Neutral Spandana Sphoorty Financial Ltd for the Target Rs. 280 by Motilal Oswal Financial Services Ltd

Loss narrows QoQ; early signs of stabilization

Sequential decline in credit costs; reported NIM expands ~20bp QoQ

* Spandana Sphoorty (SPANDANA)’s 2QFY26 loss stood at ~INR2.5b (vs. MOFSLe loss of INR2.4b). NII dipped 70% YoY to ~INR1.05b (in line). Opex declined ~14% YoY to ~INR1.9b (in line). Operating loss stood at INR690m (PQ: operating loss of ~INR590m). Total borrower count declined ~18% QoQ to 2m.

* Credit costs declined to ~INR2.6b, resulting in annualized credit costs of ~27% (PQ: ~34% and PY: ~21%). This included an additional credit cost of INR860m in 2QFY26 due to accelerated technical write-offs. Excluding this, the credit costs would have been INR1.7b.

* Management expects stronger disbursement momentum in the subsequent quarters, supported by ~1m customers who are eligible for MFI loans and a corresponding ~INR55–60b lending opportunity to such customers.

* X-bucket CE has been on an improving trajectory, with positive trends observed across the company’s top 5 states. Additionally, slippages declined to ~INR4b in 2QFY26 from ~INR5.5b in 1Q, driven by lower flow rates. The company shared that the new loan book (being built under stringent guardrails) will gradually become a dominant proportion of the loan mix and will help in further improving the flow rates in the subsequent quarters.

* Management shared that the appointment of the new MD & CEO is expected within the next 30 days. Management further shared that FY26 will be a year of rebuilding for the company, with process enhancements aimed at improving efficiency and reducing operating costs.

* We model an AUM decline of ~23% YoY to ~INR53b in FY26 and expect the company to get back to profits from 4QFY26 onwards. SPANDANA has stepped up recovery efforts in its 90+ dpd pool through frequent SMS alerts, demand notices, and selective legal action, which have yielded encouraging results. Elevated credit costs from the stressed pool, along with a sharp rundown in the AUM, suggest that a meaningful earnings expansion will be more back-ended and visible only after 3-4 quarters. Given this delayed recovery trajectory and muted near-term catalysts, we reiterate our Neutral rating on the stock with a TP of INR280 (based on 0.9x Sep’27E P/BV).

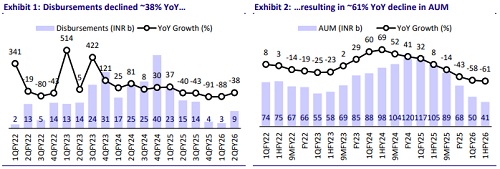

AUM dips ~61% YoY; disbursements down ~38% YoY

* AUM declined ~61% YoY and ~18% QoQ to ~INR41b. Disbursement declined ~38% YoY to INR9.3b. Disbursements in Sep’25 stood at INR4.2b, but SPANDANA shared that it expects disbursements of ~INR3.5b in Oct’25 because of a lesser number of working days and festivities across the country. With the flow rate stabilizing, disbursements are expected to now pick up pace. Management has guided further improvement in the disbursement momentum in 2HFY26.

* Loan officers (net) declined by ~850 during the quarter. SPANDANA currently employs ~8,000 loan officers.

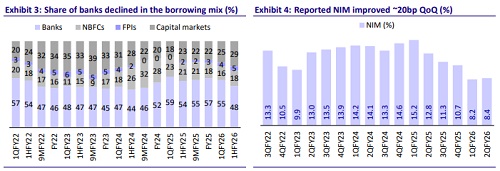

Reported NIM improves ~20bp QoQ; Yields rise ~20bp QoQ

* Reported yields improved ~20bp QoQ to ~19.6%, while CoF declined ~10bp QoQ to ~12.2%, resulting in ~30bp QoQ improvement in spreads to 7.4%.

* Reported NIM rose ~20bp QoQ to ~8.4%.

* The company shared that it has revised its lending rate to 23%–26% (previously 19.75%–24.75%), effective from 1st Oct’25, along with a corresponding increase in the processing fees as well.

GNPA broadly stable at 5.6%; credit costs decline sequentially

* GNPA/NNPA increased marginally by ~10bp/5bp QoQ to ~5.6%/1.2%. S3 PCR was broadly stable QoQ at ~80%. Stage 2 declined ~4pp QoQ to ~3.9%.

* Gross collection efficiency (including arrears) improved to 92.9% (PQ: 91.1%), and net collection efficiency improved to 92.4% (PQ: 90.6%). The X-bucket collection efficiency stood at 98.8% in Sep’25 vs. 98.0% in Jun’25.

* Customers having loans from SPANDANA +>= 3 lenders as of Sep’25 declined to ~17% (v/s ~21% in Jul’25).

* Slippages declined to ~INR4b in 2Q from ~INR5.5b in 1QFY26, aided by a reduction in flow rates. The new loan book built under stringent guardrails and higher credit filters is likely to have lower credit costs going forward.

* CRAR stood at ~47% as of Sep'25.

Key highlights from the management commentary

* Criss Financials, the subsidiary company, offers LAP and unsecured individual loans, with a total portfolio of INR6.7b. The unsecured individual loan segment is facing stress due to floods in Andhra Pradesh and Telangana. However, the micro-LAP book continues to perform well, with minimal slippages and NPAs below 1%. The company plans to increase the share of secured loans from ~39% currently to 50–55% by the end of FY26.

* The successful closure of the rights issue has strengthened the company’s capital position. Management is evaluating CGFMU to enhance credit protection, but has not made any firm decision as yet.

* Despite upcoming state elections in Bihar, this state has performed very well for SPANDANA with an X-bucket CE of 98.8%.

Valuation and view

* SPANDANA reported a minor sequential improvement in the disbursement momentum and expects this to be sustained in the subsequent quarters. The flow rates have reduced, and with its new (and stricter) underwriting standards, we expect the sequential moderation in credit costs to continue over the next few quarters till it attains steady-state normalized credit costs of 3.5%-4.0%. While FY26 is a phase of rebuilding, SPANDANA will rebound to decent profitability from FY27.

* We estimate SPANDANA to deliver RoA/RoE of 3.2%/10% in FY27E. Elevated credit costs from the stressed pool, along with a sharp run-down in the AUM, suggest that a meaningful earnings expansion will be more back-ended and visible only after 3-4 quarters. Given this delayed recovery trajectory and muted near-term catalysts, we maintain our Neutral rating on the stock with a TP of INR280 (based on 0.9x Sep’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpeg)