Neutral Asian Paints Ltd For Target Rs.2,550 by Motilal Oswal Financial Services Ltd

Weak performance as expected; industry challenges persist

* Asian Paints (APNT) reported a weak 3QFY25. Its consolidated/standalone revenue declined 6%/8% YoY (in line). Domestic volume inched up 1.6% YoY. Weak industry demand, downtrading, a subdued festive season, and rising competition adversely impacted the growth. The impact of last year’s price cuts (3%) continued to drag value growth despite a 1% price hike in 2QFY25. The decorative paints industry saw a 4-5% decline in 3Q. International business delivered 5% revenue growth (17% in CC terms).

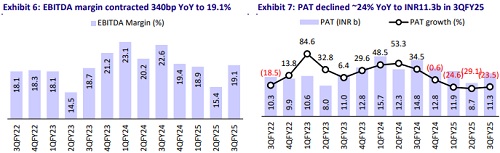

* Gross margin contracted 120bp YoY but expanded 170bp QoQ to 42.4%, driven by a 2% material cost deflation. EBITDA margin dipped 340bp YoY to 19.1% (est. 18.8%), impacted by an unfavorable product mix and higher sales & distribution expenses to counter competition. EBITDA fell 20% YoY.

* Management expects revenue weakness to persist for at least two more quarters. The company is targeting to achieve single-digit volume growth in the near term. The company is less worried about competition than industry challenges.

* The stock has massively underperformed (20% fall in the last one year) owing to a sharp cut in earnings. Considering the uncertainty of demand recovery in the near term, there is limited respite for the stock. Industry volume recovery and competitive strategy on pricing/incentives will be the key monitorables. Considering the uncertainty, we reiterate our Neutral rating with a TP of INR2,550 (based on 45x Dec’26E EPS).

In-line performance; domestic volume up ~2% YoY

* Sluggish trends persist: Consol. net sales declined 6% YoY to INR85.5b (est. INR86.8b) adversely impacted by muted demand conditions, especially in the urban market, coupled with downtrading and a weak festive season. Decorative business (India) clocked volume growth of 1.6% (est. -1%, -0.5% in 2QFY25) while revenue declined by 8% YoY.

* Margins contract: Gross margin contracted 120bp YoY to 42.4% (est. 41.5%). GP was down 9% YoY. Employee expenses rose 8% YoY, and other expenses were up 4% YoY. EBITDA margin contracted 340bp YoY to 19.1% (est. 18.8%).

* Better performance for the industrial business: The kitchen and bath business revenue grew 3% YoY. White teak and weather seal revenue declined 20% YoY. The industrial business delivered 4% revenue growth, supported by growth in the general industrial and refinish segments.

* Currency devaluation continues to affect growth: The International Business registered 5% revenue growth in INR terms (17% growth in CC terms) supported by strong demand in the Middle East and recovering macroeconomic conditions in key Asian markets.

* Double-digit decline in profitability: EBITDA declined 20% YoY to INR16.4b (est. INR16.2b). PBT dipped 24% YoY to INR14.7b (est. INR15.1b). Adj. PAT decline of 24% YoY to INR11.3b (est. INR11.7b).

* During 9MFY25, net sales/EBITDA/APAT declined 5%/22%/26% YoY

Key highlights from the management commentary

* Demand was weak with overall sentiments being muted. This adversely impacted the paint industry, and downtrading hit value performance. The demand during 3QFY25 was also hurt by the shorter festive season along with the urban slowdown.

* Several premium products were launched. Apex Ultima Air-o-Clean was launched in the exterior category, which uses advanced technology that neutralizes known pollutants. It is available in 200+ shades. There is also a range of regional packs (Maharashtra, Gujarat, and Kerala) under Royale GLITZ. There has also been a packaging change, with premium looks across luxury, premium, and economy ranges. The contribution from the new products was 12% of revenue.

* The company has not seen much competition impact in 1HFY25; instead, it was the industry weakness that hit most players. It is too early to comment on the new competition impact as the category size at INR800b is huge. Competition has now rolled out products across price points; it will be important to see real value propositions to customers as there is no uniqueness in the product.

Valuation and view

* We cut our EPS by 4% each for FY26/FY27 to reflect weak volume growth and pressure on margin.

* APNT remains focused on new launches across price segments and packaging revamps to remain competitive against both organized and unorganized players. The entry of deep-pocketed new players with significant investment commitments could drive shifts in market share and cost structures across the industry.

* We remain cautious about both value growth and margin for FY26. Despite a correction in the stock, demand and competitive pressures still hover around earnings. We reiterate our Neutral rating with a TP of INR2,550 (based on 45x Dec’26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412