Neutral ACC Ltd for the Target Rs. 2,040 by Motilal Oswal Financial Services Ltd

Cost improvement drives a beat on EBITDA

Capacity expansion of 3.4mtpa on track; commissioning expected in 3Q

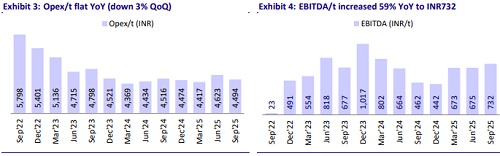

* ACC reported a strong EBITDA growth of ~91% YoY to INR8.2b in 2QFY26 (37% above our estimate, led by higher volume and lower opex/t vs. our estimate). EBITDA/t increased ~59%/8% YoY/QoQ to INR732 (vs. est. INR585). OPM up 4.7pp YoY to ~14% (est. ~11%). PAT (adjusted for tax reversal and interest income) increased ~37% YoY to INR3.2b (~3% above estimates driven by lower other income and higher tax provisioning).

* Management indicated that the industry demand grew ~5% YoY in 2QFY26. With the GST rate reduction, demand is likely to see an uptick, and it estimate ~7-8% YoY growth in FY26. Its Salai Banwa (2.4mtpa) and Kalamboli (blending unit 1.0mtpa) units are likely to be commissioned in 3QFY26, taking the total capacity to 43.7mtpa. Further, debottlenecking initiatives are going to unlock an incremental capacity of 5.6mtpa by FY28 at a capex of USD48/MT.

* We raise our EBITDA by 8% for FY26E and by ~2% for FY27/FY28 (each) to factor in the outperformance in 2QFY26. However, we retain our EPS estimates. The stock is trading at 10x/8x FY26E/FY27E EV/EBITDA and USD85/USD78 EV/t. We value the stock at 8x Sep’27E EV/EBITDA to arrive at our TP of INR2,040. Reiterate Neutral.

Sales volume up ~20% YoY; EBITDA/t at INR732 (est. INR585)

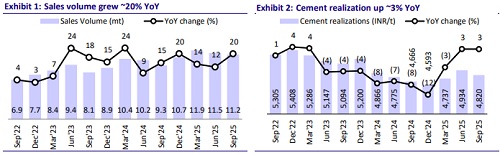

* ACC’s revenue/EBITDA/PAT stood at INR58.5b/INR8.2b/INR3.2b (+26%/+91%/ +37% YoY and +9%/+37%/+3% vs. estimates) in 2QFY26. Sales volumes were up 20% YoY at 11.2mt (+9% vs. our estimate). Cement realization rose 3% YoY (down 2% QoQ; 1% below our estimates) at INR4,820/t. Blended realization improved ~5% YoY (down 1% QoQ). Its RMC revenue increased sharply by 57% YoY to INR4.5b (42% above our estimates).

* Opex/t was flat YoY at INR4,494 (down 3% QoQ; ~4% below our estimate), led by a 12%/6% YoY decline in other expenses/freight cost. However, variable cost/t was up ~5% YoY. OPM surged 4.7pp YoY to ~14%, and EBITDA/t grew 59% YoY to INR732. It also received lease rental (included in revenue) of INR180m (INR16/t) from the holding company, and this will continue to be received going forward. Depreciation rose ~11% YoY, whereas finance cost declined ~13% YoY. Other income dipped 88% YoY, and the effective tax rate was 41.7% vs. 26.5% in 2QFY25.

* In 1HFY26, revenue/EBITDA/adj. PAT grew 21%/44%/18% YoY to INR119.2b/ INR15.9b/INR7.1b. EBITDA/t was up ~24% YoY to INR703. Operating cash outflow stood at INR22.3b vs. INR6.1b in 1HFY25 due to a sharp increase in working capital. Capex stood at INR6.4b vs. INR7.1b in 1HFY25. Net cash outflow was at INR13.2b vs. INR28.7b in 1HFY25. We estimate revenue/ EBITDA/PAT growth of 10%/43%/29% YoY in 2HFY26.

Key highlights from the management commentary

* It acquired new limestone blocks in Wadi, Kymore, and Chanda, ensuring continued operations and cost efficiency through better-quality resources.

* RMC business expanded with the addition of 28 plants YoY, taking the total to 116 plants across 45 cities. Volumes grew 49% YoY to 0.9m m³.

* The company’s net cash balance sheet is at INR7.9b as of Sep’25 and INR15.0b as of now (including the INR7.5b tax refund received in Oct’25) vs. the cash balance of INR35.9b as of Mar’25.

Valuation and view

* ACC reported strong operating performance in 2QFY26, above our estimates, led by higher volume and better cost control. Management indicated that synergies with group companies drive benefits in business operations. Volume growth continued to surprise positively, led by MSA through group companies. While higher operating leverage drives lower-than-estimated opex/t. We remain watchful for a sustainable cost reduction and profitability improvement.

* We estimate a CAGR of 13%/23%/24% for revenue/EBITDA/PAT over FY25-28. We estimate a volume CAGR of ~10% over FY25-28 and EBITDA/t at INR708/ INR763/ INR798 in FY26/FY27/FY28 vs INR570 in FY25. We continue to believe that the Adani group will have a single listed cement entity, eventually leading to the merger of ACC and ACEM. Hence, the consolidated financials of ACEM reflect a clear picture of the group's cement business performance. We value the stock at 8x Sep’27E EV/EBITDA to arrive at our TP of INR2,040. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412