Buy GAIL Ltd for the Target Rs. 212 by Motilal Oswal Financial Services Ltd

Growth in transmission volumes a key monitorable

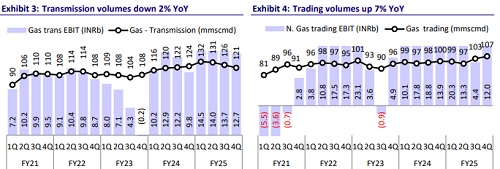

* GAIL’s 4QFY25 EBITDA came in 11% above our est. at INR32.2b, as weak transmission and petchem performances were more than offset by robust gas marketing performance. Reported PAT was in line at INR20.5b, as other income came in below our est., and the tax rate was above our estimate. Natural gas transmission/marketing volumes stood at 120.8mmscmd/ 106.5mmscmd, and petchem sales were in line at 229tmt.

* Natural gas transmission volumes came in 5% below our est. in 4Q. A 5.1mmscmd QoQ drop in gas transmission volumes was observed in 4Q as: 1) shipping volumes of ~3mmscmd pertaining to OMCs were not present in the quarter; and 2) some fertilizer companies took unplanned shutdowns. Further, GAIL has already lost ~3mmscmd volumes to GIGL pipelines and these volumes might go down further. Volumes in 1QFY26’td remain soft at ~122-125mmscmd amid plant shutdowns and muted power demand.

* Guided FY26 NG transmission volumes at ~138-139mmscmd; NG marketing EBIT guidance of INR40-45 maintained: Management expects GAIL to clock NG transmission volumes of 139/148/159mmscmd in FY26/27/28. CGDs/IOCL Barauni/Paradip/Haldia and other sources are expected to drive ~5/1.4/2.4/1mmscmd increase in volumes in FY26. Management maintained its NG marketing EBIT guidance of INR40-45b for FY26. Additionally, the company is expected to clock 108/114/120mmscmd marketing volumes in FY26/FY27/FY28.

* Other key takeaways from the earnings call:

* Management expects CGD volumes from its six standalone GAs to grow 25% YoY (from 0.4-0.45mmscmd currently). Gail Gas Ltd. saw a 40% YoY rise in profits in FY25, and it plans to add 255 new CNG stations and 0.4m new DPNG connections in the next two years.

* The KLL Dabhol Breakwater project has been completed. About 34-36 cargoes are expected to be re-gasified in FY26 (vs. 21 in FY25).

* The company shall incur INR100b capex in FY26 (INR30b/30b/10b/16b on Transmission/Petchem/renewables/CGDs and others).

* The company was allocated 0.32mmscmd NW gas from Apr’25. This resulted in a 50% reduction in APM de-allocation.

Beat on EBITDA driven by robust marketing performance; transmission volumes disappoint

* In 4QFY25, GAIL’s EBITDA was 11% above our est. at INR32.2b. While the EBIT of the NG marketing, LPG transmission, LPG, and LHC segments beat our estimates, the EBIT of the gas transmission and petrochemical segments came in below our estimates.

* However, reported PAT was in line at INR20.5b, as other income was below our est. Moreover, the tax rate was higher than our estimate.

* Natural gas transmission volume stood below our est. at 120.8mmscmd.

* However, NG marketing volume was 6% above our est. at 106.5mmscmd.

* Petchem sales were in line at 229tmt, while the petchem segment reported an EBIT loss of INR1.6b.

* In FY25, net sales/EBITDA/APAT grew 5%/10%/5% to INR1.4t/INR143b/ INR94.5b.

* The Board declared a final dividend of INR1/share (FV: INR10/sh; dividend for the full year: INR7.5/sh).

Valuation and view

* We reiterate our BUY rating on GAIL with an SoTP-based TP of INR212. During FY25-27, we estimate an 11% CAGR in PAT driven by:

* an increase in natural gas transmission volumes to 146mmscmd in FY27 from 127mmscmd in FY25;

* healthy trading segment profitability with guided EBIT of at least INR40b-45b in FY26.

* We expect RoE to improve to ~13.8% in FY26 from 9.5% in FY23, with a healthy FCF generation of INR48.3b in FY26 (vs. -INR45.3b in FY23), which we believe can support its valuations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)