Buy Tata Consumer Products Ltd For Target Rs. 1,360 by Motilal Oswal Financial Services Ltd

Margin under pressure YoY, improves QoQ with price hikes

Operating performance in line with estimates

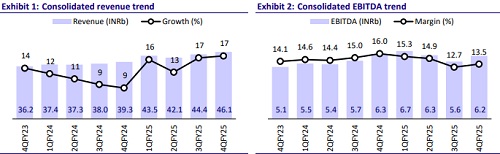

* Tata Consumer Products (TATACONS) reported 17% revenue growth in 4QFY25, while EBIT declined 9% YoY. EBIT was affected by higher input costs (tea cost inflation) in Indian branded business, which declined 25% YoY, and a 4% EBIT drop in international branded beverage segment. However, these factors were partially offset by 22% YoY EBIT growth in non-branded business. Consolidated EBIT grew 13% QoQ, led by price hikes in the tea and salt portfolio.

* Going forward, Indian business margins are likely to recover as the company has increased prices of salt and tea (staggered price hikes to mitigate cost inflation) and as there are early signs of good tea crop in Mar/Apr’25.

* We largely maintain our FY26/FY27 EBITDA estimates and reiterate BUY with an SoTP-based TP of INR1,360.

Non-branded business continues to drive operating profitability

* 4Q consolidated revenue grew 17% YoY to ~INR46b (in line). EBITDA margin contracted YoY by 260bp to 13.5% (est. 12.9%), led by lower gross margins (down 420bp YoY). EBITDA remained largely flat YoY but improved 13% QoQ to INR6.2b (est. INR5.9b).

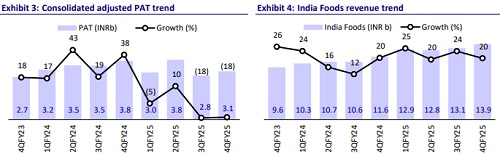

* Indian branded business grew 18% YoY to INR29.3b, led by revenue growth of 17%/20% YoY in the Indian branded beverage/Indian food businesses to INR15.5b/INR13.9b. EBIT declined 25% YoY to INR2.4b due to tea cost inflation.

* Organic underlying volume growth (UVG) for the India branded business was 5.9% in 4Q, driven by 2% volume growth in tea and 5% in salt. Salt segment’s revenue grew 13% YoY, with mid-single-digit growth in volume and pricing. The Tata Sampann portfolio grew 30% YoY.

* RTD segment’s (NourishCo) revenue grew ~10% YoY to ~INR2.1b, while the Premium business grew 29% in 4QFY25. Tata Starbucks revenue grew 5% YoY in FY25, driven by improving demand trends and addition of 6/58 stores in 4Q/FY25.

* International branded beverages revenue grew 13% YoY to ~INR12b, EBIT declined 4% YoY to INR1.5b, and EBIT margins stood at 13.2%, down 240bp YoY. Non-branded business revenue increased 25% YoY to INR5b, while EBIT jumped 22% YoY to INR1.1b.

* Adj. PAT declined 18% YoY to INR3.1b (in line).

* In FY25, revenue/EBITDA grew 16%/8.5% YoY to INR176b/INR24.8b. Adj. PAT stood at INR12.8b (down 18% YoY).

Highlights from the management commentary

* Price calibration: The company has implemented price hikes in tea and expects margin pressure to ease going forward. The price hike has compensated for 40% for 4Q and 30% for FY25 of the tea cost increase. Going forward, the company is focusing on gaining back the market share through volume growth. Guided midsingle digit volume growth in both tea and salt for FY26.

* Impact of tariffs: Since coffee is not produced in the US and is not a discretionary item, India is expected to be in an advantageous position if the US were to go ahead with its proposed import tariffs. No major competitive impact is expected; however, the impact of tariffs is yet to materialize.

* NourishCo: It generates 60-65% of revenue from Andhra Pradesh and Eastern India. Its existing network of ~40 plants offers ample growth room; expansion or capex will occur only upon a substantial demand increase.

Valuation and view

* We expect margin to recover in the Indian beverage business due to price hikes in tea and salt, stabilization of the input prices, and early signs of better tea crop growth this harvest season (Mar/Apr’25). International business is expected to continue delivering healthy operating performance. The premium portfolio in the RTD segment continues to gain traction.

* The continued synergy benefits from the integration of Capital Foods and Organic India are expected to be a key driver of growth for the Indian food business.

* We expect TATACONS to clock a CAGR of 8%/13%/20% in revenue/EBITDA/PAT during FY25-27. Reiterate BUY with an SoTP-based TP of INR1,360.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412