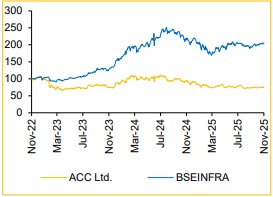

Buy ACC Ltd For Target Rs. 2,475 By Choice Broking Ltd

Structural Story Intact!

Disciplined high return growth and cost reduction strategy!

We maintain our BUY rating on ACC with a TP of INR 2,475. We retain our Volume / EBITDA per ton and EBITDA assumptions (Exhibit 2). We continue to be positive on ACC owing to: 1) Strategy around strengthening its presence in Southern India market with the acquisition of Penna Cement, 2) Valueaccretive cost-reduction plan – targeting INR 500/t cost-reduction by FY28E end under the initiative Parvat, 3) Group synergy benefits and 4) Positive sector tailwinds – we expect cement industry to grow by 7–8% in FY26E with healthy pricing environment. We incorporate a robust EV to CE (Enterprise Value to Capital Employed) based-valuation framework (Exhibit 3), which allows us a rational basis to assign a valuation multiple which captures fundamentals to value ACC.

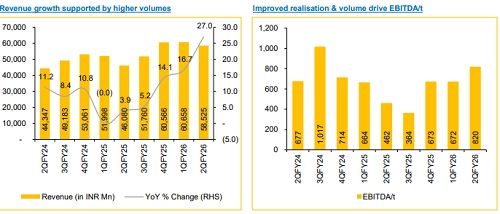

We forecast ACC’s EBITDA to expand at a CAGR of 15.5% over FY25–28E, supported by our assumption of volume growth at 8.0%/7.0%/6.0% and realisation growth of 2.0%/0.5%/0.5% in FY26E/FY27E/FY28E, respectively.

We assign an EV/CE multiple of 2.0x for FY27E/28E. We do a sanity check of our EV/CE TP using implied EV/EBITDA, P/BV and P/E multiples. On our TP of INR 2,475, FY28E implied EV/EBITDA/PB/PE multiples are 11.1x/1.9x/16.6x.

Q2FY26: Lower operating expenses drive EBITDA higher

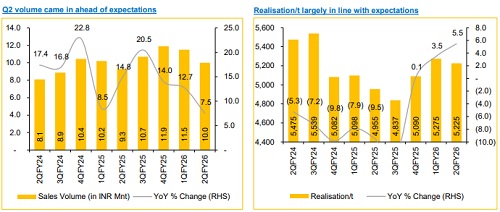

ACC reported Q2FY26 revenue and EBITDA of INR 58,525 Mn (includes government grants), (+27.0% YoY, -3.5% QoQ) and INR 8,195 Mn (+90.9% YoY, +6.0% QoQ). Total cement volume for Q2 stood at 10.0 Mnt (vs CIE est. 9.8 Mnt), up 7.5% YoY, and down 13.0% QoQ.

Blended realisation/t (including clinker volume) came in at INR 5,225/t (+5.5% YoY, -0.9% QoQ), which is higher than CIE est. of INR 5,169/t. Total cost/t came in at INR 4,494/t, (flat YoY, -2.4% QoQ). EBITDA/t came in at INR 732/t, up 58.5% YoY and 8.9% QoQ.

Accelerating growth with cost-efficient expansion: ACC is on track to strengthen its market position with ongoing capacity addition of 2.4 Mnt at Salai Banwa (Rajasthan) and 1 Mnt at Kalamboli (Maharashtra), slated for completion by Q3FY26E – taking the total cement capacity to ~43 Mnt. Further, the company’s plan to add another 5.8 Mnt through debottlenecking at an attractive capex of just ~USD 48/t underscores its focus on disciplined and high-return growth.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131