Buy Indostar Capital Finance Ltd for the Target Rs. 360 by Motilal Oswal Financial Services Ltd

Disbursements weak in vehicle finance; credit costs stable

PAT rose ~3% YoY; asset quality improved, aided by the ARC transaction.

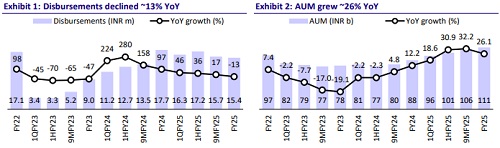

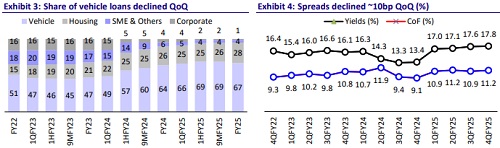

Indostar Capital Finance (IndoStar) reported a mixed quarter. Although business momentum was subdued due to the tightening of underwriting policies, asset quality improved, aided by the ARC transaction, while credit costs remained stable QoQ. Key highlights: 1) Consolidated disbursements declined ~13% YoY to ~INR15.4b and retail AUM rose ~30% YoY to ~INR109b; 2) The company added ~240 employees in 4QFY25, bringing the total count to ~5,763; 3) the CV segment contributed ~68% to the retail disbursement mix; and 4) Credit costs were stable sequentially, translating into annualized credit costs of ~1.8%.

Financial highlights

* IndoStar’s 4QFY25 PAT stood at INR362m, rising ~3% YoY (PY: INR353m). FY25 PAT grew ~4% YoY to INR1.2b.

* NII in 4QFY25 grew ~45% YoY to INR1.3b. Opex rose ~8% YoY to INR1.2b. PPOP stood at INR494m (PQ: INR479m).

* Total AUM stood at ~INR111b, up ~26% YoY and ~4% QoQ. VF AUM grew ~32% YoY to INR74b (PQ: ~INR73b).

* Asset quality improved, driven by the ARC transaction, with standalone GNPA declining ~40bp QoQ to ~4.5% and standalone NNPA declining ~20bp QoQ to 2.5%. Collection efficiency in 4QFY25 continued to remain subdued, even though there has been an improvement relative to 2Q levels. The company emphasized that the Tamil Nadu Bill is unlikely to affect formal lenders like IndoStar, as it is primarily targeted at informal lending entities.

* We estimate a CAGR of 20%/94% in AUM/PAT over FY25-27, aided by improvements in NIM to 7.8%/8.5% in FY26E/FY27E. Reiterate BUY with a TP of INR360 (premised on 1.1x Mar’27E BVPS)..

AUM grows ~26% YoY; disbursements weak in VF

* Disbursements stood at INR15.4b in 4QFY25, declining ~13% YoY. Vehicle Finance (VF) disbursements declined ~27% YoY to INR10.5b (PQ: INR12.7b).

* Management stated that the company proactively tightened its lending policies, which led to a slowdown in disbursements within the vehicle finance portfolio. The company guided for standalone AUM growth of ~12- 15% in FY26. We model a standalone AUM CAGR of 20% over FY25-27E.

Key highlights from the management commentary

* The company launched its micro-LAP product last year, and targets to drive AUM growth without incurring significant additional costs. It plans to build a granular portfolio by targeting underbanked and underserved markets. The company targets a micro-LAP AUM of ~INR3b by Mar’26.

* Demand for used vehicles remains strong and is expected to sustain due to its favorable pricing compared to new vehicles and better economic viability for fleet operators

Valuation and view

* IndoStar has strategically prioritized the expansion of its loan book in the used CV segment and micro-LAP. A reinforced management team, enhanced processes, and an improvement in the economic climate will serve as catalysts for growth in this segment.

* Corporate and SME segments now contribute only ~5% to the total AUM mix. The company has sold stressed loans in ARC transactions, and we expect the company to start FY26 on a clean slate. Going forward, this should translate into better asset quality outcomes and robust execution. The risk-reward is favorable at 0.9x FY27E P/BV. Reiterate BUY rating on the stock with a TP of INR360 (premised on 1.1x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412