Buy Kajaria Ceramics Ltd For Target Rs.1,120 by Motilal Oswal Financial Services Ltd

Demand woes continue; realization under pressure

Volume growth guidance reduced to ~8-9% YoY in FY25

* Kajaria Ceramics (KJC)’s 3QFY25 EBITDA was below our estimate due to lowerthan-estimated revenue and weak realization. EBITDA declined ~17% YoY to INR1.5b (14% miss) and OPM contracted 2.7pp YoY to ~13% (est. ~14%). Adj. PAT fell ~25% YoY to INR777m (25% miss), dragged down by lower-thanestimated other income and higher-than-estimated interest costs.

* Management highlighted that weakness in the domestic market and sluggish exports led to another subdued quarter for the tile industry. It anticipates volume growth of ~8-9% YoY in FY25, lower than its initial double-digit growth guidance. Plywood revenue declined significantly due to higher raw material prices, and KJC is now waiting for demand recovery rather than pushing sales (focusing on retail business).

* We cut our EPS estimates by ~12%/19%/23% for FY25/FY26/FY27 due to a slower-than-expected recovery in demand growth, weak realizations and negative operating leverage. Valuations appear reasonable even after assuming lower than historical margins; though demand recovery would be the key trigger to watch for. We maintain our BUY rating on KJC with a revised TP of INR1,120 (earlier INR1,450), based on 40x Dec’26E EPS

Volume up 7% YoY; EBITDA margin contracts 2.7pp YoY to ~13%

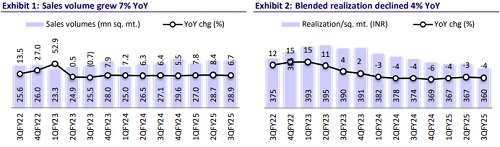

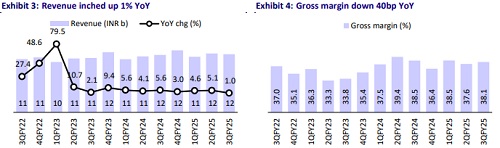

* Consol. revenue/EBITDA/PAT stood at INR11.6b/INR1.5b/INR777m (+1%/- 17%/-25% YoY and -5%/-14%/-25% vs. our estimates). Tile volume rose 7% YoY to 28.9msm, while realization declined 3% YoY to INR367/sqm.

* Gross margin declined 40bp YoY to ~38%. Employee costs increased 14% YoY (12.9% of revenue vs. 11.5% in 3QFY24). Other expenses rose 9% YoY (12.4% of revenue vs. 11.5% in 3QFY24). OPM contracted 2.7pp YoY to ~13%.

* In 9MFY25, revenue grew ~4% YoY, while EBITDA/PAT declined ~10%/21% YoY. OPM contracted 2pp YoY to ~14%. Tile sales volume grew ~8% YoY, while realization declined ~3%. In 4QFY25, we estimate revenue growth of ~3% YoY, whereas EBITDA/PAT may decline 1%/8% YoY.

Highlights from the management commentary

* Expects demand improvement in the retail segment in the coming months, led by positive effects of the budget and an anticipated rate cut by the RBI.

* Gas prices remained stable during the quarter, with the average price of INR37/scm. Propane prices are cheaper by 5-6%.

* Nepal plant, which was commissioned in Sep’24, operated at 70% utilization in 3QFY25. It plans to ramp up utilization to ~80%-85% by 4QFY25.

View and valuation

* KJC reported margin contraction due to lower realization and higher expenses. We are cautiously optimistic for the long term, given that: 1) it is a leading player in the domestic market and has delivered higher than the industry growth; 2) recovery in retail demand will benefit KJC the most, given its strong distribution network; and 3) continuous expansions across segments.

* We estimate KJC’s to post a CAGR of 9%/13%/15% in revenue/EBITDA/PAT over FY25-27. We estimate tiles volume to clock ~10% CAGR over FY25-27. We factor in lower margins of 14.1%/14.5% for FY26/27E (v/s last 10 years’ average of ~16%) considering delay in demand recovery in domestic markets and lower export revenues which in turn, has put pressure on realization. Improvement in profitability of bathware and sanitaryware segments would also help improvement in margins. Valuation at 37x/32x FY26/27E EPS appears reasonable; though, key trigger for stock price performance would be the demand recovery. We maintain our BUY rating with a revised TP of INR1,120 (earlier INR1,450), based on 40x Dec’26E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)