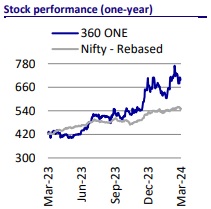

Buy 360 ONE WAM Ltd For Target Rs.1,250 by Motilal Oswal Financial Services Ltd

B&K acquisition a strategic fit

We attended an analyst call hosted by the management team of 360 ONE WAM. Management outlined the strategic rationale behind the B&K acquisition and new strategic initiatives. The following are the key takeaways from the meet:

* B&K acquisition is a strategic fit for 360ONE as it will enhance its business in multiple ways: 1) it will provide equity advisory to existing clients; 2) corporate advisory of B&K will benefit from the product portfolio of 360ONE; and 3) the corporate relationships of 360ONE will help to scale up the IB business. The deal is likely to be EPS-accretive by 3-5%.

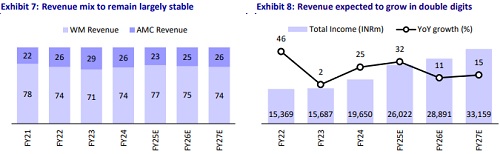

* The company expects a revenue CAGR of 15-25% in B&K business over the next 3-5 years, driven by incremental business from existing customers and new customer additions, with its inherent need for a strong equity advisory franchise.

* With the recent market corrections, the company expects to gain market share given its strong product portfolio and customers sitting on 10-20% cash for deployment in equity markets. The current flows are more toward nonequity assets, though a change in the existing AUM mix toward debt seems to be a limited possibility.

* HNI business is expected to scale up over the next 12-18 months as the company gets the right products and teams in place, which will need incremental costs. Global business, however, should start scaling up in the near term as the team and products are in place.

* We have cut our estimates by 2%/4% for FY26/FY27 to factor in the MTM hit along with lower assumptions on growth in inflows. We have not yet built in revenues/costs/dilution for the B&K acquisition. We retain our BUY rating with a one-year TP of INR1,250, premised on 34x FY27E EPS.

Synergies from B&K acquisition

* 360ONE acquired 100% of B&K Securities recently for a consideration of INR18.84b. The transaction involves a cash consideration of INR7.1b and 10m equity shares at INR1,174/share.

* Structure of the deal: Of the total INR7b cash, ~INR2b stands in the B&K balance sheet. Of the balance INR5b, around INR1b will be utilized for the purchase of warrants, and the net cash outflow will be INR1-1.5b. With a strong research platform and interest-aligned management in place and a fiveyear lock-in for ESOPs, there is favorable leverage on the deal structure. The deal is expected to be 3-5% EPS-accretive.

* ESOP cost will be~INR2-2.4b over six years, with a vesting period of 48/60/72 months.

* Strategic rationale for acquisition: 1) to provide a complete service cycle to clients as it believes the capital market has become a large part of client activity and exposure and expects the momentum to continue for the next 10- 15 years at least; 2) to build steady growth of 6-10% in TBR AUM; 3) to create a robust research-backed brokerage platform for the company.

* In order to maintain steady growth in the TBR segment, 360ONE aims to improve the contribution from the equity brokerage book to 40-50% from ~12% (9MFY25) of TBR mix.

* The expansion of companies under coverage from 400-450 stocks to ~600, acquisition synergies via incremental brokerage from B&K acquisition (INR1.9b in annualized 9MFY25), an increase in equity-biased clients such as family offices/AIFs for 360ONE, and a granular approach to equity wallets of existing clients will likely lead to growth of ~15-25% in the equity brokerage segment for the next 3-5 years.

* In the corporate distribution business, there is a lot of synergy that can result in exponential growth. B&K is one of the leading corporate distributors with an excellent team and experienced leadership in place.

* Growth in IB business will be driven by strong relationships with corporates in multiple stages of fundraising. However, growth is expected to be slower due to the requirement of a stronger team and a robust execution platform.

New business initiatives

* In global business, distribution will be mainly focused on the company’s own asset management products. 360ONE is engaged with few firms that will be managing money for nearly 6-8 large endowments.

* The global business cost will remain the same as no significant hiring will be done in the near term. 360ONE plans to have limited coverage with a focus on building a small sales team for attracting institutional and family office money.

* In HNI business, 360ONE has built a team of ~30 professionals to strengthen engagements. The delay in launching the HNI platform was mainly due to the structuring of UHNI business and employing the right people. The business will see a ~15-20% increase in cost due to employee additions.

Core businesses to remain largely stable

* Amid weak market sentiment, business opportunities could be weak for the next 4-6 months. 360ONE believes it is well poised for a market share gain in this environment, driven by its astute portfolio management team, a rise in equity allocations after a market correction, and a strong team in the alternates space.

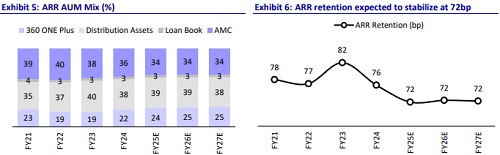

* An ideal contribution from ARR to the mix remains at 75-80%, even after the B&K acquisition.

* The cost-to-income ratio will remain in the range of 45-50%. Few anomalies can be witnessed in building the new businesses, which will be offset by the continuous optimization of core businesses.

* Margins are expected to expand steady as its platforms widens its reach and its ability to approach clients improves.

* Net flows will likely be within the guidance range. MTM will be impacted with slower markets, which will be offset by higher unlisted activity and market share gains.

* No shift is expected in the asset allocation mix. ~10-15% of cash in the sidelines will come back into the equity segment once the market stabilizes.

* Incremental flows currently are largely toward the fixed-income side.

Valuation and view

360ONE maintains a strong position in the industry, reflected by robust flows and consistent performance. Diversification across client segments (mass affluent) and geography (lower-tier cities) is gaining traction, and its global platform has also seen green shoots. The B&K acquisition will bring in many synergies and is expected to be 3-5% EPS-accretive. We have cut our estimates by 2%/4% for FY26/FY27 to factor in the MTM hit along with lower assumptions on growth in inflows. We have not yet built in revenues/costs/dilution for the B&K acquisition. We retain our BUY rating with a one-year TP of INR1,250, premised on 34x FY27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)