Quote on WPI inflation for November 2025 by Sonal Badhan, Economist, Bank of Baroda

Below the Quote on WPI inflation for November 2025 by Sonal Badhan, Economist, Bank of Baroda

WPI inflation remains in deflation

WPI inflation fell by (-) 0.3% in Nov’25 following 2.2% increase in Nov’24. Inflation was slightly higher than (-) 1.2% decline in Oct’25. Compared with last year (Nov’24), softening in prices was helped by food, fuel and manufactured product inflation. Core inflation inched higher to 1.5% in Nov’25 from 0.6% in Nov’24. Within food, vegetable, fruits and spices helped drag the index down, while milk inflation increased. Food grain inflation remains muted, led by pulses. Amongst cereals, wheat prices fell more steeply in Nov’25, and paddy price index also cooled. Under manufactured products, softness in inflation was driven by items like basic metals, computers/electronics, chemicals/leather products, food and beverages—continuing to reflect the impact of GST rate cuts and weak international commodity prices. Slower pace of deflation in fuel inflation was driven by mineral oil index. However, globally, prices of Lead and Copper are showing upside pressures. In contrast, oil prices continue to decline at similar pace in Dec’25 as well, driven by supply side concerns. However, possibility of higher growth in the US next year (Fed’s revised projections) may push commodity prices higher and pressure on rupee may exert some upward pressure on fuel inflation in the coming months.

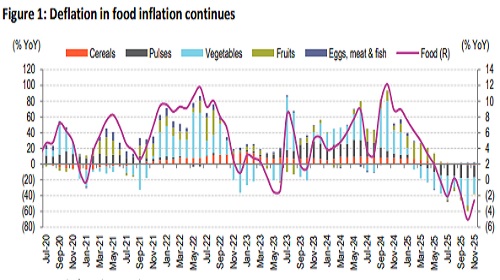

Food inflation continues to support headline WPI:

Headline WPI inflation remained in inflation for second consecutive month in Nov’25 (-0.3%). This is much lower than 2.2% registered in Nov’24 but contracted at a slower pace compared with Oct’25 (- 1.2%). Compared to last year (Nov’24), food inflation contracted again by (-) 2.6% versus 8.9% increase in Nov’24. Vegetable inflation index declined for the 10th consecutive month in Nov’25, and fell by (-) 20.2%, much sharper than 29.3% increase noted during the same period last year. This was helped by decline in index for potato, onion, tomato, carrot, cabbage, and pumpkin etc. Index for spices and condiments (-13.7% versus -0.7% in Nov’24) remains in contraction for the 16 th consecutive month in Nov’25. Index for fruits also recorded 5 th consecutive decline in Nov’25 (-0.9% versus 5.6% in Nov’24). On the other hand, index for milk (3.3% versus 2%) prices inched up. That of eggs, meat and fish, remained muted (2.1% versus 3.2%), while food grain inflation also declined in Nov’25 (-4.4% versus 7.3%), led by sharp dip in inflation index for pulses (-15.2% versus 6.0%). Cereals also registered deflation, mainly due to movement in wheat inflation (-1.4% versus 8.2% in Nov’24). Paddy inflation also noted considerable deceleration (-1.7% versus 7.7%). Comparing cereal prices on a global level (World Bank’s pink sheet) shows that domestic paddy prices are following international trend. Paddy prices internationally have fallen by (-) 28.5% in Nov’25, versus (-) 15.9% decline noted in Nov’24. However, pace of decline in internation wheat prices appears to be slowing (-2.4% versus -8%).

Fuel and power inflation remains low:

Deflation in fuel and power segment slowed as the index fell by (-) 2.3% in Nov’25, after declining by (-) 4% in Nov’24, and was even higher than Oct’25 (-2.6%). Compared to the previous year, the slowdown in pace of decline was broad-based. Inflation index for mineral oil segment registered (-) 3.4% fall compared with (-) 5.2% dip last year in Nov’24. Electricity index too eased at a softer pace (- 0.9% versus 2.5%). Coal inflation inched up (0.4% versus -0.9%). Internationally, crude oil prices have fallen at a faster pace in Nov’25 (-13.3%) compared with last year (-10.5% in Nov’25). Pressure on domestic prices could be a result of depreciating rupee (-5.1% in Nov’25 versus -1.3% in Nov’24). Domestically, within mineral oils, inflation index for petroleum coke, Kerosene and ATF noted the most increase from last year. In Dec’25 so far, pace of decline in international brent prices is broadly similar to last month (~-13%), as there remain concerns regarding oversupply and possibility of UkraineRussia peace deal. However, as pressure on rupee continues compared with last year, it may exert some upward pressure on fuel inflation.

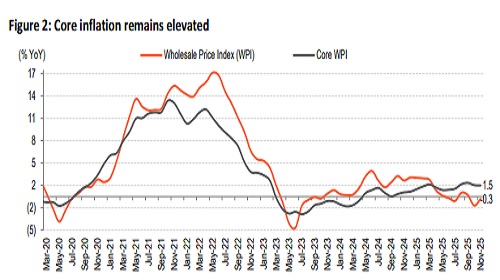

Core WPI remains sticky:

Core inflation remains higher at 1.5% in Nov’25, up from 0.6% last year (Nov’24). It is unchanged from last month (Oct’25). Manufactured product inflation however eased, to 1.3% in Nov’25 from 2.1% last year during the same period. It was also lower than last month’s (Oct’25) 1.5% print. Of the 22 commodity sub-indices, 8 indices rose at a slower pace in Nov’25 than Nov'24 led by—food, beverage, leather/chemicals/rubber & plastic products, basic metals, computer/electronics and electrical equipment. In contrast items like textiles, pharma products registered higher inflation than last year. Deflation in basic metals continued for the 8 th consecutive month in Nov’25 but was at a slightly faster pace (-1.2% versus -1.1%). Inflation for key metalsshows that index for Aluminium (8.7% versus 9.7%), Copper (11.6% versus 13.8%) and Zinc (0.2% versus 8.8%) eased compared with last year, while that for Lead declined further (-1.5% versus -0.6%). In comparison, international prices are showing a mixed trend. Prices of Copper (19.1% versus 10.8%) and Lead (0.6% versus -9.2%) have increased. However, prices of Aluminium (9.2% versus 17.3%) and Zinc (5.7% versus 18.1%) have softened.

When compared with data for the previous month (Oct’25), we note that in Nov’25 price pressures appear to be inching up with pace of decline in headline inflation slowing from (-) 1.2% in Oct’25 to (- ) 0.3% in Nov’25. Mostly this is due to reduced pace of decline in food inflation (-2.6% versus -5%), led by upside pressures visible in vegetables (potato, tomato, cauliflower, brinjal, okra, cucumber), fruits, milk, and eggs/meat/fish. Within food grains, paddy and pulses inflation fell at a slower pace. Deflation in fuel and power inflation has also slowed, driven by electricity price index. Coal index remained stable, while that of mineral oils fell at a faster pace. Core inflation was sticky at 1.5% in Nov’25 versus Oct’25, but manufactured inflation softened. This was helped by inflation of food, beverages, chemicals, pharma products, and other transport equipment.

Above views are of the author and not of the website kindly read disclaimer

More News

Perspective on CPI Data by Mr. Sanjay Kumar, MD & CEO, Rassense Pvt Ltd