sustenance capex of INR160b over FY26-28E. As a result, we expect JSPL to generate operating cash flow of ~INR200b over FY26-27, enabling it to comfortably fund its capex (ongoing + proposed) without breaching the net debt/EBITDA target of 1.5x.

Valuations

* The capacity expansion will boost its crude steel capacity by 65% to 15.9mtpa, which would primarily support revenue growth. The ramp-up of currently operational coal mines, the commencement of Utkal block (C and B1 & B2), slurry pipeline, and ACPPII commissioning would lower coal costs and support margins. Further, the company’s focus on improving the VAP share (CRM complex + VAP enhancement project) will support NSR.

* JSPL has followed a prudent deleveraging policy, which has helped the company strengthen its balance sheet. The company has deleveraged its balance sheet from INR464b of net debt in FY16 to ~INR110b as of FY25, translating into a net debt-to-EBITDA ratio of 1.1x. JSPL aims to maintain it below 1.5x considering the ongoing and proposed capex.

* At CMP, the stock trades at 6.2x EV/EBITDA and 1.6x P/B on FY27 estimate. We maintain our BUY rating on JSPL with a TP of INR1,100, based on 7x EV/EBITDA on FY27 estimate.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412