Neutral Alkyl Amines Chemicals Ltd for the Target Rs. 1,900 by Motilal Oswal Financial Services Ltd

Muted volume and pricing drag down overall performance

Earnings below our estimate

* Alkyl Amines Chemicals (AACL) reported a muted operating performance in 2QFY26 as EBITDA declined 5% YoY. Despite some raw material cost pressure, EBITDA margins expanded marginally by 30bp YoY to 18%.

* While volume growth in 1HFY26 was marginally higher on a YoY basis, the momentum is expected to remain muted in the near term due to prevailing demand softness across key end-user industries, ongoing geopolitical uncertainties, and heightened competitive intensity from Chinese manufacturers. Additionally, global sanctions and trade restrictions are likely to continue to disrupt supply chains.

* We broadly maintain our earnings estimates and value the stock at 45x FY27E EPS to arrive at a TP of INR1,900. Reiterate Neutral.

Muted operating performance

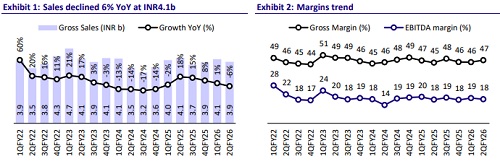

* Revenue declined 6% YoY/4% QoQ to INR3.9b (est. INR4.2b), while gross margin expanded by 190bp YoY and 150bp QoQ to 47.3%.

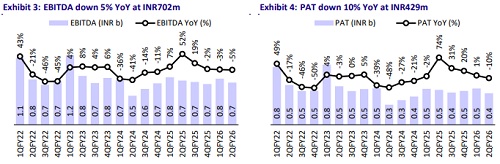

* EBITDA margins expanded 30bp YoY but contracted 80bp QoQ to 18% (est. 18.3%). Employee costs as a percentage of sales stood at 7% (vs. 6% in 2QFY25), while other expenses stood at 22% vs. 21% in 2QFY25.

* EBITDA stood at INR702m, down 5% YoY and 8% QoQ (est. of INR776m).

* Adj. PAT stood at INR429m, down 10% YoY and 13% QoQ (est. of INR505m).

* In 1HFY26, revenue/EBITDA/adj. PAT declined 2%/4%/4% to INR7.9b/INR1.5b/INR924m.

* The company stands debt free as of Sep’25. Further, the cash flow from operations in Sep’25 stood at INR750m compared to INR1.6b in Sep’24.

Highlights from the management commentary

* Outlook: Volume growth in the first half was slightly higher compared to last year. Management does not expect to meet its volume growth target of 7- 10% for FY26. However, anti-dumping duties on acetonitrile are expected to benefit the company from 4Q onward.

* Macro environment: The industry faced multiple challenges, including demand pressures, geopolitical disruptions, and intensified competition from Chinese suppliers, which are dumping products across Asia and other regions, leading to heightened pricing pressure.

* Product development: The company is developing an import-substitute product at its Kurkumbh facility for the dyes, pigments, and electronics markets, with an expected launch in 1QFY27 and an asset turnover of 1.5x. It also has additional products in the R&D pipeline to further drive growth momentum.

Valuation and view

* We expect short-term headwinds to persist, with volumes likely to be affected by global demand softness and weakness across key end-user industries, along with continued pricing pressure due to heightened competition from Chinese manufacturers.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)

.jpg)