Buy Polycab India Ltd for the Target Rs. 9,110 by Motilal Oswal Financial Services Ltd

Robust growth in C&W, along with margin expansion

FMEG remains profitable despite seasonal headwinds

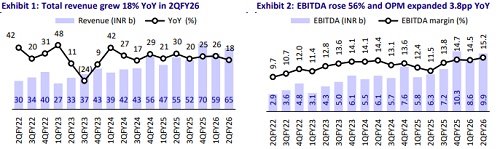

* Polycab India (POLYCAB) posted yet another strong quarter with revenue growing ~18% YoY to INR64.8b (in line) in 2QFY26, driven by ~19%/14% growth in Cables and Wires (C&W)/FMEG segments. EBITDA (adjusted for one-off gain of INR300m in the EPC business) increased ~56% YoY to INR9.9b (~11% beat), and OPM expanded 3.8pp YoY to 15.3% (+1.5pp vs. estimates). Adjusted PAT grew ~50% YoY to INR6.6b (~10% beat).

* Management indicated that the C&W demand outlook remains strong in 2HFY26. It maintains a long-term margin guidance of ~11-13%, though the near-term margin could be higher. The expansion of the EHV plant is continuing as planned and will be commissioned by 4QCY26-end. Commercial production is expected from early 2027. In FMEG, the fans category witnessed only marginal growth due to prolonged monsoons and high channel inventory, while demand for lighting, switches, switchgears, and conduit solutions remained healthy. Solar products continued their strong momentum, driven by central and state incentive schemes.

* We largely maintain our EPS estimates for FY26-28. The stock is currently trading at 37x/31x FY27E/FY28E EPS. We value POLYCAB at 40x Dec’27E EPS to arrive at our TP of INR9,110. Reiterate BUY

C&W/FMEG revenue up ~19%/14% YoY; OPM up 3.8pp YoY to 15.2%

* Consolidated revenue/adj. EBITDA/PAT stood at INR64.8b/INR9.9b/INR6.6b (+18%/+56%/+50% YoY and in line/+11%/+10% vs. estimates). Gross margin surged 3.6pp YoY to 27.1%. OPM expanded 3.8pp YoY to 15.2%. Ad spend accounted for 0.5% of revenue vs. 0.6%/0.3% in 2QFY25/1QFY26.

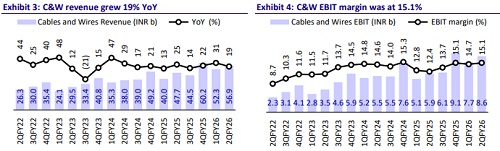

* Segmental highlights: C&W revenue rose 19% YoY to INR56.9b, and EBIT grew ~45% YoY to INR8.6b (~7% beat). EBIT margin surged 2.7pp YoY to 15.1% (est. 14.0%). FMEG revenue grew ~14% YoY to INR4.5b. It posted an EBIT of INR22m (est. loss of INR114m) vs. a loss of INR252m YoY. The EPC revenue declined ~10% YoY to INR3.4b, and adjusted EBIT declined ~17% YoY to INR313m. EBIT margin contracted 70bp YoY to 9.3%.

* In 1HFY26, Revenue/EBITDA/PAT grew 21%/52%/50% YoY. OPM expanded 3.0pp YoY to 14.9%. OCF stood at INR17.9b vs. INR13.3b in 1HFY25. Capex stood at INR7.5b vs. INR5.8b in 1HFY25. FCF stood at INR10.4b v/s INR7.5b in H1FY25. In 2HFY26, the company projects revenue/EBITDA to grow ~18% (each), with PAT growth of ~20% YoY.

Key highlights from the management commentary

* In C&W, sales across both distribution and institutional channels showed healthy traction, indicating broad-based demand. Regionally, the North market led growth, followed by the West, South, and East markets. Volume growth was in the high-teens in 2Q, with cables growth marginally higher compared to wires.

* The company’s focus on premiumization, along with operating leverage, has helped its FMEG business achieve its third consecutive profitable quarter despite increasing A&P spends.

* Inventory days increased slightly in anticipation of strong 3Q demand, while increased payables days helped reduce overall working capital days to 33. This is expected to normalize to 50-55 days in the coming quarters.

Valuation and view

* POLYCAB reported strong earnings in 2QFY25, above our estimates, supported by higher-than-estimated margin in both the C&W and FMEG segments, while revenue was in-line. Demand in C&W remains robust, led by higher government capex, strong real-estate demand, and signs of recovery in private capex. Export also witnessed strong momentum. In FMEG, the company reported its third consecutive quarter of positive segment margin and reiterated its goal to achieve 8-10% margin by FY30.

* We estimate a CAGR of 18%/22%/21% in POLYCAB’s revenue/EBITDA/PAT over FY25-28. We estimate OPM to stand at 14.6%/14.2%/14.4% in FY26/FY27/FY28 vs. 13.2% in FY25. Cumulative FCF during FY26-28E is expected to be at INR43.4b, which will further improve its liquidity position (estimate net cash to improve to INR48.3b in FY28E vs. INR24.3b as of Sep’25). We reiterate our BUY rating on POLYCAB with a TP of INR9,110 (based on 40x Dec’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)