Neutral PB Fintech Ltd for the Target Rs. 2,000 by Motilal Oswal Financial Services Ltd

Protect, borrow, prosper!

Building trustworthy digital rails for India’s financial needs

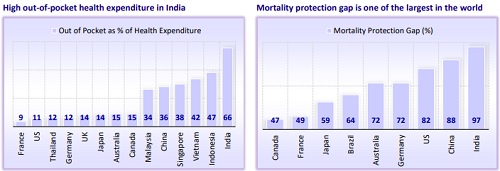

* PB Fintech is a dominant digital marketplace in both insurance and consumer credit—two sectors benefiting from rising financial awareness, digitalization, and significant under-penetration. With ~90% share in online insurance and growing traction in digital unsecured loans, the company offers scaled access to India’s structurally growing protection (life and health insurance) and credit markets.

* The company has rapidly scaled its presence in India’s insurance distribution landscape, with its share of overall industry premiums rising to ~3% in FY25 (1.3% in FY20). This sharp expansion underscores the platform’s growing relevance as a mainstream distribution channel, steadily challenging the dominance of traditional offline players.

* The business has evolved from customer acquisition to lifecycle monetization. PB Fintech reported an annualized run-rate of renewal revenue at INR7.7b in 2QFY26 (+39% YoY) and positive adjusted EBITDA across both Policy Bazaar (PLB) and Paisa Bazaar (PSB). We believe the platform is well-positioned for long-term margin expansion and expect EBITDA margin to reach ~13% in FY28 (from 2% in FY25).

* The company is transforming from a marketplace to a multi-vertical platform, with scaled initiatives like point of sales persons (POSP), Corporate, UAE, Secured Credit, and PB Health. Each vertical builds on the existing core infrastructure, data, and brand equity, supported by disciplined funding, as reflected in a net cash position exceeding INR54b. We expect these initiatives to achieve EBITDA breakeven by FY28.

* From insurance aggregation to hospital ownership, PB Fintech is strategically building a financial + health services ecosystem. Its boldest bet—PB Health—aims to address India’s broken care incentives through a ‘Payvider’ model. The company offers exposure to both near-term growth and long-term disruption across two of India’s largest household financial products: insurance and credit.

* We expect PB Fintech to post a strong FY25-28 revenue/EBITDA/PAT CAGR of 35%/156%/56%, factoring in a strengthening position in the under-penetrated credit and insurance industries. However, we believe the stock is fairly valued, and all the positives are priced in at current levels. The possibility of commission restructuring by insurance companies due to the loss of input tax credit post GST exemption, poses a key risk for the company’s top-line growth. We initiate coverage on PB Fintech with a Neutral rating and a one-year TP of INR2,000 on the basis of DCFbased valuation (implying Sep’27E EV/EBITDA multiple of 58x).

Policy Bazaar (PLB) – Compounding through trust and digital dominance

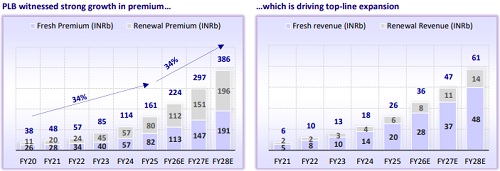

* PLB is India’s largest digital insurance platform, accounting for ~90% market share in online distribution. This enables unparalleled customer reach across health, term, savings, and motor products. The platform has posted a 34% premium CAGR over FY20-25, increasing its share of overall insurance premiums to 3% in FY25 (1.3% in FY20). We expect this strong momentum to continue, with a projected 34% CAGR over FY25-28.

* Deep consumer engagement, built on over 23m transacting users, superior claims support, and over 80% CSAT/NPS, is driving trust-led retention and cross-selling.

* PLB integrates over 50 insurers, delivering real-time underwriting and enabling robust checks, which provides insurers with the opportunity to co-create customer-friendly products as well as build a strong book from a claims perspective.

* EBITDA-positive and structurally asset-light, PLB benefits from scale-driven margin expansion and a declining incremental CAC. The growing renewal book (fresh-to-renewal ratio at 49.3% in FY25 from 41.6% in FY22) has driven contribution margin from 36% in FY22 to 43% in FY25 due to a lower cost of acquisition with respect to renewals. We expect strong retention capabilities to further expand contribution margin to 45.1% by FY28.

