Neutral TVS Motor Company Ltd For Target Rs.2,570 by Motilal Oswal Financial Services Ltd

Operationally in line; margin expansion continues.

Market share loss in motorcycles remains a cause for concern.

* TVS Motor (TVSL) delivered an in-line operating performance, with its EBITDA margin showing continued improvement, reaching 11.9% in 3QFY25 (up 70bp YoY). For the first time in many years, TVSL has underperformed the industry in FY25 YTD. More importantly, TVSL has underperformed in the 125cc segment, which has been its key growth driver in recent years.

* At ~36x/30x FY26E/FY27E EPS, we believe most of the positives are in the price. We maintain our FY25E/26E EPS estimates. Reiterate Neutral with a TP of ~INR2,570 (based on ~32x Dec’26E EPS and INR205/sh for the NBFC).

Better mix and FX realization lead to sequential margin improvement

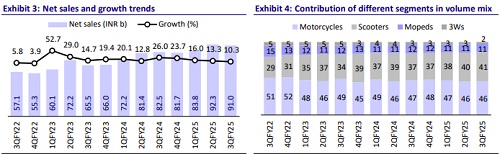

* TVSL’s revenue/EBITDA/adj. PAT grew 10%/17%/4% YoY in 3QFY25 to INR90.97b/INR10.8b/INR6.2b (est. INR91.1b/10.5b/6.5b). Its 9MFY25 revenue/EBITDA/adj. PAT grew 13%/21%/16% YoY.

* Revenue growth of ~10% YoY was entirely driven by volume growth. ASPs remained flat both YoY/QoQ at INR75.2k per unit.

* RM costs were largely flat QoQ with a minimal price increase.

* Overall, EBITDA margin improved marginally by 20bp QoQ (70bp YoY) to 11.9% (est. 11.6%). This led to ~17% YoY EBITDA growth to INR10.8b (est. INR10.5).

* Other income for the quarter includes INR411.6m loss on the fair valuation of investments held by the company.

* This led to a lower Adj. PAT of INR6.2b (+4% YoY, est. INR6.5b). Adjusted for fair valuation in other income, Adj. PAT would have been in line.

Key takeaways from the management interaction

* Domestic: Expect growth momentum to continue in FY26. The 2W retail market grew ~9% YoY in FY25YTD, with rural growth slightly higher at ~10%. Healthy reservoir levels, improved crop outlook, and higher infrastructure investments are expected to support demand going forward.

* International: During 3Q, Africa showed improvement, with expectations for further growth in 4Q. LATAM continues to perform well, with consistent MoM growth. Sri Lanka’s reopening is a positive development in the Asia market, where Nepal is performing well. While Bangladesh faces challenges, a recovery is anticipated in the coming quarters. The Middle East also continues to perform well overall.

* Capex: Guided for capex for FY25 of ~INR13b and investments of INR17b. Investments are focused on product readiness, e-bikes, new technology via TVS Singapore, and setting up a new international hub in Dubai to tap into opportunities in Africa, the Middle East, and Europe.

Valuation and view

* The recently launched Jupiter 110 has been very well received by customers and is likely to help TVSL gain a share in scooters in the coming quarters. However, in motorcycles, for the first time in many years, TVSL has underperformed the industry in FY25 YTD. More importantly, TVSL has underperformed in the 125cc segment, which has been its key growth driver in recent years. Additionally, while there is a recovery in the export market, its full recovery is yet to be realized.

* Given these factors, we believe TVSL at 36x/30x FY26E/FY27E EPS appears fairly valued. Reiterate Neutral with a TP of ~INR2,570 (based on ~32x Dec’26E EPS and INR205/sh for the NBFC)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412