Buy Gail India Ltd for the Target Rs. 211 By Prabhudas Liladhar Capital Ltd

GAIL Gas: towards adulthood!

Quick Pointers:

* GAIL has called for a study before listing of its wholly owned subsidiary GAIL Gas

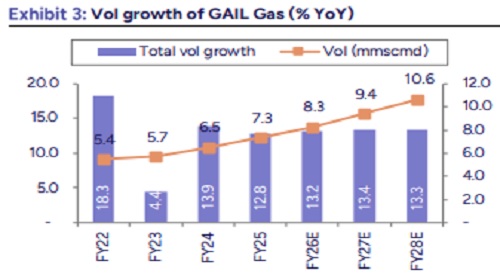

* Sales at 7.3mmscmd in FY25; CNG/PNG comprising 40% of total sales grew at 17%

GAIL India (GAIL IN) has initiated a study on listing of its wholly owned subsidiary GAIL Gas Ltd (GGL). This literal move towards adulthood, nearly eighteen years after it was founded in 2008, is bode to provide a strong fillip to GAIL through Rs11/share accretion even post 25% holding company discount. With a total of 16 geographical areas (GAs) in standalone and additional 9 through JVs, it’s total sales volume stood at 7.3mmscmd in FY25. Key areas of operation include Bengaluru, Sonepat, Dewas etc. Additionally, we believe that the downward revisions in transmission volume are over for GAIL. With 8-10mmscmd of rise in transmission volume in FY27 YoY, we expect EPS of Rs16/17 in FY27/28. The stock is trading at 11.5x FY27 EPS. Valuing standalone at 11x FY27/28 EPS and adding the value of investments, we arrive at a target price of Rs211 and reiterate Buy on the stock.

GAIL Gas- CNG growth to better EBITDA/scm: Due to bulk sales comprising 60% of total sales volume, gross margin of the company stood at Rs4.8/scm and EBITDA/scm stood at Rs2.9/scm. However, CNG sales grew at 36% CAGR in past three years with Bengaluru crossing 1mmscmd in FY25. It added 75 CNG stations in FY25 and the continued thrust on infrastructure is expected to continue rapid growth in CNG sales. With growth in CNG, profitability is also expected to better.

GAIL Gas- staring at a market cap of ~Rs100bn: The company is expected to grow its CNG/PNG portfolio at 18% CAGR for next three years. Excluding bulk sales, we estimate that the company made EBITDA/scm of Rs5.1/scm. Independent listing would definitely raise focus on both growth and profitability. We estimate that GAIL Gas on a standalone basis may fetch a PAT of Rs6.8bn in FY28E. Valuing the company at 15x (~25% premium to IGL & MGL due to high growth and improvement in profitability), it would easily command a market cap of ~Rs100bn.

Expect improvement in GAIL’s transmission volume from here: In Q1FY26, total gas consumption in India declined by 6.4% YoY due to lower offtake from fertilizer plants and power sector. As a result, GAIL’s transmission volume declined by 8% YoY in Q1FY26. However, the same appears to have normalized in Q2FY26 with 0.2% YoY growth in Q2FY26. Although GAIL’s transmission volume declined by 5% YoY in Q2FY26 as well, we believe that further decline may not happen.

Valuation and recommendation:

GAIL is currently trading at 11.5x FY27 EPS. The upcoming expansions of IOCL’s refineries is expected to add 8-10mmscmd in next three years in addition to the demand boost from CGDs and other sectors. We expect transmission volume of 124/136/146mmscmd in FY26/27/28. We value the stock at Rs211.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271