Sell Mahindra Lifespaces Ltd For Target Rs. 382 by Motilal Oswal Financial Services Ltd

Pre-sales beat; stable launch pipeline to drive growth

Healthy collections; net D/E declines

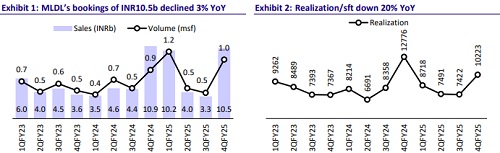

* Pre-sales: MLDL achieved bookings of INR10.5b in 4QFY25, down 3% YoY and up 3x QoQ (53% above estimates). FY25 bookings stood at INR28b, up 20% YoY (15% beat). This growth was driven by strong bookings of ~INR21b in 1QFY25 and 4QFY25 combined, following the successful launches of Vista Ph2, IvyLush, Zen, and Green Estates. The company aims to achieve its pre-sales target of ~INR95b by FY30.

* 4Q sales volume stood at 1.0msf, up 21% YoY and 2x QoQ (80% above estimate). For FY25, sales volume rose 28% YoY to 3.2msf (17% above estimate).

* Blended realization in 4QFY25 was down 20% YoY and up 38% QoQ at ~INR8,818 psf.

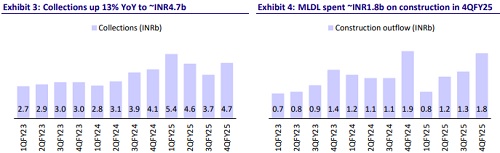

* Collections: The company achieved quarterly collections of INR4.7b, up 13% YoY/ 27% QoQ, and spent INR1.8b on construction. The net debt-toequity ratio stood at 0.39x (vs. 0.5x in 3QFY25). The cost of debt was at 8.8%.

* In 4QFY25, MLDL added a project with a GDV of INR36.5b (Bengaluru – INR10b and MMR – INR26.5b). Additionally, the company plans to add projects with a GDV of ~INR59b to achieve its cumulative BD target of INR450b.

* The company launched 0.9msf in 4QFY25, bringing the total FY25 launches to 2.26msf. In FY25, 65% of sales came from new launches, while 35% were from sustenance. In the near term, launches are expected to remain strong, with a pipeline of ~17msf across new and existing projects.

* IC&IC segment: In the IC&IC segment, the company leased 85.1 acres, generating revenue of INR4.9b.

* The company has recommended a final dividend of INR2.8 per share on equity shares of INR10 each for FY25.

* P&L performance: In 4QFY25, MLDL’s revenue stood at INR92m, down 35% YoY (75% below estimate). The company reported an operating loss of INR552m vs. a loss of INR541m in 4QFY24. PAT was up 19% YoY at INR851m due to a 15% YoY increase in other income and a considerably higher share of profit coming from JV & associates.

* For FY25, revenue grew 76% YoY to INR3.7b (7% below estimate). EBITDA loss stood at INR1.7b, flat compared to YoY, while PAT declined 38% YoY to INR613m (28% below estimate).

Key highlights from the management commentary

* MLDL is focusing on market consolidation by temporarily pulling back from NCR to strengthen its position in MMR, Pune, and Bengaluru. It is emphasizing high-impact projects like Bhandup and prioritizing land acquisitions and redevelopment opportunities.

* The company is expanding its capacity in line with project timelines, effectively managing channel partners across retail, institutional, and broader India models, while excelling in distribution and execution.

* Recent launches include Project Vista Phase 2, Project Ivy Lush, and Zen 2, with upcoming projects like Citadel, Project Navy, and Bhandup Phase 1 scheduled for future release.

* MLDL has signed projects worth INR48b from Jan-Apr’25 and has acquired INR390b of its INR450b GDV expansion target, with continued focus on Pune and Bangalore.

* The company is experiencing a significant shift toward premium residential sales, with premium projects expected to drive 97% of sales value by FY30, while affordable housing is being phased out.

* MLDL has approved a rights issue to raise INR15b for long-term debt repayment and funding future acquisitions, positioning itself for further growth with a projected net worth of INR34b post-issue.

* MLDL’s project-level IRR grew from 3% in FY18 to an average of 26% by FY24 across five projects worth INR50b. Currently, the company generates a ~16% IRR at the portfolio level.

Valuation and view

* MLDL posted strong booking growth and is well-positioned to improve this momentum, given the healthy project pipeline across its key markets.

* We value the Residential business on a DCF basis, with a WACC of ~14% translating into INR44b.

* We reiterate our NEUTRAL rating on the stock with a revised TP of INR382, a 14% upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412