Neutral Jubilant FoodWorks Ltd for the Target Rs. 750 by Motilal Oswal Financial Services Ltd

Delivery outperformance sustains; beat on margins

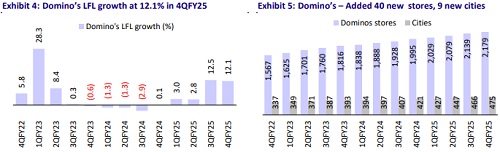

* Jubilant FoodWorks (JUBI) posted 19% YoY growth in standalone revenue to INR15.9b (in line) in 4QFY25. Domino’s orders grew 25% with LFL growth of 12.1%. Delivery business saw strong 27% YoY revenue growth with 22% LFL growth, contributing 73% (68% in 4QFY24) of total revenue. Dine-in revenue was flat YoY. The waiver of delivery charges continues to shift demand from dine-in to delivery.

* Domino’s India added 40 new stores (+9% YoY) and entered nine new cities in 4Q. The company plans to add 250 Dominos India and 30 Popeyes stores in FY26, which will help to broaden its customer reach.

* Standalone gross margin was down 210bp YoY and 60bp QoQ to 74.5% (est. 75.3%), affected by increased cheese offerings and inflation. EBITDA margin inched up 20bp YoY (down 10bp QoQ) to 19.3% and EBITDA was up 20%. Pre-Ind-AS EBITDA margin expanded 90bp YoY (-140bp in base) to 11.8% and EBITDA rose 29% (-6% in base).

* Domino’s Turkey saw 1% LFL growth, while COFFY saw 5% LFL decline, primarily due to currency devaluation. DPEU margins remained under pressure, with EBITDA margin at 18.4% (21.8% in FY25) and PAT margin at 4.8% (6.6% in FY25) in 4Q, impacted by negative operating leverage. Revenue growth was strong in Domino’s Sri Lanka (72%) and Bangladesh (28%), though operating profitability was weak.

* JUBI’s focus on customer acquisition and drive order frequency has been driving strong delivery growth. Value offering and product innovation will continue to drive order growth in FY26. We model operating margin recovery for India business in FY26 after seeing a 300bp fall in EBITDA margin (pre-IND AS) during the last two years to 13.5% in FY27 vs. 11.9% in FY25. However, given rich valuations, we reiterate our Neutral rating on the stock with a TP of INR750 -- India business at 40x EV/EBITDA (pre-IND AS) and International at 18x EV/EBITDA on FY27E.

Delivery LFL up 22%; better commentary on margin outlook

* Strong LFL growth at 12.5%: JUBI reported sales growth of 19% YoY to INR15.9b (est. INR15.9b), led by order growth of 25%. LFL growth was 12% (delivery LFL growth 22%).

* Store rollout continues: In India, JUBI added 38 net stores in India, taking the count to 2,304 stores. Domino’s opened 40 new Domino’s Pizza stores to 2,179 stores. Popeyes opened 3 new stores, taking the count to 61 stores. Hong’s Kitchen closed two stores, taking the count to 33. Dunkin’ Donuts closed three stores, taking the count to 31.

* Steady operating margins: Gross profit grew 16% YoY to INR11.8b (est. INR11.9b). GM declined 210bp YoY/60bp QoQ to 74.5% (est. 75.3%). EBITDA margins inched up 20bp YoY to 19.3% (est. 18%). Pre-Ind AS EBITDA margin expanded 90bp YoY but contracted 60bp YoY to 11.8% (est. 10.2%). PBT margin was 4.3% vs. 3.8% 4QFY24 and 4.9% 3QFY25.

* Growth in profitability: EBITDA grew 20% YoY to INR3.1b (est. INR2.9b). PBT (before exceptional) was up 33% YoY at INR677m (est. INR503m). Adj. PAT rose 43% YoY to INR495m (est. INR351m).

* In FY25, net sales/EBITDA grew by 14%/8%, while APAT fell 12% YoY.

International business

* Domino’s Sri Lanka revenue grew 72% YoY to INR230m. No store has been opened in Sri Lanka.

* Domino’s Bangladesh revenue rose 28% YoY to INR162m. Two stores were opened in in Bangladesh, taking the total count to 39 stores.

DPEU

* DPEU System Sales stood at INR7,643m. Domino’s Turkey LFL growth was 1%, while COFFY saw 5% LFL decline.

* Operating EBITDA margin was 18.4% and PAT margin was 4.8%.

* In DP Eurasia, the company opened 16 stores in 4QFY25, taking the total count to 923 stores.

Highlights from the management commentary

* The company has completed a high-commissary capex cycle, and future capex will now focus primarily on store expansion and technology upgrades.

* JUBI plans to open 250 new Domino’s stores across India. While some of these will be split stores, their share is expected to be no more than 20% of the total.

* It is targeting an EBITDA margin expansion of 200bp over the next three years, supported by scale and efficiency.

* In Turkey, the company remains unaffected by geopolitical concerns (e.g., IndiaPakistan tensions, US tariffs). In Turkey, the macroeconomic environment is improving, with interest rates declining and inflation cooling, aiding business momentum.

Valuation and view

* There are no material changes to our EBITDA estimates for FY26 and FY27.

* JUBI has been the key beneficiary of healthy traffic growth for the delivery business. Delivery is expected to outperform in the near term, which will continue to lead to better growth metrics than those of its peers in the near term.

* JUBI’s focus on customer acquisition and drive order frequency has been driving strong delivery growth. Value offering and product innovation will continue to drive order growth in FY26. We model operating margin recovery for India business in FY26 after seeing 300bp fall in EBITDA margin (pre-IND AS) during the last two years to 13.5% in FY27 vs. 11.9% in FY25. However, given rich valuations, we reiterate our Neutral rating on stock with a TP of INR750 -- India business at 40x EV/EBITDA (pre-IND AS) and International at 18x EV/EBITDA on FY27E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412