Paisa Bazaar (PSB) – Scaling India’s leading credit gateway

* PSB is the largest independent digital credit marketplace, having served over 20m customers across both unsecured and secured products in partnership with more than 60 lenders. The company reported a 23% CAGR in lending disbursals over FY20-24, post which disbursals declined 20% YoY in FY25 due to tighter regulatory guardrails. We expect a gradual recovery, leading to a 13% CAGR in disbursals over FY26-28.

* PSB’s current portfolio of co-created products like credit cards and retail loans is designed to empower underserved customer segments and expand access to formal credit. Credit card issuance has posted a 26% CAGR over FY20-25, and we expect growth to stabilize at 5% over FY25-28.

* PSB has built the largest credit score platform in India, with ~54.8m customers having checked their credit score on the platform as of 2QFY26. This serves as a critical funnel for cross-selling loans and credit cards, and a strong indicator of long-term customer engagement.

* The platform’s deep data integration and real-time matching allow for high approval rates, personalized offers, and pre-qualified journeys, making it a preferred channel for lenders and consumers alike.

* The business has a profitable and capital-efficient model with strong repeat usage and a growing share of co-lending/NBFC-driven revenue. Going forward, we expect contribution margin to remain stable at ~42%.

New initiatives – Improving platform synergies and building optionality

* PLB’s new initiatives, including POSP, Corporate, and UAE businesses, significantly expand the platform’s insurance distribution by: 1) improving penetration into non-metro geographies, 2) serving smaller corporates and SMEs, and 3) extending services to NRIs and expat communities through crossborder protection. Premiums from these initiatives have expanded at a 110% CAGR over FY22-25, with strong double-digit growth across segments. We expect premiums to maintain momentum and expect 41% CAGR over FY25-28, largely due to single-digit growth in the corporate segment.

* PSB’s recent entry into secured credit is gaining traction, with INR112b worth of disbursals already achieved by the end of 1HFY26. The segment unlocks higher ticket sizes and stable revenue, while deepening platform stickiness for premium customer cohorts. We expect the segment to maintain a strong growth trajectory, with disbursals clocking 81% CAGR over FY25-28.

* The hospital venture, PB Healthcare, is a long-cycle investment with the potential to be one of the most transformative initiatives. Having secured seed funding and acquired its first hospital, the company is set to operate with the goal of reshaping affordability and trust within India’s healthcare ecosystem. The venture has raised seed capital of USD218m from various investors, including General Catalyst, with PB Fintech holding a 26% stake.

* These initiatives, though still in early stages, are capital-efficient, synergistic, and create optionality for the company. Revenue from these initiatives has reached 104% CAGR over FY22-25, with a projected CAGR of 43% over FY25-28. We expect these businesses to achieve EBITDA breakeven by FY28 (ex-healthcare initiative).

Valuation and view

* We believe PB Fintech holds a strong position in two of India’s most underpenetrated financial services segments, complemented by embedded optionality from new initiatives that offer further long-term convexity.

* We expect consolidated revenue to post a 35% CAGR over FY25-28, driven by a sustained momentum in core online businesses and the monetization of new verticals. Adjusted EBITDA margins are expected to expand meaningfully, from 2% in FY25 to 13% by FY28, driven by operating leverage in the core business and stabilization of early-stage investments.

* We expect PB Fintech to post a strong FY25-28 revenue/EBITDA/PAT CAGR of 35%/156%/56%, factoring in a strengthening position in the under-penetrated credit and insurance industries. However, we believe the stock is fairly valued, and all the positives are priced in at current levels. The possibility of commission restructuring by insurance companies due to the loss of input tax credit post GST exemption, poses a key risk for the company’s top-line growth. We initiate coverage on PB Fintech with a Neutral rating and a one-year TP of INR2,000 on the basis of DCF-based valuation (implying Sep’27E EV/EBITDA multiple of 58x).

* Rising competition from both digital-first players and incumbent insurers’ direct channels could erode market share. Additionally, any cut in distributor commission due to the loss of input tax credit post GST exemption could impact revenue growth. However, stronger persistency and renewal monetization in PLB could drive earlier-than-expected margin expansion. Faster digital adoption in insurance and lending may accelerate market share gains.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412